Australian Dollar Price Forecast: A move to 0.6800 emerges on the horizon

- AUD/USD eases from 15-month peaks near 0.6760 on Wednesday.

- Australian inflation lost some momentum in November.

- The RBA is seen hiking its OCR by around 50 basis points this year.

AUD/USD keeps putting the upper end of its multi-month consolidative range to the test, backed by the lack of direction in the US Dollar and prospects of a hawkish RBA in 2026.

The Australian Dollar (AUD) came under renewed pressure on Wednesday, with AUD/USD deflating from fresh 15-month highs around 0.6760 to revisit the 0.6720 region. The pair, in addition, set aside three consecutive daily advances, although it still maintains a solid start to the new year.

Despite the hesitation, the broader tone remains constructive. Supporting this, spot is holding comfortably above its key 200-week and 200-day SMAs at 0.6628 and 0.6508, respectively.

The lack of follow-through higher appears more related to some profit-taking mood amid the broader absence of direction in the FX universe than to any deterioration in the underlying AUD narrative.

A steady economy quietly doing what it needs to do

Australia isn’t delivering blockbuster upside surprises, and that’s largely the point. The recovery continues to progress at a measured pace, with recent data broadly consistent with a soft-landing-style outcome.

The latest PMI readings helped reinforce that view, with Manufacturing and Services posting decent readings, Retail Sales looking healthy, and the trade surplus (A$4.385 billion in October) adding an extra layer of robustness to the economy.

Growth did undershoot expectations, however, with GDP expanding 0.4% QoQ in the July-September period versus 0.7% previously, although the annual pace held at a solid 2.1%, broadly in line with what the Reserve Bank of Australia had pencilled in for year-end.

The labour market seems to have lost some traction in November. That month, the Employment Change dropped by 21.3K individuals, while the Unemployment Rate held steady at 4.3%.

Inflation remains somewhat elevated despite losing impulse in November. Indeed, the latest data saw the Headline CPI ease to 3.4% and the significant trimmed mean CPI deflate a tad to 3.2%.

China is still helping, just less dramatically

China continues to provide a supportive, if increasingly subdued, backdrop for the Aussie.

Q3 GDP growth held at 4.0% YoY, while Retail Sales expanded by 1.3% YoY in November, respectable outcomes, though a far cry from the growth impulses seen in earlier cycles. More recent indicators point to some improvement in momentum: the official manufacturing PMI entered expansionary territory at 50.1 in December, the same as the more export-sensitive Caixin gauge, which rose to 50.1.

Services activity also gathered some steam, with non-manufacturing PMI increasing to 50.2, and the Caixin’s Services PMI stayed expansionary at 52.0. The trade surplus widened decently to $111.68 billion in November, with exports expanding by nearly 6% vs. an almost 2% decline from imports.

There are some tentative bright spots. Headline CPI remained positive in November, rising 0.7% YoY, while Producer Prices extended their downside, declining at an annualised 2.2%, underscoring lingering deflationary pressures.

For now, the People’s Bank of China remains patient. Loan Prime Rates were left unchanged at 3.00% (one-year) and 3.50% (five-year) on December 22, reinforcing the view that policy support will be gradual rather than forceful.

RBA staying firm on the tiller

The Reserve Bank of Australia delivered a widely expected “hawkish hold” at its latest meeting.

The cash rate was left unchanged at 3.60% in December, but the accompanying message remained firm. Policymakers continue to flag capacity constraints and weak productivity as medium-term risks, even as the labour market shows tentative signs of cooling.

Governor Michele Bullock pushed back against near-term easing expectations, noting that the Board is weighing a prolonged pause or even the possibility of further tightening if inflation proves more persistent. Q4 trimmed mean CPI was highlighted as a critical data point — though that clarity won’t arrive until late January.

Minutes from that meeting suggest policymakers are starting to ask some uncomfortable questions, including whether another rate hike might be needed next year to keep inflation in check. There’s clearly a bit of soul-searching going on, with officials unsure whether financial conditions are actually restrictive enough.

The message is that keeping rates on hold next year won’t be a given. The RBA wants to be confident that financial conditions are tight and that the recent lift in inflation won’t last. That puts a lot of weight on the quarterly inflation data due in late January, which could prove pivotal.

