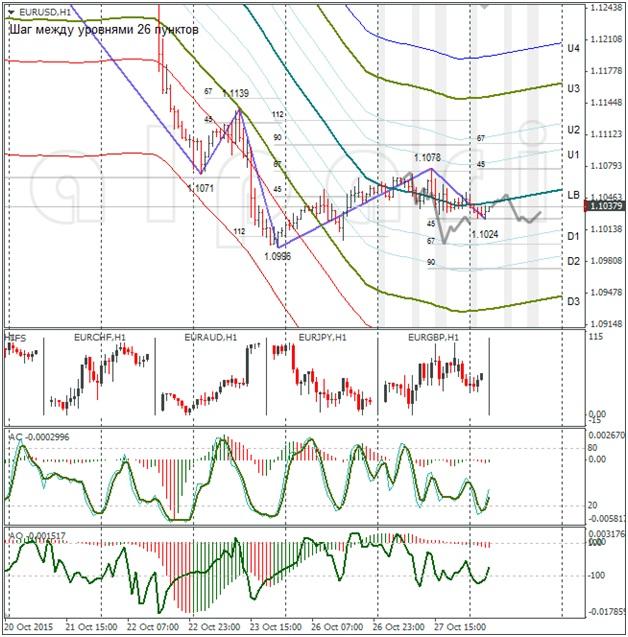

Hourly

Yesterday’s Trading:

On Tuesday the DXY index closed up slightly, despite the weak US stats. Durable goods orders, the consumer confidence index and the service sector PMI for the country were all worse than expected.

The FOMC meeting which began yesterday is holding the dollar from falling. The Federal Reserve’s interest rate decision will be made public this evening at 20:00 EET.

The US consumer confidence index for October stood at 97.6 (forecasted: 102.9, previous: reassessed from 103.0 to 102.6).

Durable goods orders in the US for September were down by 1.2% (forecasted: -1.3%, previous: -3.0%).

Main news of the day:

At 12:00 EET, Germany’s Gfk consumer confidence index for November will be out;

At 20:00 EET, the FOMC decision will be out for the public to see;

At 22:00 EET, the RBNZ will make public its interest rate decision.

Market Expectations:

The weak stats couldn’t manage to lend a hand to the euro bulls. The euro fell following the GBP.

All attention is on the Fed decision. It’s expected that the rates will be left unchanged. If everything goes as expected, market participants will look for hints in the press release as to when the rate will be finally put up.

Due to this important currency market event, I made my forecast for up to 20:00 EET. The RBNZ will give its interest rate decision within two hours of the Fed giving theirs. As such, volatility this evening will be high.

Technical Analysis:

Intraday target maximum: n/a, minimum: n/a, close: n/a;

Intraday volatility for last 10 weeks: 119 points (4 figures).

The euro/dollar is trading under the LB at 1.1034. Despite the AUD’s fall after Aussie stats came out, I’m still expecting the euro/dollar to sit in a sideways until 20:00 EET. It would be nice if we could see a strengthening below 1.10 today.

Daily

The euro/dollar rate is still in a correctional phase. On Tuesday the euro didn’t return to 1.10. The euro/pound cross was supporting it after UK GDP data came out. The technical picture is indicating a continued fall to 1.0807-1.0818 (minimums from 27th May and 20th July). Only the US Fed can stop the euro falling. Now to thee Weekly.

Weekly

Nothing has changed on the weekly graph. The indicators are indicating a further fall for the euro. The target is 1.0818.

Forecasts which are made in the review constitute the personal view of the author. Commentaries made do not constitute trade recommendations or guidance for working on financial markets. Alpari bears no responsibility whatsoever for any possible losses (or other forms of damage), whether direct or indirect, which may occur in case of using material published in the review

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.