Crude Oil: Decision time

Crude oil bounced off key long-term support, but it did so right into layered resistance… and immediately stalled.

Now the price is sitting in a tight battlefield where short-term signals say “careful” while long-term structure says, “this area matters a lot”. This is where trends don’t just “move” they choose sides.

What’s Really Happening with Crude Oil?

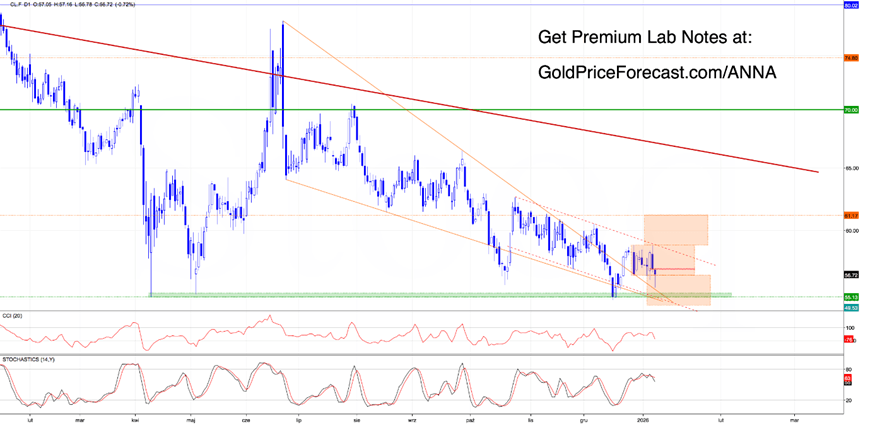

Daily chart: The bounce meets reality

The first big win for the bulls?

Crude oil climbed back above the previously broken upper line of the orange declining wedge, which is a technical victory that normally opens the door for more upside.

But that door didn’t stay open long.

Right above price, three major bearish elements lined up almost perfectly:

• upper border of the red declining channel

• top of the orange consolidation zone

• H4 resistance cluster

That stack of resistance acted like a ceiling and sellers showed up fast. Crude oil pulled back, retested the lower edge of the orange consolidation (marked on the daily chart) and although bulls fought back, they woke up today to something they didn’t want to see - a fresh red bearish gap + a new sell signal on daily Stochastics.

That combo? Not a great look for team bull.

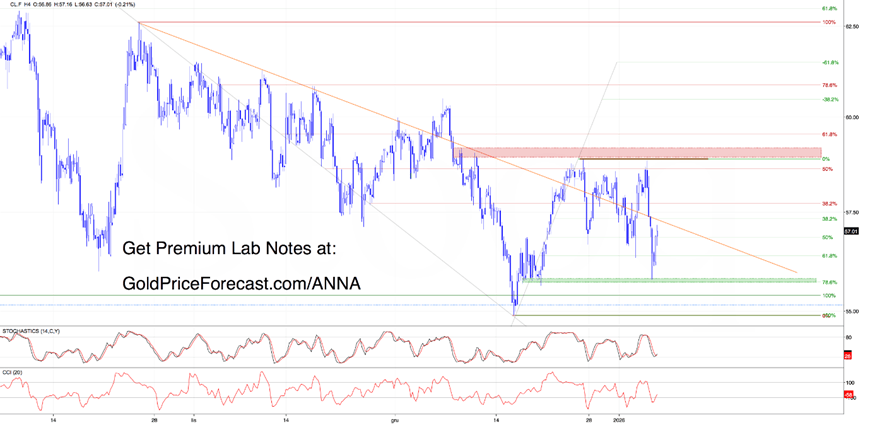

Yes, you’re right - H4 indicators flashed buy signals…but as long as that bearish gap stays open, sellers still have the upper hand, and the risk remains high that they retest the green support zone on H4 (built from prior lows + the 78.6% Fibonacci retracement).

And here’s the key: that green zone is the last real defensive wall before December lows.

Therefore, if bulls lose it the market will likely extend losses. Why? Because if black gold closes below the orange consolidation, the next technical magnet will be the retest of the above-mentioned upper line of the orange wedge (daily).

And that retest will be a war:

• if bulls defend it → that becomes a textbook verification of the breakout and the price will likely bounce toward the top of the orange consolidation again.

• if they fail → bears will likely open the door to $55 region and the measured move target near $54.60

And this is exactly where the bigger-timeframe story gets powerful…

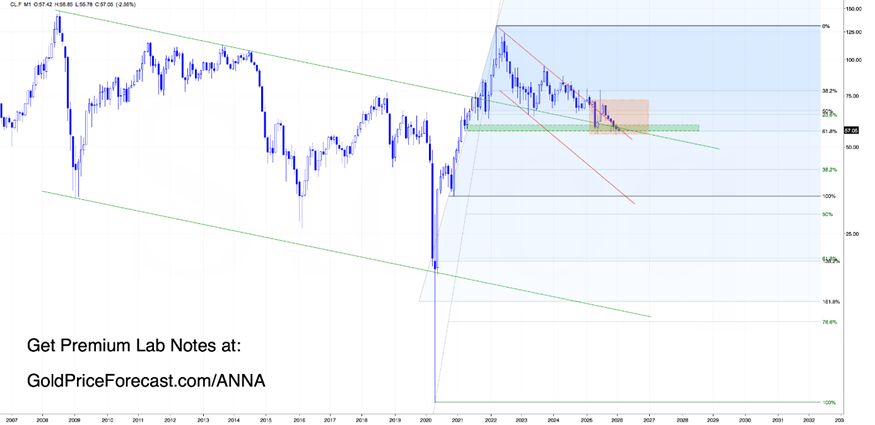

Monthly chart: Why is this zone sacred ground?

