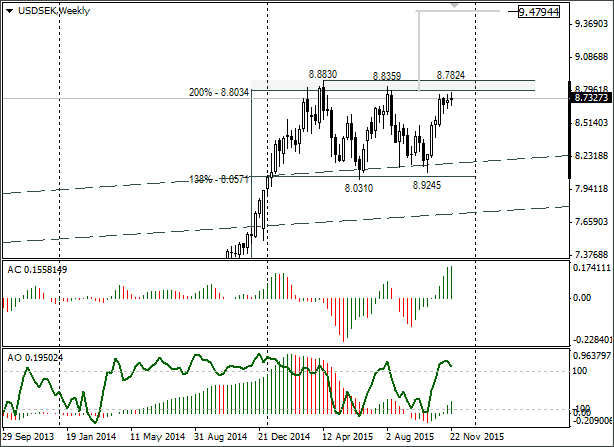

Trading opportunities for currency pair: a W-shape pattern is just about formed. If the US Fed raises rates on 16th December, the USD/SEK will head to 9.4794. It has until April 2016 to reach the target. The interim target is at 9.3259 (March 2009 maximum). Growth will cancel if the weekly candle closes below 8.4933. Following a rebound from 8.83, I will be waiting for a return to 8.18 along the same W-shaped pattern.

Background:

The last USD/SEK idea I made came out on 26th October. The rate at that time stood at 8.4945. I was waiting for the dollar to strengthen to 8.8359 along the W-shaped pattern. The target still hasn’t been reached. In actual fact, the USD/SEK lifted to 8.7824.

As things are at the moment:

So what should we do if it reaches 8.8359? Market participants are expecting the US Fed to put up their rates. On the 4th December a US labour market report will be out. After the trading session closes on Friday, ready yourself for a break in the 8.88 resistance or the formation of an inverted candle combination (bounce from the resistance).

If the US Fed raises rates on 16th December, the USD/SEK will head to 9.4794. The interim target in this case will be 9.3259 (March 2009 maximum). If we see a rebound from 8.83, I’ll be expecting a return of the rate to 8.18 along the same W-shaped pattern.

Forecasts which are made in the review constitute the personal view of the author. Commentaries made do not constitute trade recommendations or guidance for working on financial markets. Alpari bears no responsibility whatsoever for any possible losses (or other forms of damage), whether direct or indirect, which may occur in case of using material published in the review

Recommended Content

Editors’ Picks

AUD/USD awaits RBA Meeting Minutes for direction

The AUD/USD pair retreated from above 0.6700 and trades around 0.6670 early in Asia, following clues from Gold price in the absence of other news. Australia will publish Westpac Consumer Confidence and RBA Minutes early on Tuesday.

EUR/USD consolidates ahead of 1.0900

The EUR/USD pair failed to grab speculative interest’s attention on Monday and consolidated at around 1.0860. Federal Reserve officials keep flooding the news, but so far, failed to spur some action.

Gold retreated from record highs, maintains the upward bias

Gold rose sharply at the beginning of the week on escalating geopolitical tensions and touched a new all-time high of $2,450. With market mood improving modestly, XAU/USD erases a majority of its daily gains but manages to hold above $2,400.

Ethereum poised for high volatility as SEC may ‘slow play S-1s’ filings

Ethereum's (ETH) price movement on Monday reveals traders' uncertainty following Grayscale CEO's departure and expectations that the Securities & Exchange Commission (SEC) would deny applications for spot ETH ETFs this week.

Signed into law: Alabama abolishes income taxes on Gold and Silver

On May 14, 2024, Alabama Governor Kay Ivey signed a bill that removes all income taxes on capital gains from the sale of gold and silver, enabling the state to take an important step forward in reinforcing sound money principles.