GBP/USD

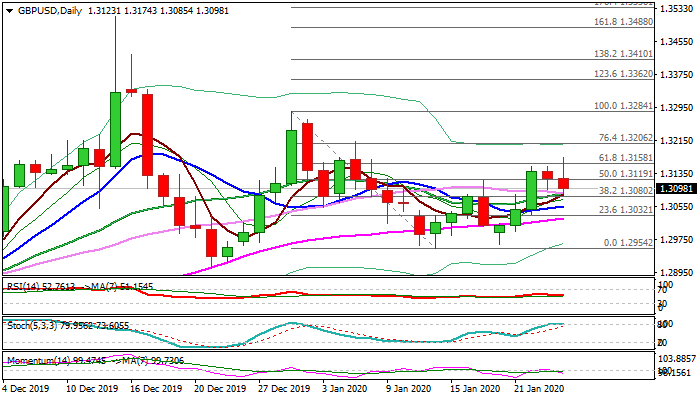

Cable jumped to two-week high (1.3174 after release of much better than expected UK PMI data, but gains were short-lived as traders took profits from longs in past four days and sent the pair to session low at 1.3085.

The sentiment soured after third straight failure to clear pivotal Fibo barrier at 1.3158 (61.8% of 1.3284/1.2954) and Thursday's close in red that generated initial signal of stall.

Upbeat UK PMI figures further eased expectations for rate cut on BoE's next week policy meeting, however, pound's immediate reaction was not in line with expected scenario.

Daily momentum (14-d) is back to negative territory and stochastic is overbought, adding to negative outlook.

Fresh weakness cracked pivotal supports at 1.3093/87 (Fibo 38.2% of 1.2962/1.3174 upleg/converged 20/30DMA's), close below which would generate negative signal and risk further easing.

Also, Friday's repeated close below 200WMA (1.3061) would add to bearish outlook. Alternatively, bounce and close above key Fibo barrier at 1.3158 would sideline downside risk and shift near-term focus higher.

Res: 1.3152; 1.3174; 1.3200; 1.3223

Sup: 1.3085; 1.3061; 1.3043; 1.3025

Interested in GBP/USD technicals? Check out the key levels

This overview can be used only for informational purposes. Dukascopy SA is not responsible for any losses arising from any investment based on any recommendation, forecast or other information herein contained.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.