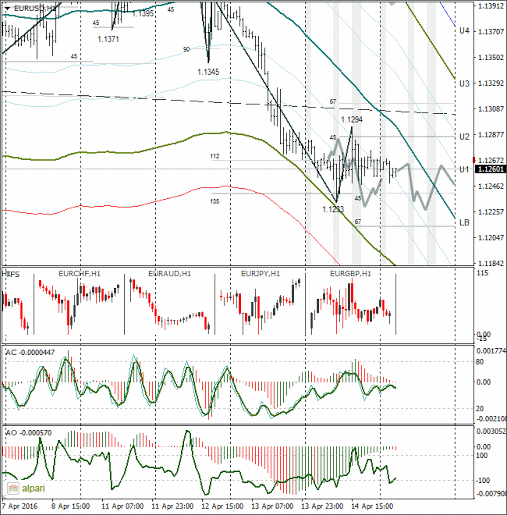

Yesterday’s Trading:

On Thursday the euro/dollar was touching the support at around 1.1233. Bouncing off the 135th gradient, the euro at one moment rose to 1.1294 after the Bank of England convened. The euro bulls were stopped going further by the US stats. So they had to drop to 1.1260. The euro is trading at this level now. The Asian participants even ignored the Chinese stats this morning. It’s possible that the news will have its effect later on.

The US data showed a fall in unemployment benefit applications. Consumer inflation was worse than expected. This data could reduce the chances of interest rates being raised.

The number of US unemployment benefit applications for the week was 253k (forecasted: 270k, previous: 266k).

The US CPI in March was 0.1% (forecasted: 0.2%, previous: -0.2%). The CPI without food and energy was 0.1% (forecasted: 0.2%, previous: 0.3%).

Market Expectations:

The euro/dollar is stable in a 1.1247-1.1275 range. Since the MA line is heading down and the price is under the balance line, in the first half of the day I expect a weakening of the euro to 1.1230. If the euro/pound falls from 0.7955 to 0.7905. the minimum will shift to 1.1215. There’s no important data out in Europe. In the forecast I’ve gone for a V-shaped pattern.

Day’s News:

-

11:30, UK construction in February;

-

12:00, Eurozone February balance of trade;

-

15:30, Bank of Canada February industrial sales;

-

15:30, US New York Fed business activity in manufacturing for April;BOE

-

16:15, US industrial production for March;

-

17:00, US preliminary consumer confidence from Michigan university for April.

Technical Analysis:

The euro has been trading sideways for fifteen hours. The balance line heads through 1.1283 so there is a risk that it will drop to this level before trading opens in Europe. Only, if the euro rises above 1.1295, it’d be worth staving off sales of the currency until Wednesday. A proper break in yesterday’s minimum of 1.1233 with support from the euro/pound cross will open the road to 1.1170 for the sellers. Today is Friday and so before the weekend anything could happen.

Forecasts which are made in the review constitute the personal view of the author. Commentaries made do not constitute trade recommendations or guidance for working on financial markets. Alpari bears no responsibility whatsoever for any possible losses (or other forms of damage), whether direct or indirect, which may occur in case of using material published in the review

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.