Growth numbers from the second quarter in the UK were not revised. The pound weakened further after the report. The GBP/USD dropped to 1.5363 and remains below 1.5400 under pressure.

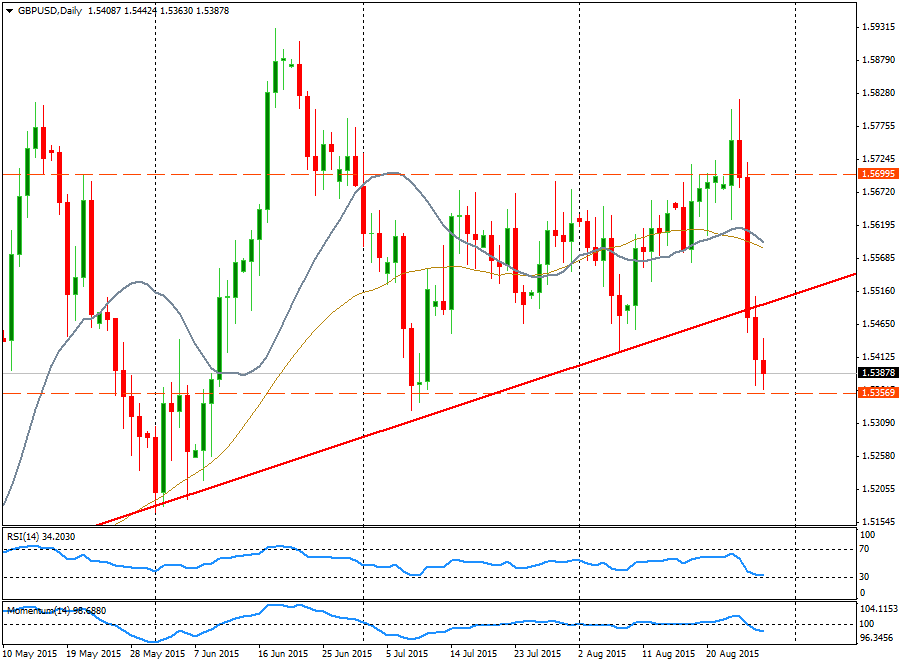

After being rejected from above 1.5700 and making a sharp reversal, the pair broke an uptrend line and dropped back to the previous trading range. Now testing a relevant support that capped the decline on July and worked as a resistance in the past. A break of the 1.5350 area should open the doors for further losses, with targets at 1.5300 and then around 1.5200. June lows should offer support.

The area around 1.5360 seems like a strong support from where a bounce to the upside is possible. So far the bounce from the lows has been limited. If it gains momentum it could rise to 1.5450/60; only above it could remove some of the bearish momentum and would open the doors toward 1.5500.

The pair is about to post the first close under the weekly 20-SMA; the negative signal could be offset if it manages to end above 1.5350. But anyway the outlook remains bearish after the reversal and the break of an uptrend line. A close on top of 1.5500 would remove strength to the US dollar.

Recommended Content

Editors’ Picks

How will US Dollar react to April jobs report? – LIVE

Following the Fed's policy announcements, market focus shifts to the April jobs report from the US. Nonfarm Payrolls are forecast to rise 238K. Investors will also pay close attention to revisions and wage inflation figures.

EUR/USD clings to gains near 1.0750 ahead of US jobs report

EUR/USD clings to modest gains at around 1.0750 after closing the previous two days in positive territory. Investors eagerly await April jobs report from the US, which will include Nonfarm Payrolls and Unemployment Rate readings.

GBP/USD advances to 1.2550, all eyes on US NFP data

The GBP/USD pair trades on a stronger note around 1.2550 amid the softer US Dollar on Friday. Market participants refrain from taking large positions as focus shifts to April Nonfarm Payrolls and ISM Services PMI data from the US.

Gold remains stuck near $2,300 ahead of US NFP

Gold price struggles to gain any meaningful traction and trades in a tight channel near $2,300. The Fed’s less hawkish outlook drags the USD to a multi-week low and lends support to XAU/USD ahead of the key US NFP data.

XRP edges up after week-long decline as Ripple files letter in reply to SEC’s motion

Ripple filed a letter to the court to support its April 22 motion to strike new expert materials. The legal clash concerns whether SEC accountant Andrea Fox's testimony should be treated as a summary or expert witness.