Yesterday’s Trading:

Wednesday’s close saw the euro down against the dollar. The pair couldn’t continue its growth after US labour market data for the private sector came out. The ISM index and manufacturing orders kept the dollar from falling.

The ADP index came out much lower than expected. The weak data could lead the experts into a change of forecast downwards for the Non-Farm Payrolls. The report is out two days before the official US employment report.

The US’ March manufacturing orders were up 1.1% (forecasted: 0.5%, previous: -1.9%).

The ISM index for service sector activity in April was 55.7 (forecasted: 54.6, previous: 54.5).

Market Expectations:

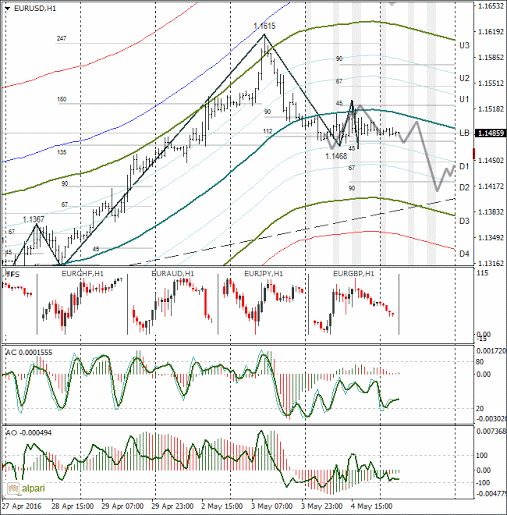

The euro/dollar stabilised at 1.1486 and has been consolidating in a narrow range for 12 hours. Since a pinbar formed on the daily on 3rd May, after a sideways movement I’d take a risk to say that the price will exit downwards to 1.1415.

The key event of the week is the Non-Farm Payrolls report. The official US Department of Labor report will be out at 15:30 EET on Friday. It is expected that job creation in April will be at 200k and the unemployment level will have fallen from 5% to 4.9%. The ADP and NFP don’t have a positive correlation, so I’m not really looking at this.

Day’s News (EET):

-

10:30, UK housing prices for April from Halifax; 11:00, ECB’s economic bulletin;

-

11:30, UK service sector business activity index for April;

-

15:30, Canadian data on March construction permits. US initial applications for unemployment benefits for the week;

-

18:30, Saint Louis Fed president speaking.

Technical Analysis:

The euro/dollar has bounced to the balance line and the price returned to 1.1485 from here. The hourly indicators are in a neutral zone. Taking the 3rd May’s pinbar into account. I expect to see a weakening of the euro against the dollar to 1.1415 on Thursday. At the moment we could well drop to 1.1395 (to the trend line).

Definitely keep an eye on the euro/pound cross. The cross on the hourly has bounced to the LB. A sharp rebound upwards and the euro will start to strengthen against the USD. I reckon we’ll see a growth of the euro to 1.1507, but it’s not worth letting the buyers get any higher or the euro will rise to 1.1575 over the course of 2-3 hours.

Forecasts which are made in the review constitute the personal view of the author. Commentaries made do not constitute trade recommendations or guidance for working on financial markets. Alpari bears no responsibility whatsoever for any possible losses (or other forms of damage), whether direct or indirect, which may occur in case of using material published in the review

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.