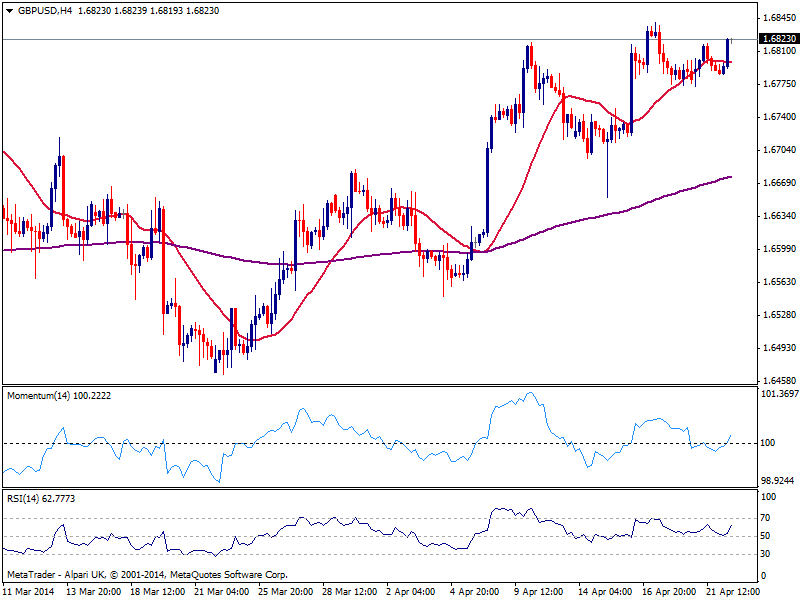

Technically, the GBP/USD maintains the bullish tone seen on previous updates, with the 4 hours chart showing indicators picking up momentum above their midlines, and current candle above a flat 20 SMA. Trading barely 20 pips below the year’s high of 1.6841, a price acceleration above this level should see price advancing in a quick spike towards 1.6870 immediate resistance as per being November 2009 monthly high. Once above the path is pretty clear up to the 1.7000 figure, with an intermediate resistance at 1.6920.

Buyers will likely surge on retracements down to 1.6770/80 area first intraday support, followed later by 1.6745. This last hardly seen broken in the days to come, unless panic selling takes control over all markets.

View Live Chart for GBP/USD

Recommended Content

Editors’ Picks

EUR/USD stays below 1.0700 as focus shifts to Fed policy decisions

EUR/USD stays in its daily range below 1.0700 after the data from the US showed that private sector employment rose more than expected in April. The Federal Reserve will announce monetary policy decisions later in the day.

GBP/USD holds steady below 1.2500 ahead of Fed

GBP/USD is off the lows but stays flatlined below 1.2500 on Wednesday. The US Dollar holds its ground after upbeat ADP Employment Change data and doesn't allow the pair to stage a rebound ahead of the Fed's policy decisions.

Gold consolidates losses below $2,300, eyes on Fed policy decision

Gold price hovers below $2,300 as uncertainty ahead of the Fed’s policy announcements improves the appeal of the US Dollar and bond yields. The Fed is expected to hold the policy rate unchanged amid stubborn inflation.

A new stage of Bitcoin's decline

Bitcoin's closing price on Tuesday became the lowest since late February, confirming the downward trend and falling under March and April support and the psychologically important round level.

US Federal Reserve Decision Preview: Markets look for clues about interest rate cut timing

The Federal Reserve is widely anticipated to keep interest rates unchanged. Fed Chairman Powell’s remarks could provide important clues about the timing of the policy pivot.