Sterling fell across the board in mid-European session trading after announcement that Britain’s Labor party will vote against any Brexit deal reached by PM Theresa May.

Labor party expects that their decision would result in no viable deal in divorce process between the UK and the European union, which would force PM May to step down from her position before Christmas.

Fresh political turmoil in the UK comes just days after calming and optimistic comments from top EU Brexit negotiator, increasing volatility in the markets.

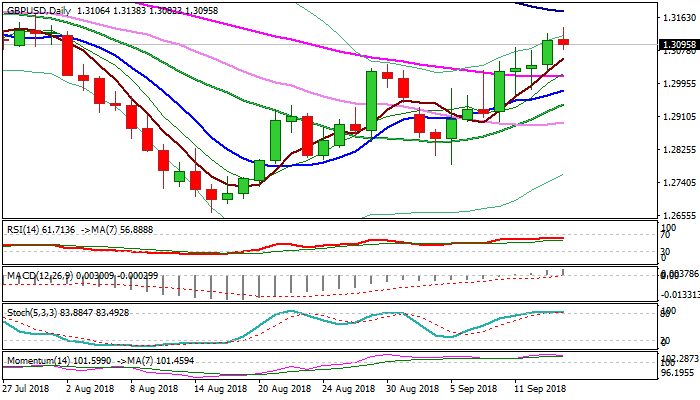

Cable dipped back below 1.31 handle, trading in the middle of daily cloud after fresh bulls cracked cloud top earlier today.

South-turning overbought daily slow stochastic and weakening momentum warn of deeper pullback, as sentiment was soured by recent news.

Consolidation within daily cloud would keep bullish bias in play for renewed attempts higher and attack at falling 100SMA (1.3178) on break above cloud. Conversely weaker tone could be expected on return and close below cloud base (1.3043).

Res: 1.3145; 1.3162; 1.3179; 1.3213

Sup: 1.3101; 1.3066; 1.3043; 1.3011

Interested in GBPUSD technicals? Check out the key levels

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.