- GBP/USD has been edging lower from the highs amid some dollar strength.

- An increase in UK deaths, fraught Brexit talks, and growing chances of negative rates may send sterling lower.

- BOE Governor Andrew Bailey's public appearance is eyed.

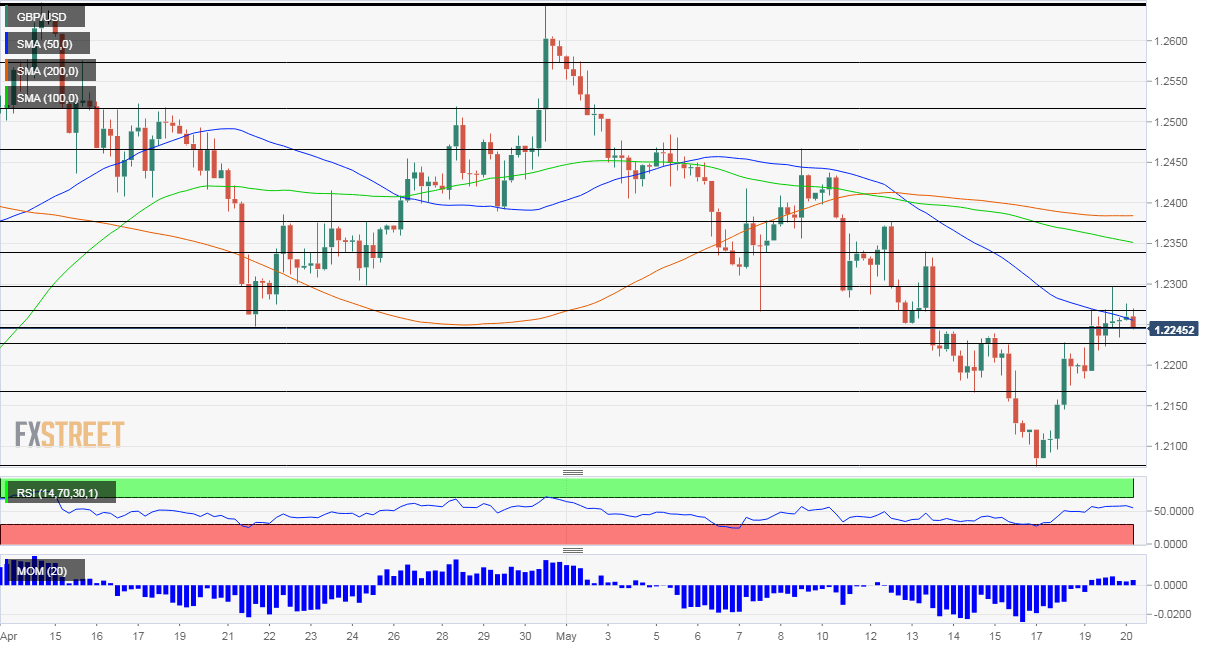

- Wednesday's four-hour chart is painting a mixed picture.

A breather before next move up? Not so fast, especially with Brexit breathing down the pound's neck.GBP/USD has been edging lower as the safe-haven US dollar regained some ground. While the greenback may be ready to retreat once again, the pound's position may limit any gains and perhaps suggest falls.

Markets rallied on Monday – diminishing demand for the dollar – amid hopes for a coronavirus vaccine. Massachusets-based Moderna announced positive results among eight patients and inspired investors. However, as time passed by, the lack of any details that scientists could scrutinize – nor any acknowledgment from government bodies involved in the project – caused doubts, that sent the dollar back up and equities lower.

While shares have found their feet and the greenback is giving ground again, sterling may still stumble due to UK-related reasons:

Three pound pressures

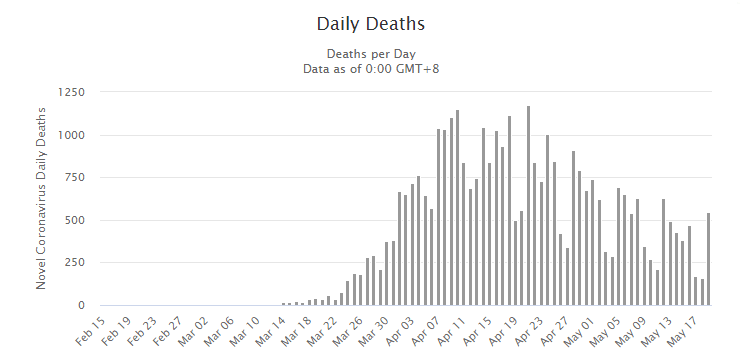

1) Daily COVID-19 deaths are on the rise once again, jumping to 545 in Tuesday's report. The weekend effect – in which statistics are relatively rosy for Saturdays and Sundays, is pronounced in Britain and the setback on workdays is substantial. Total coronavirus mortalities have topped 35,000 with the focus on care homes.

Source: WorldInfoMeter

The ongoing misery limits the government's ability to lift the lockdown, weighing on the economy. Chancellor of the Exchequer Rishi Sunak painted a gloomy picture of the economy, saying the UK is facing a recession "the likes of which have never been seen."

2) Brexit talks getting nasty: David Frost, London's Chief Negotiator, said that the EU is treating the UK as an "unworthy partner" trying to bend it to EU norms, offering a low-quality deal. He described Brussels' proposals as "egregious" when referring to having EU state rules as part of British law. His counterpart Michel Barnier blamed Britain for wanting to keep the benefits of a member state without the obligations.

The ongoing tensions raise the chance that the UK exits the transition period without a trade deal, reverting to World Trade Organization rules, worrying investors.

3) Rising chances of negative rates: Britain's Consumer Price Index fell to 0.8% yearly in April, worse than expected. The sharp fall in inflation raises the chances that interest rates fall below zero – in addition to more Quantitative Easing.

Andrew Bailey, Governor of the Bank of England, will speak to lawmakers later in the day and may refer to the topic. While he previously sounded skeptical about such a move, several of his colleagues have been open to the idea. That could weigh on the pound as well.

Money markets are raising their bets on the BOE taking that path.

Traders are also speculating on negative rates in the US. Jerome Powell, Chairman of the Federal Reserve, recently rejected setting sub-zero borrowing costs, The bank's meeting minutes are eyed. Powell vowed to support the economy and nudged elected officials to add fiscal stimulus in a testimony on Tuesday.

See FOMC Minutes Preview: Watching for hints of negative rates

Sino-American relations remain tense, but not as much as beforehand.

GBP/USD Technical Analysis

Pound/dollar has failed in its attempt to top the 50 Simple Moving Average on the four-hour chart, but momentum remains to the upside. The picture is mixed.

Support awaits at 1.2225, a swing high earlier this week, followed by 1.2165, a former double bottom. It is followed by 1.2075, May's low.

Some resistance is at 1.2270, a swing low from early May that has also held the pair down recently. Tuesday's high at 1.2295 is the next level to watch. Further above, 1.2340 and 1.2370 are eyed.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.