GBP/USD Weekly Forecast: Pound Sterling looks set for more pain in the week ahead

- The Pound Sterling extended its correction from seven-month highs against the US Dollar.

- Dovish BoE vote split spelt doom for GBP/USD buyers, despite a dovish Fed outlook.

- GBP/USD confirmed a bearish channel on the daily chart, while the RSI points to more weakness.

The Pound Sterling (GBP) failed to hold its upswing against the US Dollar (USD), as the GBP/USD correction from seven-month highs of 1.2894 regained traction in the central banks’ bonanza week.

Dovish BoE vote split pounds the Pound Sterling

The policy outlooks announced by the US Federal Reserve and the Bank of England (BoE) remained the key drivers for the GBP/USD price action in the past week. But the selling momentum around the Pound Sterling was unabated, as the US Dollar kept its bullish tone intact, despite a brief pullback midweek.

In the early part of the week, markets sensed caution in the lead-up to the key central banks’ monetary policy announcements and preferred to hold onto the US Dollar amid mounting tension. The Bank of Japan’s (BoJ) first interest rate hike on Tuesday was widely expected and triggered a “sell the fact” reaction in the Japanese Yen, lifting the USD/JPY pair. That had a positive “rub-off” effect on the US Dollar, lifting the Greenback against most of its major pairs.

Subsequently, GBP/USD fell as low as 1.2668 before rebounding sharply toward 1.2800 on Wednesday after the Fed's economic projections, the so-called Dot Plot chart, still predicted three rate cuts this year as seen in December. Markets had begun pricing two Fed rate cuts this year after two consecutive months of higher inflation readings. The median Fed dot plot for 2024 was unchanged despite a 0.2% increase in the median 2024 Core PCE inflation. This was perceived as dovish by markets, throwing the Greenback under the bus.

However, the tide turned against the Pound Sterling on Thursday after the BoE’s no-rate change decision. In an unexpected move, two BoE policymakers – Jonathan Haskel and Catherine Mann –, who previously voted for hikes, opted to keep rates unchanged with one dissenter (Swati Dhingra) continuing to favor a rate cut. The dovish turn in the vote split spelt doom for the British Pound, smashing GBP/USD to two-week lows at 1.2650.

The downside in the pair extended on Friday, as sellers rushed toward the 1.2600 threshold amid a sustained recovery in the US Dollar, following the dovish Fed aftermath. Therefore, GBP/USD mired in multi-week troughs just above the 1.2600 level notwithstanding the better-than-expected results of the UK’s February Retail Sales report. The UK Retail Sales showed no growth over the month in February vs. -0.3% expected and 3.6% registered in January, according to the latest data published by the Office for National Statistics (ONS) on Friday. The Core Retail Sales, stripping the auto motor fuel sales, rose 0.2% MoM vs. -0.1% expected and 3.4% in January.

Holy Friday makes up for a light week ahead

Following an event-packed week, Pound Sterling traders will breathe a sigh of relief in the holiday-shortened week ahead.

It’s Holy Friday and most major markets will remain closed, leaving minimal volatility and thin liquidity around the GBP/USD pair.

