GBP/USD Forecast: Four Top-tier figures to determine direction after BOE blow, election mess

- GBP/USD has been on the back foot after the dovish BOE decision

- UK GDP, employment, inflation, and retail sales compete with the elections for attention.

- Mid-November's daily chart is pointing to further gains for the pound.

- The FX Poll is showing that experts are bearish in the short term and uncertain afterward.

The Bank of England is back to influencing the pound – but to the downside. After the BOE's warnings, a daily dose of high-level figures will compete with election headlines – high volatility will likely be sustained.

This week in GBP/USD: BOE breaks the pound

Mark Carney, Governor of the Bank of England, gave pound bears a departing gift. While he and six of his colleagues at the Monetary Policy Committee (MPC) voted to leave rates unchanged, two other members supported a rate cut. Michael Saunders, a former hawk in the committee, completed his move to the dovish camp. Moreover, he cited worries about the labor market – seemingly a healthy part of the economy – as one of the reasons to cut.

Governor Carney then painted a gloomy picture of the economy, with falls in manufacturing and a somewhat restrained consumer. The damage from Brexit has been done and his warnings about the global economy – saying it may "feel like a recession" – painted an unflattering outlook.

More BOE Analysis: Carney catches up with cloudy reality, GBP/USD support removed

GBP/USD tumbled down in response, stealing the show from politics, that were otherwise driving sterling. Prime Minister Boris Johnson's Conservatives remain in the lead of some 12 points over the opposition Labour Party. The 37% support for the Tories is far from guaranteeing an absolute majority. Investors prefer Johnson's hard Brexit deal and a business-friendly government over uncertainty about the UK's exit and seeing leftist Jeremy Corbyn in Downing Street.

Both main parties have been on the defensive. Jacob Rees-Mogg, the Conservative Leader of the House, made an insensitive comment, and another Alun Cairns, the Wales minister, was forced to resign over lying in a sensitive inquiry. On the other side of the aisle, deputy leader Tom Watson quit the party in a blow to Corbyn, while another MP Ian Austin has called the public to support the Tories.

The pace of US-Sino headlines has intensified. Reports that the first phase of an agreement would be delayed to December depressed markets. The world's largest economies were unable to agree on the location of the signing ceremony nor the reduction of tariffs. Later on, Beijing said it had reached an agreement with the US on a gradual tariff reduction, allowing stocks to recover.

Services Purchasing Managers' Indexes on both sides of the pond beat expectations. The Markit/CIPS services PMI in the UK recovered to 50 points – the threshold separating expansion from contraction. The US ISM Non-Manufacturing PMI jumped to 54.7 – already reflecting healthy growth. In both countries, the manufacturing sectors continue struggling.

Overall, pound/dollar has been moving mostly on UK developments, and this may continue.

UK events: Opinion polls and four figures to watch

December 12 is getting closer, and opinion polls may have a stronger say on the pound's price. If Johnson's Conservative advance toward and beyond 40%, they have a good shot at achieving an absolute majority, sending sterling higher. If Labour narrows the gap below 10%, GBP/USD may retreat.

The deadline for submitting the lists of candidates is Thursday, November 14. Nigel Farage's Brexit Party – which sees the PM's Brexit deal as not going far enough – is on course to field candidates across the country. If the right-wing outfit decides to withdraw some candidates to make way for the Tories, it may be pound-positive.

Election surveys have been varied, showing differing levels of a Conservative lead. A more detailed study mapping out constituencies may provide a clearer picture.

Economic figures may move the pound more than beforehand, especially after we have seen the impact of the BOE – especially top-tier data.

1) GDP: Quarterly Gross Domestic Product (GDP) figures are due out on Monday and may have show the economy contracted in the third quarter. Monthly data for July and August have been unimpressive. The yearly GDP growth has likely slowed down as well. Headlines warning of a recession may exacerbate GBP/USD's fall while Manufacturing Production numbers for September have room to impact sterling if GDP data meet expectations.

2) Jobs report: After the central bank expressed concern about the labor market, markets will learn about the recent developments for September on Tuesday. Forecasts remain upbeat. The Unemployment Rate is set to remain unchanged at 3.9% while wage growth carries expectations for remaining at 3.8% – both when including and excluding bonuses.

3) Inflation: The headline Consumer Price Index (CPI) has disappointed in the past two months and dropped to 1.7%. A pick up to 1.8% yearly is on the cards for October, bringing it closer to the BOE's 2% target. Producer prices are of interest as they serve as another gauge of the manufacturing sector.

4) Retail Sales: Thursday's consumption report completes the picture – and it may complete a gloomy picture. Sales remained flat in September and are set to drop by 0.2% in the figures for October. Brexit uncertainty has remained high and may have impacted shoppers.

