Yesterday’s Trading:

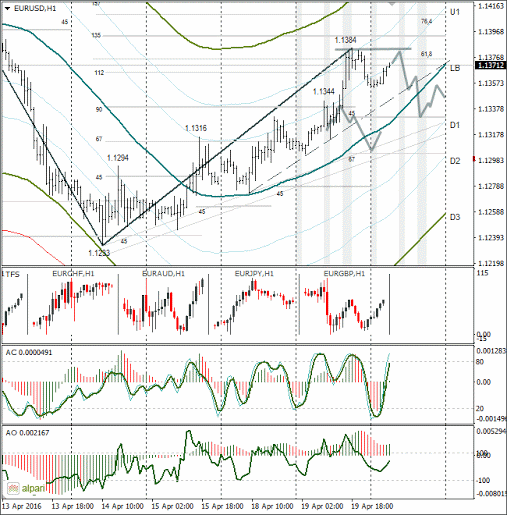

The euro/dollar broke through the 1.1340 marker due to a revival of the euro/pound cross and weak US stats. Data on construction in the US turned out worse than expected, provoking renewed speculation as to whether the Fed will decline to lift interest rates in the coming time.

The euro/dollar reached 1.1384. The strengthening of the euro against the dollar stopped between the 112th and 135th degrees at the 61.8% fibo level from the downward wave with a 1.1464 maximum to 1.1233.

Market Expectations:

On Thursday the ECB is set to convene and Draghi will hold a press conference. As this event approached, yesterday I expected the euro to weaken to 1.1330. I looked at a depart of the price down through the double peak, but it seems there will be no repeat touch of 1.1384.

US oil reserve data from the API came out last night. Reserves were up 3.1 million barrels against an expected 1.6 million rise. Brent in Asia fell 1.9% to $43.09. Other than the API report, in Kuwait the workers’ strike which has been supporting oil quotes since Monday came to an end.

Oil is falling in price, and with it the euro. I reckon that a return of the rate to 1.1300-1.1330 before the ECB convenes will be an excellent scenario.

Day’s News (EET):

-

09:00, German March PMI;

-

11:30, UK average wage changes and number of unemployment benefit applications in March. Unemployment level for February.

-

17:00, US data on sales in the secondary housing market for March.

-

17:30, US changes in oil reserves from the ministry for energy.

Technical Analysis:

At 07:11 EET, the euro/dollar was trading at 1.1363. Taking the rise of the euro/pound into account, I expect a weakening of the euro from 1.1380-1.1384. The euro will receive support from the fall in oil via the euro/Canadian and euro/Australian crosses. If the USD in Europe switches into attack, these crosses will not help the euro strengthen. As soon as 1.1350 is broken, pressure on the euro will compound.

In yesterday’s analysis I wrote that the 90th degree isn’t an important support. The euro often disappoints from the 112-135 zone. The 135th degree passes through 1.1393. If demand for the euro remains high in the crosses, it’s likely that there will be a growth of the euro/dollar to 1.1393. I’ve no intention of buying euro before Draghi’s press conference.

Forecasts which are made in the review constitute the personal view of the author. Commentaries made do not constitute trade recommendations or guidance for working on financial markets. Alpari bears no responsibility whatsoever for any possible losses (or other forms of damage), whether direct or indirect, which may occur in case of using material published in the review

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.