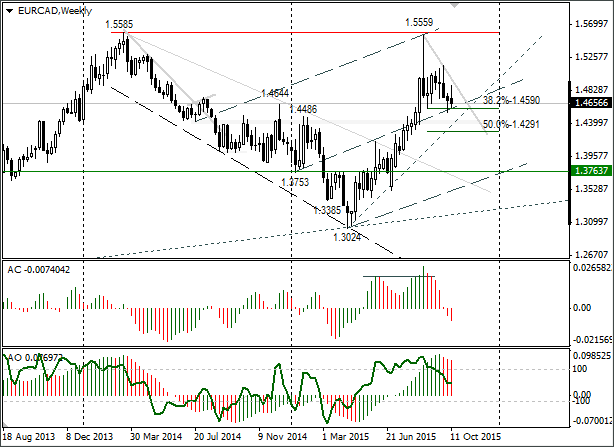

Trading opportunities for currency pair: the euro is under pressure since market participants expect the ECB to extend its QE program. Due to these expectations and the stable oil price around 50 USD, expect the euro to fall to 1.4490 and below. A close of the weekly candle above 1.4930 will stop any fall.

Background

In August we could see a pinbar forming, on the weekly graph. I went for a fall of the euro to 1.4490 and then to 1.4220. Between 31st August and 19th October, the EUR/CAD has dropped 109 points. The pair has been stuck in a correctional phase for three weeks so not much has happened. The euro has lost 1.84% against the Canadian over the last three weeks (-275 points). The falling tendency is set to continue for the euro.

Current situation

On Thursday (15th October), the ECB’s Ewald Nowotny pushed the eurobulls into closing long positions. It’s highly likely that, before the ECB’s Thursday meeting, we’ll see euro sales increase across all pairs. A day earlier, on Wednesday, the Bank of Canada is set to convene.

The euro is under pressure, while the Canadian has support from the oil quotes. Brent costs more than 50 USD per barrel and doesn’t want to fall, even with news that OPEC extraction is up and so are reserves. Market participants are focused on the fall of oil rigs and oil extraction in the US.

According to the latest data from Baker Hughes, the total number of rigs in the US for the week ending 16th October was down by 8 to 787. This is a 1131 fall for the year. The number of oil rigs was down by 10 to 595. Gas rigs were up by 3 to 192.

What’s interesting at the moment?

The 1.4490 and 1.4220 targets are still on. The pair has now bounced from the 38.2% fibo-level from a growth from 1.3024-1.5559. For the fall to hasten, we need to see a strengthening below 1.4480. A close of the weekly candle above 1.4930 will cancel out the fall. As a long-term target, we can take 1.4000 for April 2016 (along the dotted line from the 1.3024 minimum).

Forecasts which are made in the review constitute the personal view of the author. Commentaries made do not constitute trade recommendations or guidance for working on financial markets. Alpari bears no responsibility whatsoever for any possible losses (or other forms of damage), whether direct or indirect, which may occur in case of using material published in the review

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.