Cutting through the noise

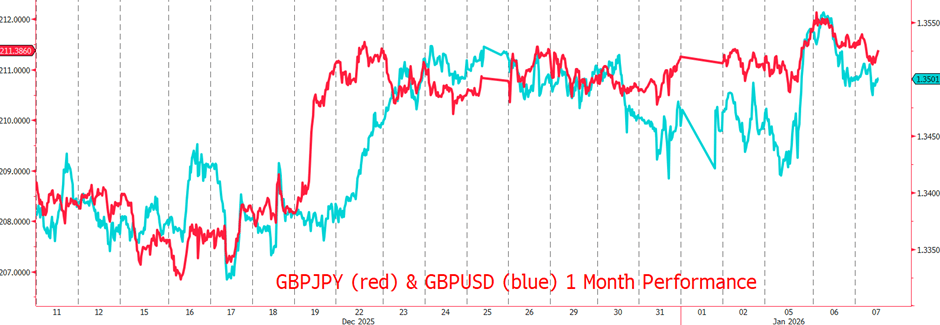

The first full week of 2026 has become entirely engrossed by geopolitics, much of which seems very unlikely to have a material impact on FX markets over the long run. But it has still generated an enormous amount of noise, to the extent that almost everything else has become crowded out. You can see the limited extent that the FX market has taken notice by the only modest rally in safe haven currencies such as JPY and USD.

Indeed, the Swiss Franc, usually a reliable safe haven, managed to actually soften over this week.

But practically, this year will be decided by the health of the US economy, more specifically how the unemployment rate behaves as the year goes on. Certainly, the mid-terms in November are important, but distant at this moment and with the tariff madness behind us, I suspect that this year will mark a return to more level headed analysis.

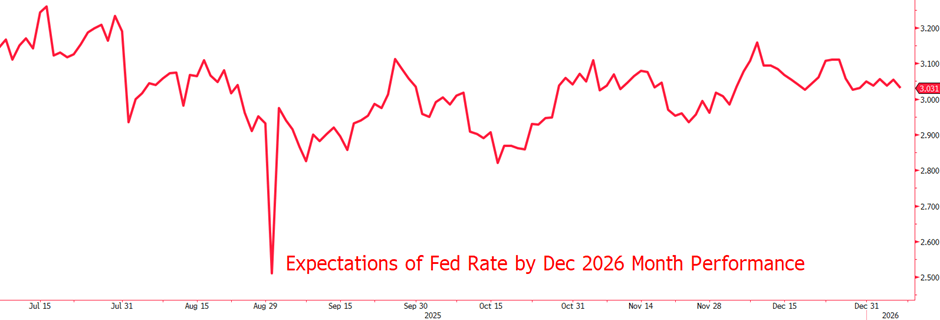

Trump’s pick for Fed Chair should be imminent, with doves Kevin Hassett and Kevin Warsh essentially equal in chances, based on the market estimate. This decision, not the decision to intervene in Venezuela, will likely prove the most decisive and important of the first quarter of this year.

The market already expects just shy of 3 interest rate cuts from the Fed this year as a response to a softening economy, meaning that, on forecasts, the Bank of England will maintain a 0.25% higher rate and the ECB’s rate differential against the Fed will be nearly halved by December.

Considering the Fed managed to cut 3 times in 2025, pivoting from a previously hawkish stance, I suspect the market is underestimating the number of cuts possible this year.

This Friday’s Non-Farm Payroll will be a key litmus test for the US economy after a strong showing in Wednesday’s ISM services data and could well be the deciding factor of the Fed’s decision come the 28th. But regardless of short term concerns, a dovish Fed seems certain this year. with the only question being just how dovish the Fed comes out.

Author

David Stritch

Caxton

Working as an FX Analyst at London-based payments provider Caxton since 2022, David has deftly guided clients through the immediate post-Liz Truss volatility, the 2020 and 2024 US elections and innumerable other crises and events.