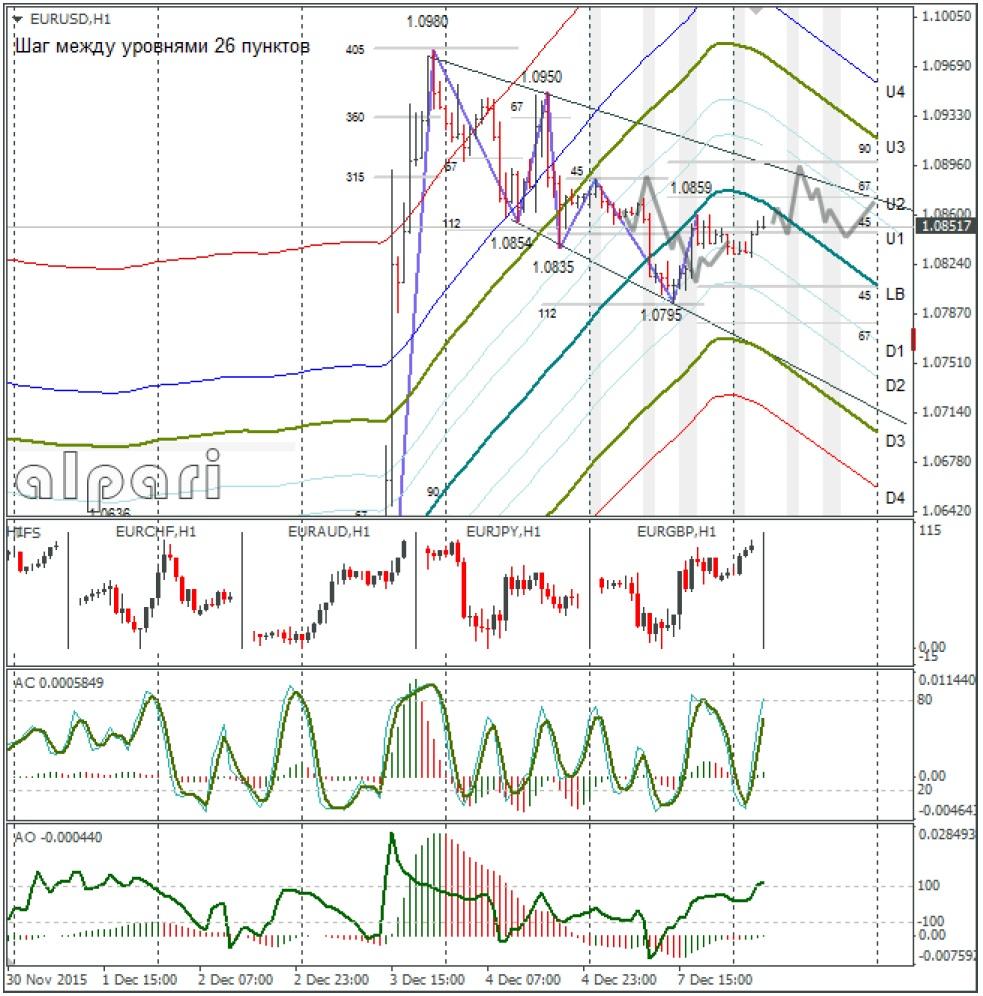

Hourly

Yesterday’s Trading:

Monday saw the euro/dollar reaching for the support at around 1.0800. The correction was 38.2% from the growth from 1.0518 to 1.0980. The calendar was empty, so the price easily returned to the balance line at 1.0859.

Main news of the day (EET):

11:30, UK industrial manufacturing and production in the manufacturing sector for October;

12:00 Eurozone Q3 GDP;

15:15, Canadian new housing orders for November and construction permits for October;

17:00, US job vacancies and labour turnover for October. UK GDP from NIESR for November;

19:50, Bank of Canada’s Poloz to speak.

Market Expectations:

Trader attention on Tuesday will be focussed on UK and Eurozone data. However, it’s the upcoming FOMC meeting that will set the scene on the market. The futures market assesses the likelihood of a US rate rise at around 80%. The market has already taken a rise into account, so it makes more sense to expect a consolidation at the levels reached (a wide flat) on the key pairs.

Technical Analysis:

Intraday target maximum: 1.0890, minimum: 1.0829 (current Asian), close: 1.0868;

Intraday volatility for last 10 weeks: 103 points (4 figures).

The euro/dollar is trading near the LB at 1.0849. The day closed above 1.0807, so I expect we’ll see a test of 1.0890. The falling price of oil and gold will impact the euro and so in the second half of the day I reckon we will see a rebound from 1.0890.

Daily

The euro/dollar closed down on Monday, but above 1.0807. The growth tendency is still alive and kicking. The falling oil and gold prices could hold off the euro bulls. Now to the Weekly.

Weekly

For the moment I am keeping an eye on market events and the formation of a double bottom.

Forecasts which are made in the review constitute the personal view of the author. Commentaries made do not constitute trade recommendations or guidance for working on financial markets. Alpari bears no responsibility whatsoever for any possible losses (or other forms of damage), whether direct or indirect, which may occur in case of using material published in the review

Recommended Content

Editors’ Picks

EUR/USD holds positive ground above 1.0750 ahead of Eurozone PMI, PPI data

EUR/USD trades in positive territory for the fourth consecutive day near 1.0765 during the early Monday. The softer US Dollar provides some support to the major pair. Traders await the HCOB Purchasing Managers’ Index (PMI) data from Germany and the Eurozone, along with the Eurozone PPI.

GBP/USD rises to near 1.2550 due to dovish sentiment surrounding Fed

GBP/USD continues its winning streak for the fourth consecutive day, trading around 1.2550 during the Asian trading hours on Monday. The appreciation of the pair could be attributed to the recalibrated expectations for the Fed's interest rate cuts in 2024 following the release of lower-than-expected US jobs data.

Gold price rebounds on downbeat NFP data, softer US Dollar

Gold price snaps the two-day losing streak during the Asian session on Monday. The weaker-than-expected US employment reports have boosted the odds of a September rate cut from the US Federal Reserve. This, in turn, has dragged the US Dollar lower and lifted the USD-denominated gold.

Bitcoin Cash could become a Cardano partnerchain as 66% of 11.3K voters say “Aye”

Bitcoin Cash is the current mania in the Cardano ecosystem following a proposal by the network’s executive inviting the public to vote on X, about a possible integration.

Week ahead: BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.