Trading opportunities for currency pair: after a correctional movement, a growth for the dollar against the yen to 124.30/50 is expected due to Fed rate hike expectations for December.

Background:

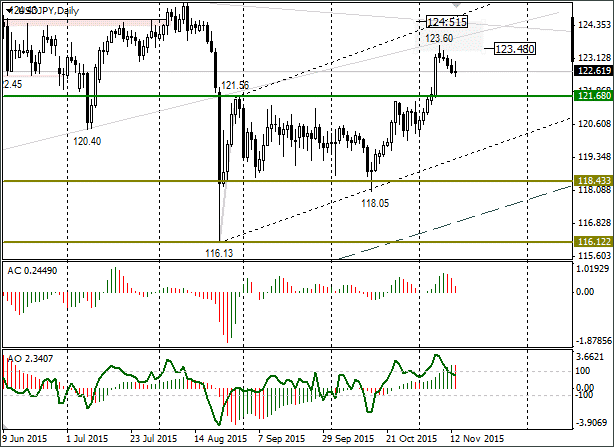

The last USD/JPY idea I did came out on 26th October. The price at the moment of publication was 121.46. I expected to see a break in the 121.68 resistance before the FOMC meeting (28th October) and then a subsequent growth to the 123.48-124.51 target zone.

The 123.48 price level was reached on 9th November after the NFP on the previous Friday came out. The Non-Farm Payrolls report increased the likelihood of a US Fed rate hike at the meeting to take place in December.

As things are at the moment:

Forex trader market activity is down after the payrolls. The dollar/yen has corrected from 123.06 to 122.44.

What’s of interest at the moment?

Janet Yellen’s rhetoric disappointed the dollar bulls. On Thursday (12th November) we were waiting to hear hints from her about a rate hike by the FOMC in December; this didn’t happen.

The daily indicators are showing that the dollar’s growth against the yen hasn’t yet finished. After 123.60 is reached, the next target is 124.30/50. The trend line (125.85 and 125.27 maximums) passes through this price level.

Forecasts which are made in the review constitute the personal view of the author. Commentaries made do not constitute trade recommendations or guidance for working on financial markets. Alpari bears no responsibility whatsoever for any possible losses (or other forms of damage), whether direct or indirect, which may occur in case of using material published in the review

Recommended Content

Editors’ Picks

EUR/USD extends sideways grind below 1.0900

EUR/USD stays in a consolidation phase below 1.0900 following the previous week's rally. In the absence of high-tier data releases, the US Dollar stays resilient against its rivals as investors scrutinize comments from central bank officials.

Gold retreated from record highs, maintains the upward bias

Gold rose sharply at the beginning of the week on escalating geopolitical tensions and touched a new all-time high of $2,450. With market mood improving modestly, XAU/USD erases a majority of its daily gains but manages to hold above $2,400.

GBP/USD holds steady near 1.2700, Fedspeak in focus

GBP/USD fluctuates in a narrow channel near 1.2700 on the first trading day of the week. The cautious market stance helps the US Dollar hold its ground, while market participants assess remarks from central bank officials ahead of this week's key events.

Ripple stays above $0.50 on Monday as firm backs research on blockchain and quantum computing

XRP price holds steady above the $0.50 key support level and edges higher on Monday, trading at 0.5130 and rising 0.70% in the day at the time of writing.

Week ahead: Nvidia results and UK CPI falling back to target

What a week for investors. The Dow Jones reached a record high and closed last week above 40,000, for the first time ever. This is a major bullish signal even though gains for global stocks were fairly modest on Friday, and European stocks closed lower.