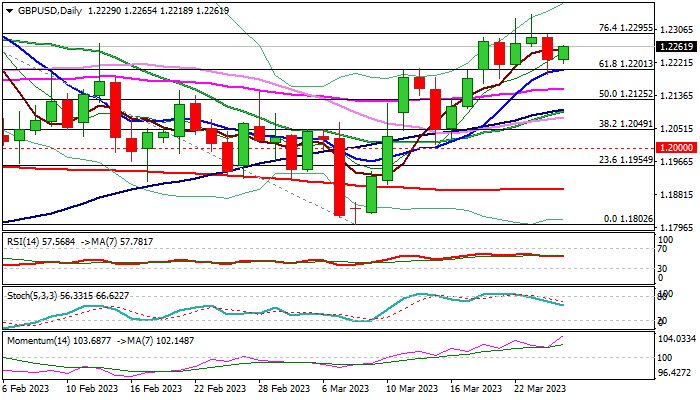

GBP/USD: Near-term action remains directionless but bullishly aligned above key supports at 1.2200 zone

GBP/USD

Cable regained traction after 0.5% drop last Friday, pushing the price into the upper part of prolonged consolidation range, which extends into sixth straight day.

Friday’s pullback was again contained by strong supports at 1.2200 zone (broken Fibo 61.8% of 1.2447/1.1802, reinforced by rising 10DMA), keeping overall bullish structure intact.

Several dips below 1.2200 handle, seen last week, failed to register close below, adding to the significance of this support.

However, near-term action is expected to remain in sideways mode while holding within the range boundaries, but with slight bullish bias, as long as holding above 1.2200 zone and daily indicators are in bullish configuration.

Firm break of pivotal barriers at 1.2295/1.2343 (Fibo 76.4% / Mar 23 spike high/range top) is needed to signal bullish continuation and expose targets at 1.2402/47 (Feb 2 lower top / 2023 high of Jan 23).

Caution on loss of 1.2200 pivot, which would dent larger bulls and risk deeper fall.

Res: 1.2295; 1.2343; 1.2402; 1.2447.

Sup: 1.2200; 1.2166; 1.2151; 1.2099.

Interested in GBP/USD technicals? Check out the key levels

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.