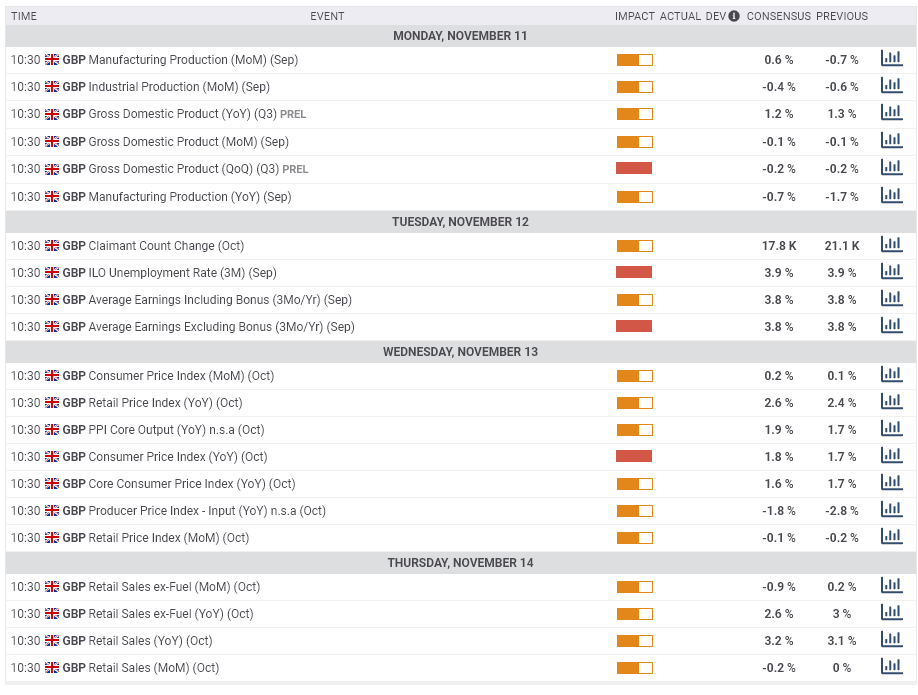

Here is the list of UK events from the FXStreet calendar:

US events: Powell's testimony and trade developments

Further headlines around trade are set to rock markets as the world's largest economies aim to clinch a deal around mid-November. GBP/USD has been relatively calm in its responses to these headlines, but this may change.

America's inflation report is set to show another increase in Core CPI – potentially curbing the chances of another rate cut by the central bank. Wednesday's figures may be overshadowed by a critical testimony from Jerome Powell, Chairman of the Federal Reserve.

Powell goes to Capitol Hill and will provide an update on the state of the US economy and the next moves in monetary policy. Politicians may grill him on the impact of trade uncertainty as well as the potential policies they want to promote. Any hint about further moves may rock the dollar.

Producer prices are of interest on Thursday, but markets will likely digest the Fed Chair's words and prepare for Friday's Retail Sales figures. Consumption has been leading the economy forward in recent months. However, September's stagnation in the all-important Control Group has worried investors. Expectations are substantially higher this time – a leap of 0.7% in the control group and a recovery in headline sales.

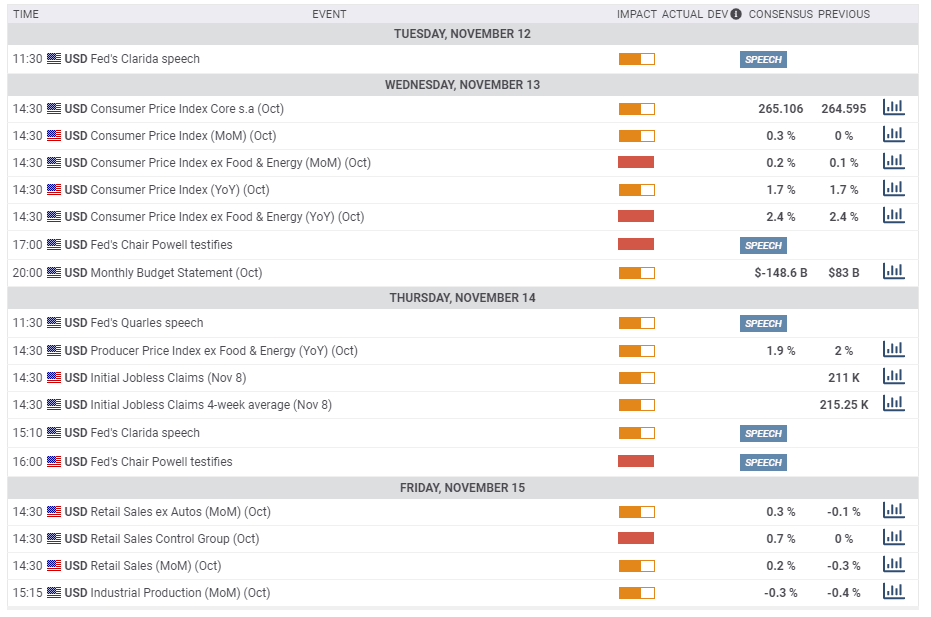

Here are all the top US events on the economic calendar:

GBP/USD Technical Analysis

The daily GBP/USD paints a mostly upbeat picture for the currency pair. Momentum remains to the upside, the Relative Strength Index has exited overbought conditions, and it trades above the 50, 100, and 200-day Simple Moving Averages.

However, it has recently marked a lower high – raising the chances of a downturn.

Robust support awaits at 1.2785, which is a near-double-bottom after GBP/USD fell close to this level in early November. Lower, 1.2705 was a stepping stone on the way up and it converges with the 200-day SMA. 1.2580 was a resistance line in September and also in late August. It is followed by 1.2520, 1.2415, and 1.2390.

1.2780 worked as support back in the spring and may play a role in the next moves. Further above, 1.2980 capped GBP/USD in its recovery attempt in late October, and 1.3013 is the cycle high from earlier that month. 1.3135 is the next line to watch and dates back to the spring.

GBP/USD Sentiment

The 2017 elections have seen a narrowing of the Conservatives' lead at this point in the campaign – and it may happen again now. Combined with potentially meager economic figures, the pound has more room to extend its falls than rising.

The FX Poll is showing a bearish tendency in the short term but mixed views and rising uncertainty in the medium and long terms. The targets are little-changed in comparison to the previous week.

Related Forecasts

- USD/JPY Forecast: Buy Trump's trade rumor, sell the fact? Powell's outlook also eyed

- EUR/USD Forecast: US-China headlines to keep stealing the show

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.