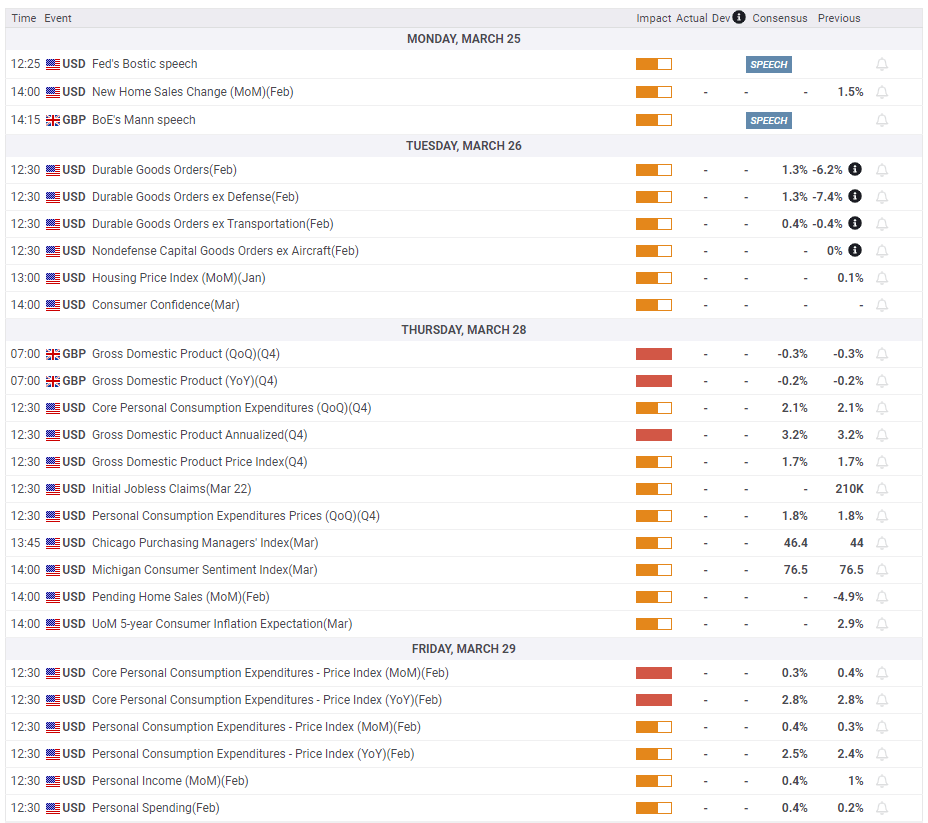

During the week, there are no top-tier economic data from the UK but the US calendar will feature Durable Goods Orders on Tuesday.

Thursday will see the releases of the US final Q4 Gross Domestic Product (GDP), Pending Home Sales and the weekly Jobless Claims.

Amidst light trading on Good Friday, the US Core Personal Consumption Expenditures (PCE) Price Index data will stand out.

Meanwhile, the return of the Fed speakers and the BoE’s Financial Stability Report (FSR) will also grab some attention.

GBP/USD: Technical Outlook

As observed on the daily chart, GBP/USD breached the rising channel support at 1.2680 on a daily closing basis on Thursday, confirming a Bearish Channel.

The next critical support level is seen at the horizontal 200-day Simple Moving Average (SMA) at 1.2592. A weekly closing below that level is needed to extend the corrective decline.

Sellers will then target the mid-February low near 1.2540, followed by the 1.2500 round figure. If the selling pressure intensifies on a break below the latter, a test of the 1.2400 mark cannot be ruled out.

The 14-day Relative Strength Index (RSI) points south below the midline, suggesting that there is more scope for the GBP/USD downside.

If buyers manage to defend the 1.2540 support area, a decent comeback toward the channel-support-turned resistance at 1.2680 could be in the offing. However, at that level the 50-day SMA coincides, making it a stiff resistance.

Further up, the pair could run into offers at the 21-day SMA at 1.2722. A sustained move above it will challenge the weekly top at 1.2803.

Pound Sterling FAQs

The Pound Sterling (GBP) is the oldest currency in the world (886 AD) and the official currency of the United Kingdom. It is the fourth most traded unit for foreign exchange (FX) in the world, accounting for 12% of all transactions, averaging $630 billion a day, according to 2022 data. Its key trading pairs are GBP/USD, aka ‘Cable’, which accounts for 11% of FX, GBP/JPY, or the ‘Dragon’ as it is known by traders (3%), and EUR/GBP (2%). The Pound Sterling is issued by the Bank of England (BoE).

The single most important factor influencing the value of the Pound Sterling is monetary policy decided by the Bank of England. The BoE bases its decisions on whether it has achieved its primary goal of “price stability” – a steady inflation rate of around 2%. Its primary tool for achieving this is the adjustment of interest rates. When inflation is too high, the BoE will try to rein it in by raising interest rates, making it more expensive for people and businesses to access credit. This is generally positive for GBP, as higher interest rates make the UK a more attractive place for global investors to park their money. When inflation falls too low it is a sign economic growth is slowing. In this scenario, the BoE will consider lowering interest rates to cheapen credit so businesses will borrow more to invest in growth-generating projects.

Data releases gauge the health of the economy and can impact the value of the Pound Sterling. Indicators such as GDP, Manufacturing and Services PMIs, and employment can all influence the direction of the GBP. A strong economy is good for Sterling. Not only does it attract more foreign investment but it may encourage the BoE to put up interest rates, which will directly strengthen GBP. Otherwise, if economic data is weak, the Pound Sterling is likely to fall.

Another significant data release for the Pound Sterling is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought-after exports, its currency will benefit purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.