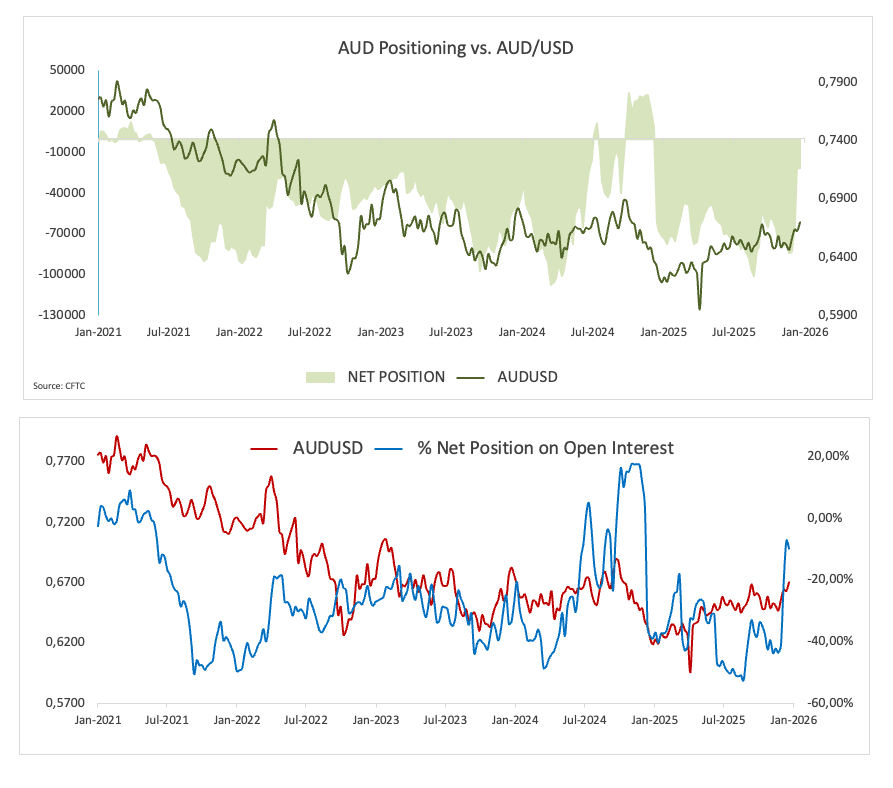

Positioning appears supportive of AUD

CFTC data for the week ending December 23 showed speculators continuing to trim bearish AUD exposure, with net shorts falling to nearly 26K contracts, the lowest level since late September 2024.

In addition, open interest contracted sharply to around 217.2K contracts (from nearly 294K contracts in the previous week), suggesting the improvement in positioning reflects reduced conviction and lighter overall exposure rather than aggressive bullish re-engagement.

What matters next

Short term: Australia’s trade data comes out on Thursday, and markets will be looking for a confirmation of momentum. On the USD side, labour market prints should be crucial for the very near-term price action and, potentially, for the Fed plans for the next months

Risk: A sharp risk-off turn, renewed China pessimism, or a solid recovery in the US Dollar could weigh on sentiment and prompt sellers to step back in.

Technical picture

AUD/USD remains focused on the upside, initially targeting the key 0.6800 barrier.

If bulls push harder, spot should face its next resistance of note at the 2026 ceiling of 0.6766 (January 7) ahead of the 2024 peak at 0.6942 (September 30), all preceding the 0.7000 milestone.

On the other hand, there is transitory support at the weekly low at 0.6659 (December 31), ahead of another weekly floor at 0.6592 (December 18). Down from here, the 55-day and 100-day SMAs at 0.6579 and 0.6568, respectively, should offer interim contention prior to the more relevant 200-day SMA at 0.6508 and the November base at 0.6421 (November 21).

The pair’s near-term positive outlook is expected to persist as long as it trades above its 200-day SMA.

Additionally, momentum indicators point to extra gains in the short-term horizon, albeit not without caution: The Relative Strength Index (RSI) trades around the 66 level, while the Average Directional Index (ADX) just over the 32 mark indicates a really strong trend.

-1767805696160-1767805696161.png&w=1536&q=95)

So where does that leave AUD/USD?

No fireworks just yet, but still a gentle upward lean. The Aussie remains very sensitive to global risk appetite and China’s mood. A clean breach above 0.6800 appears needed to get into a more serious uptrend.

Right now, an irresolute US Dollar, steady local data, an RBA that isn’t flinching, and modest support from China all point the currency gently higher. It may climb slowly, but the bias remains tilted toward gains.

Australian Dollar FAQs

One of the most significant factors for the Australian Dollar (AUD) is the level of interest rates set by the Reserve Bank of Australia (RBA). Because Australia is a resource-rich country another key driver is the price of its biggest export, Iron Ore. The health of the Chinese economy, its largest trading partner, is a factor, as well as inflation in Australia, its growth rate and Trade Balance. Market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – is also a factor, with risk-on positive for AUD.

The Reserve Bank of Australia (RBA) influences the Australian Dollar (AUD) by setting the level of interest rates that Australian banks can lend to each other. This influences the level of interest rates in the economy as a whole. The main goal of the RBA is to maintain a stable inflation rate of 2-3% by adjusting interest rates up or down. Relatively high interest rates compared to other major central banks support the AUD, and the opposite for relatively low. The RBA can also use quantitative easing and tightening to influence credit conditions, with the former AUD-negative and the latter AUD-positive.

China is Australia’s largest trading partner so the health of the Chinese economy is a major influence on the value of the Australian Dollar (AUD). When the Chinese economy is doing well it purchases more raw materials, goods and services from Australia, lifting demand for the AUD, and pushing up its value. The opposite is the case when the Chinese economy is not growing as fast as expected. Positive or negative surprises in Chinese growth data, therefore, often have a direct impact on the Australian Dollar and its pairs.

Iron Ore is Australia’s largest export, accounting for $118 billion a year according to data from 2021, with China as its primary destination. The price of Iron Ore, therefore, can be a driver of the Australian Dollar. Generally, if the price of Iron Ore rises, AUD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Iron Ore falls. Higher Iron Ore prices also tend to result in a greater likelihood of a positive Trade Balance for Australia, which is also positive of the AUD.

The Trade Balance, which is the difference between what a country earns from its exports versus what it pays for its imports, is another factor that can influence the value of the Australian Dollar. If Australia produces highly sought after exports, then its currency will gain in value purely from the surplus demand created from foreign buyers seeking to purchase its exports versus what it spends to purchase imports. Therefore, a positive net Trade Balance strengthens the AUD, with the opposite effect if the Trade Balance is negative.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.