From this perspective, we see that crude oil is consolidating for over half year right above very important supports: the 61.8% Fib retracement of the 2020-2022 bull run and the upper border of the old green declining channel.

Bears have pushed price into this support multiple times…but bulls haven’t let it break. And here’s why that really matters. What could happen if this zone breaks? $50 becomes a magnet - fast. Not just technically, but also psychologically.

Why $50 is such a big deal?

Markets aren’t just numbers - they’re behavior:

• above $50? Traders feel like oil is “holding value.” Dips attract buyers. Risk feels balanced

• below $50? Narratives shift and history reminds us why this matter…

When crude oil lost the $50 level in early March 2020, it didn’t just drift lower. It triggered a chain reaction. The breakdown below $50 marked a psychological and structural shift in positioning - accelerating deleveraging, forced selling, and aggressive downside hedging.

That cascade ultimately pushed crude oil into price territory that most participants previously considered theoretical rather than possible. In other words, once $50 cracked the market stopped “thinking” and started reacting.

That’s why, for bulls, $50 is not just a number.

It’s a pressure point - mentally and financially.

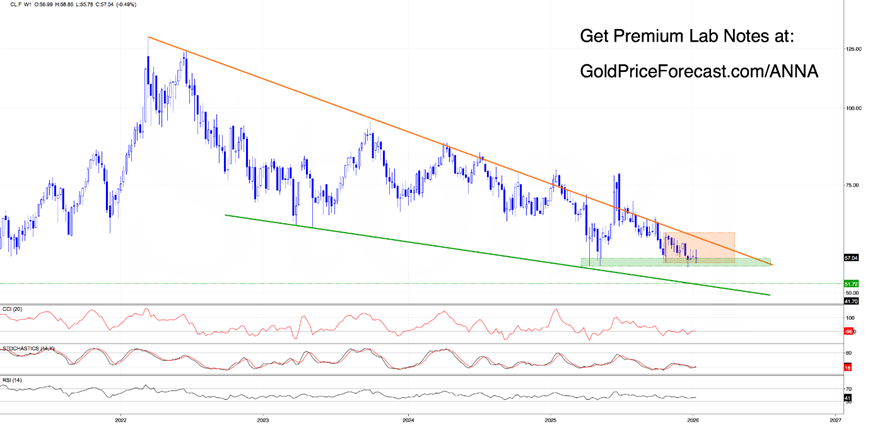

Weekly chart: The final technical lock

On the weekly chart, we clearly see that the lower border of the massive multi-year declining wedge sits right inside this same support zone (around $50).

Yes, weekly indicators show bullish divergence…but divergence only matters if price confirms. Until then, it’s potential energy - not motion.

What could happen next? The roadmap

Bearish Path

If black gold closes day below the orange consolidation, we’ll likely see (at least) a retest of the orange wedge breakout. If the bulls win here, we’ll see another bounce and buyers will likely try to close today’s bearish gap. However, if they fail, price will slide toward $55 or even $50.

Bullish Path

Do the bulls still have a chance to save themselves from the 50 test? Yup, but they need to defend nearest support zones, close today’s bearish gap and break cleanly above resistance cluster marked on H4. Only then does the narrative brighten.

Positioning Mindset

This is a decision zone. And decision zones are NOT the places where professional traders go big.

Why?

Because this is the part of the market where the fight is still happening. Pros don’t swing hard while the punch is still being thrown. They wait until one side clearly wins, the move gets confirmed and the path forward becomes cleaner.

Intraday - sure. Tactical scalps? Fine.

But swing-risk?

Not yet.

Because this is where capital goes to die when traders force a bias before the market declares one. Right now, the mission isn’t prediction. It’s patience.

Lab takeaway - What to do with this (today)

Right now, crude oil is not trending. It’s building pressure at a huge long-term support zone.

That means one thing: this is a “wait and watch” market - not a “jump in early” market. Your job isn’t to guess the winner. Your job is to let the market show you who wins and then ride the move.

So, for now… mark the key levels, watch how price behaves around them, save your emotional capital and your financial capital. The big move (whichever direction it comes) will be clear enough to catch without stress… and with way better risk-reward.

Stay sharp. Stay curious. And let the chart choose the story before you do.

Want free follow-ups to the above article and details not available to 99%+ investors? Sign up to our free newsletter today!

Author

Anna Radomska

Sunshine Profits

Anna's passion for drawing evolved into a fascination with colorful lines and shapes, which later inspired her interest in the stock market.