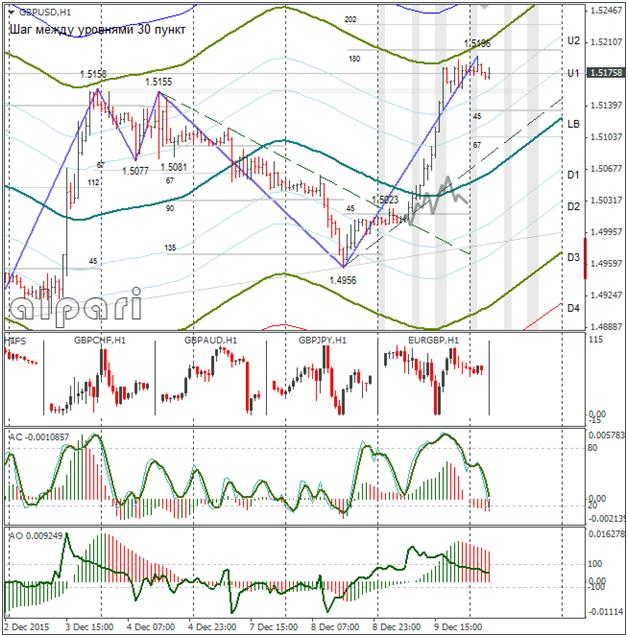

Hourly

I was ready for the pound to strengthen yesterday, but not for as much as it did. There was no news which would have pushed the dollar down. The market is continuing to close long positions on the dollar and has been doing so since the ECB didn’t go as far with their monetary policy plans as the market expected.

Market attention today is on the BoE’s interest rate decision. The rate won’t be put up, that’s for sure. It will be important how the votes go though. If it’s 9-1 then the pound/dollar will drop from the U3 to 1.5135. I didn’t bother making a forecast since there could be some surprises in the minutes. If the voting ends up 8-2, the pound will head to 1.5285.

Daily

The pound/dollar updated the maximum and left Thursday’s range. The BoE’s meeting will take place and we’ll know how the pound will move next week after close. If we only look at the technical side: the closest target is 1.5230/40.

Weekly

A hammer is forming.

Forecasts which are made in the review constitute the personal view of the author. Commentaries made do not constitute trade recommendations or guidance for working on financial markets. Alpari bears no responsibility whatsoever for any possible losses (or other forms of damage), whether direct or indirect, which may occur in case of using material published in the review

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.