The latest UK political turmoil, led by reports that a significant number of Conservative MPs were ready to sign a letter of no confidence, weighed heavily on the British Pound at the start of a new trading week. The GBP/USD pair tumbled closer to early-November lows near mid-1.3000s, touched in the aftermath of dovish BOE rate hike, but managed to recover back above the 1.3100 handle. The recovery move was supported by BOE Chief Economist Andy Haldane's comments that UK CPI is likely to stay above the target 'for the next few years'.

The pair, however, seemed lacking any follow through momentum as focus shifts to the latest UK inflation figures, due to be released during the European session and expected to show headline CPI increased 3.1% y-o-y in October. Against the backdrop of a deadlock on the Brexit settlement bill, easing inflationary pressure would scale back market expectations for any additional BOE rate hike and might trigger a fresh round of GBP weakness.

Meanwhile, an uptick in the CPI might provide a minor boost to the British Pound, but would force BOE Governor Mark Carney to write an open letter to the Chancellor of Exchequer Philip Hammond, explaining reasons for inflation moving away from the central bank's upper band and what actions ought to be taken to bring inflation back to target.

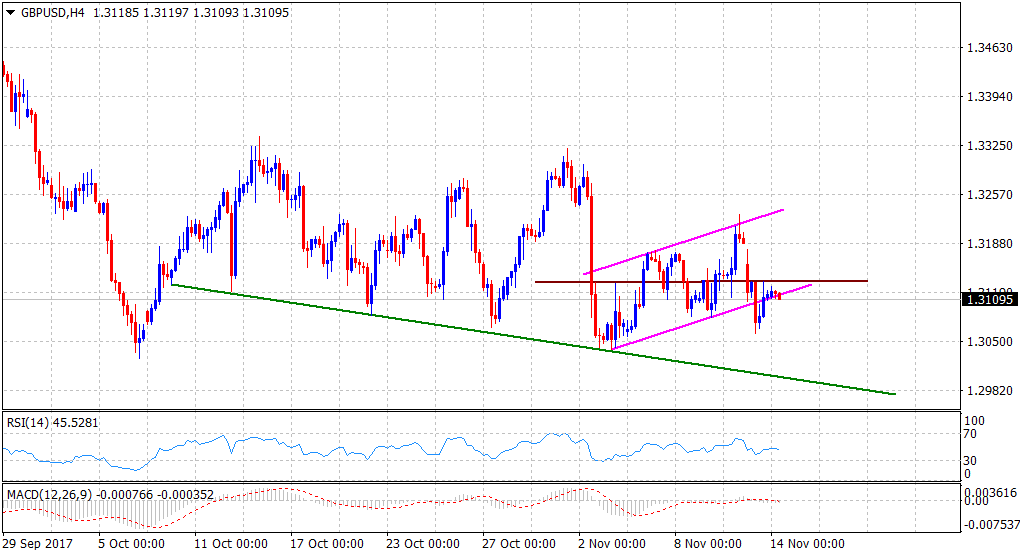

From a technical perspective, the pair on Monday confirmed a bearish break below a short-term ascending trend-channel. Moreover, the subsequent recovery confronted fresh supply near the 1.3135 region, which now becomes an immediate hurdle. A clear break through the mentioned barrier could trigger a short-covering bounce towards 1.3175 horizontal resistance but might still struggle to lift the pair back above the 1.3200 handle.

On the flip side, weakness back below the 1.3100 handle, leading to a subsequent break below 1.3080 level, might continue dragging the pair towards an unfinished target of 1.30 mark.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD holds below 1.0750 ahead of key US data

EUR/USD trades in a tight range below 1.0750 in the European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

GBP/USD consolidates above 1.2500, eyes on US PCE data

GBP/USD fluctuates at around 1.2500 in the European session on Friday following the three-day rebound. The PCE inflation data for March will be watched closely by market participants later in the day.

Gold clings to modest daily gains at around $2,350

Gold stays in positive territory at around $2,350 after closing in positive territory on Thursday. The benchmark 10-year US Treasury bond yield edges lower ahead of US PCE Price Index data, allowing XAU/USD to stretch higher.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.