EUR/USD Price Forecast: Next on the upside comes 1.1800

- EUR/USD trades in an inconclusive fashion below the 1.1700 mark.

- The US Dollar advances marginally amid a broad-based absence of direction.

- The US ADP report disappointed estimates in December ahead of Friday’s NFP.

EUR/USD’s ongoing bearish leg appears to have met some initial contention near 1.1670 as markets remain in a wait-and-see mode ahead of Friday’s critical NFP data.

EUR/USD alternates gains with losses in the sub-1.1700 region midweek, extending the bearish leg that followed the late-December tops just over 1.1800 the figure.

The pair’s vacillating price action comes in tandem with the equally irresolute developments surrounding the Greenback, which struggles to extend the firm recovery following December lows around 97.70 when measured by the US Dollar Index (DXY).

Furthermore, the pair’s lack of direction also comes in line with declining US Treasury yields across the board as well as a move lower in Germany’s 10-year bund yields, as market participants continue to digest softer-than-expected inflation figures in the Euroland and poor prints from the US ADP report in December (+41K), all prior to the crucial Nonfarm Payrolls (NFP) on Friday.

The Fed continues to look at the labour market

The Fed delivered the cut markets had priced in in December, but it was the message around it that mattered most.

The split vote and Chair Jerome Powell’s carefully calibrated tone made clear that policymakers are in no rush to accelerate the easing cycle. Officials want greater confidence that the labour market is cooling in an orderly way and that inflation, which Powell described as “still somewhat elevated”, is on a convincing path back to target.

Updated projections did little to alter the broader narrative. Policymakers continue to pencil in just one additional 25 basis point cut in 2026, unchanged from September. Inflation is seen easing to around 2.4% by the end of next year, while growth is expected to hold near a respectable 2.3% and unemployment to settle around 4.4%.

During the press conference, Powell stressed that the Fed feels well positioned to respond to incoming data, but he offered no hint of an imminent follow-up cut. At the same time, he firmly dismissed the idea of rate hikes, which he said do not feature in the baseline outlook.

On inflation, Powell pointed directly to import tariffs introduced under President Donald Trump as a key factor keeping price pressures above the Fed’s 2% target for now, reinforcing the sense that some of the inflation overshoot is policy-driven rather than demand-led.

The Fed’s December rate cut was anything but a done deal, according to the Minutes released on December 30. Indeed, policymakers were deeply split, with several officials saying the decision was finely balanced and that they could just as easily have argued for leaving rates unchanged.

The core tension was clear: some members felt a cut was needed to get ahead of a cooling labour market, while others worried that inflation progress had stalled and that easing too soon could undermine the 2% target. That split showed up starkly in the vote, with dissent coming from both the hawkish and dovish sides, an unusual situation that has now happened twice in a row.

Although the Fed went ahead with a third consecutive quarter-point cut, taking rates closer to a neutral level, conviction about further easing is fading. New projections point to just one cut next year, and the policy statement signals a likely pause unless inflation resumes falling or unemployment rises more than expected.

Complicating matters further is the lack of reliable data following the long government shutdown, which has left policymakers flying partly blind. Several officials made clear they would prefer to wait for a fuller run of labour market and inflation data before backing any additional rate cuts.

ECB mood: steady hands for now

The European Central Bank (ECB) hit the pause button at its December 18 meeting, keeping interest rates unchanged, but the tone of the discussion felt a touch less dovish than before. Policymakers also nudged up parts of their growth and inflation outlook, a combination that all but shuts the door on further rate cuts in the near term.

Recent data have given the central bank some reassurance. Eurozone growth has come in stronger than expected, helped by exporters coping better than feared with US tariffs and by solid domestic demand picking up the slack left by a still-struggling manufacturing sector. On the inflation front, price pressures have been hovering close to the ECB’s 2% target, with services inflation doing much of the heavy lifting, and officials expect that to remain the case for a while.

In its updated projections, the ECB still sees inflation dipping below 2% in 2026 and 2027, largely thanks to lower energy prices, before edging back to target in 2028. That said, the bank flagged that services inflation could prove stickier than hoped, with wage costs slowing the pace of any decline. Growth forecasts were also revised slightly higher for this year, reflecting an economy that looks more resilient than feared in the face of higher US tariffs and competition from cheaper Chinese imports. As President Christine Lagarde put it, exports remain “sustainable” for now.

The ECB now expects the economy to grow by 1.4% this year, 1.2% in 2026, and 1.4% in both 2027 and 2028.

In her press conference, Lagarde was careful to keep her options open. She stressed that policy decisions will continue to be taken meeting by meeting, guided by incoming data, and reiterated that the central bank is not committing to any preset path for interest rates.

