The latest UK inflation data has been released this morning. To the delight of Bank of England Governor Mark Carney and his dovish Monetary Policy Committee colleagues, the headline Consumer Price Index came in below expectations at 2.6% year-on-year for June compared to 2.9% expected and last. The Office for National Statistics (ONS) said a fall in motor fuel prices and in recreational and cultural goods offset rises in furniture and furnishings prices. The pound was quick to react as it dropped nearly 100 pips from its highs against the dollar to trade around a key support level circa 1.3025 at the time of this writing, where we were anticipating a rebound.

The June CPI miss was the first time in four months that inflation has fallen below analysts’ expectations. Other measures of inflation were mostly weaker too, with core CPI dipping to 2.4% from 2.6% while RPI slipped to 3.5% form 3.7% previously. However, it is worth remembering that this is just one month’s worth of data, and given that oil prices have bounced back again in recent weeks, the fall in CPI could turn out to be temporary. So I don’t think the June CPI miss was a game changer as we need more evidence to suggest prices will fall.

The June miss aside, the Bank of England has been extremely tolerant to the recent sharp rises in the general level of prices, arguing temporary factors were to blame. The fact that the growth in wages has not kept up with the pace of inflation has been their main concern. So to counteract the potential impact of Brexit on consumer confidence and domestic growth, the BoE has – until now – decided to keep its monetary policy extremely loose. Nevertheless the generally higher levels of inflation has caused a split in the BoE's Monetary Policy Committee. After last week’s stronger jobs and wages data, the market has been speculating that the dovish MPC members might turn hawkish if inflation were to rise further. So the pound has been rising. If next month’s inflation data surprise to the upside then calls for a rate rise will increase again.

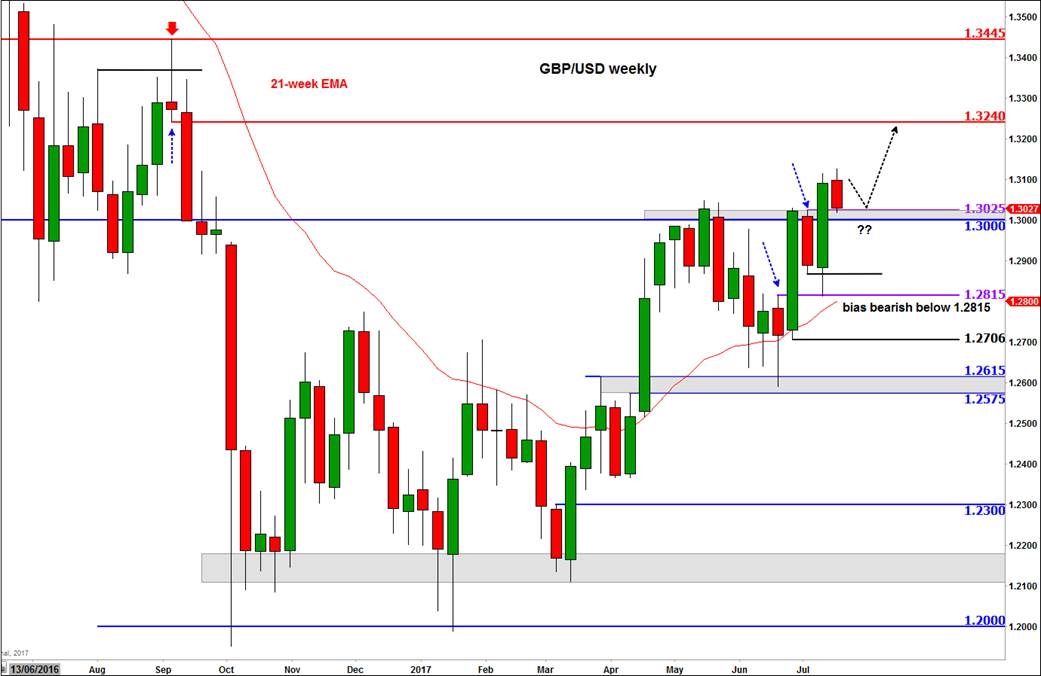

Despite today’s sell-off, the price action on the GBP/USD looks bullish thanks mainly to ongoing weakness in US dollar. The cable took its sweet time but last week finally cleared a major hurdle when it closed above the 1.3000-1.3050 resistance area where it had struggled in the past. Now above this area, the path of least resistance is to the upside and will remain that way until such a time we see a distinct reversal pattern unfold. At the time of this writing, the cable was testing 1.3025, which was the last resistance prior to last week's breakout. Once resistance, this level could turn into support. If it does and we hold above it then I wouldn’t rule out the possibility of further gains in this week. Some of our bullish objectives are shown on the chart, which include 1.3240 and 1.3445. We will drop out bullish view on a potential closing break back below the 1.30 level or if there is a more significant reversal pattern formed at higher levels first.

Trading leveraged products such as FX, CFDs and Spread Bets carry a high level of risk which means you could lose your capital and is therefore not suitable for all investors. All of this website’s contents and information provided by Fawad Razaqzada elsewhere, such as on telegram and other social channels, including news, opinions, market analyses, trade ideas, trade signals or other information are solely provided as general market commentary and do not constitute a recommendation or investment advice. Please ensure you fully understand the risks involved by reading our disclaimer, terms and policies.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.