Yesterday’s Trading:

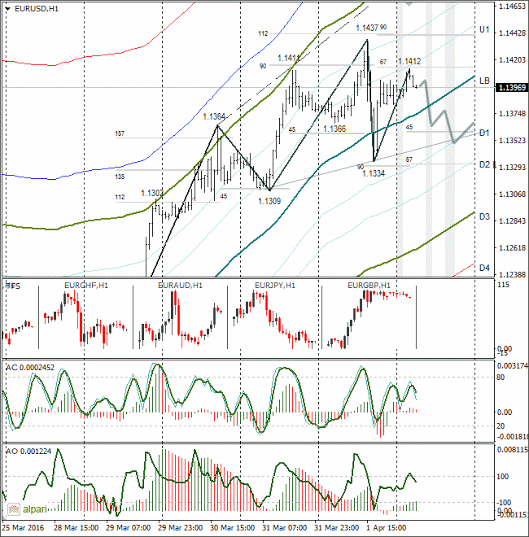

The euro on Friday updated the week’s maximum due to demand for the currency in the cross pairs. After the release of strong American labour market data, the buyers’ position began to waver. The euro weakened against the dollar by one figure to 1.1334 on the news and from here it was snapped up. Trades closed slightly up.

Job creation in the US during March stood at 215k (forecasted: 205k). January’s figure was reassessed from 172k to 168k and February’s from 242k to 245k. Unemployment was up 0.1% to 5.0% (forecasted: 4.9%, previous: 4.9%). Average hourly earnings for the US in March were up 0.3% (forecasted: 0.2%, previous: -0.1%).

Market Expectations:

On Monday I don’t bother looking at the planned economic data. On my forecast I’ve gone for a weakening of the euro against the US dollar to 1.1350 due to a downward correction of the euro/pound cross.

Until the price drops below 1.1334 (Friday’s minimum) a fall to 1.1350 will be seen as a correction against the growth from 1.1143 to 1.1437.

From 1st April, the ECB extended its QE program in which it will purchase bonds, including corporate ones. The Bank’s actions will have a negative effect on the euro.

Day’s News:

-

11:30, UK business activeness index in the construction sector for March;

-

12:00, Eurozone February unemployment;

-

17:00, US manufacturing orders for February and labour market conditions for March;

-

17:30, Bank of Canada quarterly review of economic conditions and business development prospects.

Technical Analysis:

A double bear divergence has formed on the hourly. The target on it is 1.1310. Along the way the sellers will meet an important level: 1.1350. If they are able to strengthen below it, then 1.1310 will not hold. Closing of long positions in the crosses will only worsen the situation in the main pair. As a result, the euro will crash like the pound. Today’s target is 1.1350, then we will have a look at the situation.

Forecasts which are made in the review constitute the personal view of the author. Commentaries made do not constitute trade recommendations or guidance for working on financial markets. Alpari bears no responsibility whatsoever for any possible losses (or other forms of damage), whether direct or indirect, which may occur in case of using material published in the review

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.