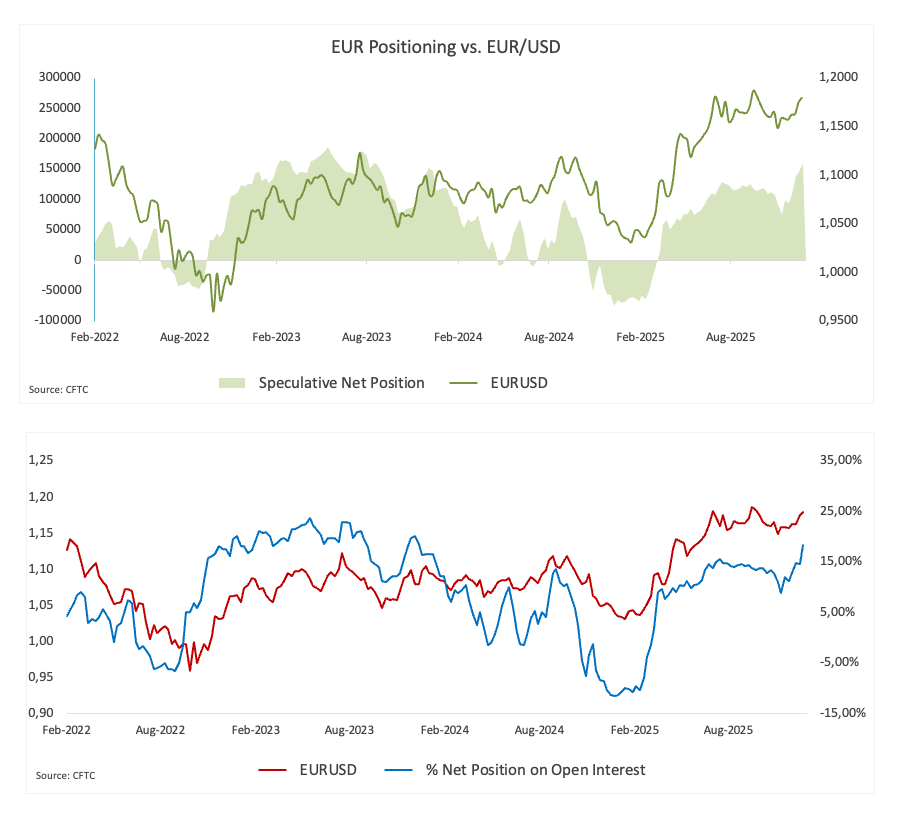

Speculators remain bullish on EUR

Non-commercial demand for the Euro (EUR) has strengthened. Commodity Futures Trading Commission (CFTC) data for the week ending December 23 showed net longs increasing to levels last seen in the summer of 2023 near 160K contracts. Meanwhile, institutional accounts also increased their exposure, with net shorts also rising to more than two-year highs around 209.5K contracts.

In addition, total open interest fell to three-week lows of nearly 867K contracts, a combination that points to some waning conviction on both sides of the market.

What matters next

Short term: US data flow (labour); EUR/USD remains primarily a Dollar story until the Fed’s reaction function becomes clearer.

Risk: a renewed rise in US yields or a hawkish repricing of the Fed path; on the topside, a clean break and hold above 1.1800 would improve momentum.

Tech corner

EUR/USD could regain more convincing upside traction once it clears the area of the December high at 1.1807 (December 24), while its key 200-day SMA near 1.1560 continues to hold occasional sell-offs.

That said, a break above the December top could put a test of the 2025 ceiling at 1.1918 (September 17) back on the radar, ahead of the key round level at 1.2000.

On the flip side, there is a transitory support at the 55-day SMA at 1.1638. The loss of this level should prompt spot to attempt a test of the key 200-day SMA at 1.1557. Down from here sits the November base at 1.1468 (November 5), prior to the August bottom at 1.1391 (August 1) and the weekly low at 1.1210 (May 29).

In addition, momentum indicators appear mixed: The Relative Strength Index (RSI) retreats to around the 47 level, leaving the door open to extra losses, while the Average Directional Index (ADX) near 24 points to quite a firm trend.

-1767811963140-1767811963140.png&w=1536&q=95)

EUR/USD retains a modest upward bias, but conviction remains thin.

For the time being, EUR/USD is still being driven more by what’s coming out of the US and how the Dollar is behaving than by anything new at home in the euro area. Until the Fed offers clearer clues on how far it’s prepared to ease policy, or Europe shows more convincing signs of cyclical momentum, any upside in the pair is likely to be steady rather than dramatic.

Put simply, the Euro is getting a lift from a softer Dollar, but it’s still lacking a story of its own.

Euro FAQs

The Euro is the currency for the 20 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day. EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy. The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates – or the expectation of higher rates – will usually benefit the Euro and vice versa. The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), is an important econometric for the Euro. If inflation rises more than expected, especially if above the ECB’s 2% target, it obliges the ECB to raise interest rates to bring it back under control. Relatively high interest rates compared to its counterparts will usually benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.

Data releases gauge the health of the economy and can impact on the Euro. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the single currency. A strong economy is good for the Euro. Not only does it attract more foreign investment but it may encourage the ECB to put up interest rates, which will directly strengthen the Euro. Otherwise, if economic data is weak, the Euro is likely to fall. Economic data for the four largest economies in the euro area (Germany, France, Italy and Spain) are especially significant, as they account for 75% of the Eurozone’s economy.

Another significant data release for the Euro is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought after exports then its currency will gain in value purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.