GBP/USD analysis: Trades sideways

GBP/USD

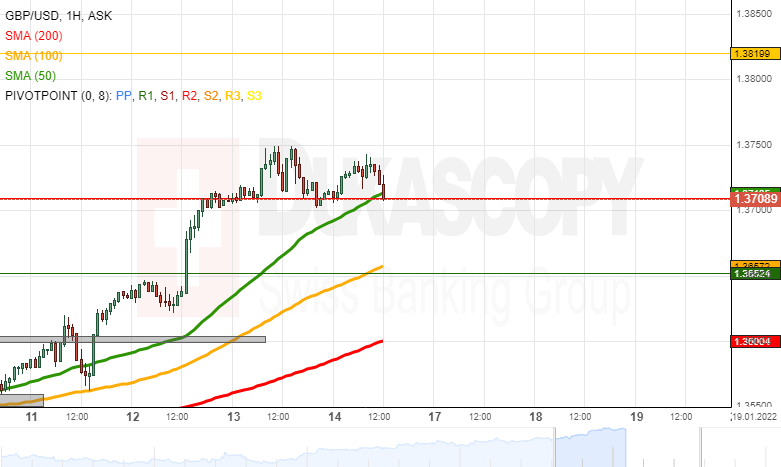

The GBP/USD currency exchange rate has been trading between the 1.3700 and 1.3750 levels since the US CPI surge. Most recently, on Friday the rate was approached by the 50-hour simple moving average. Meanwhile, the pair almost in all cases ignored the support of the weekly R2 simple pivot point at 1.3709.

If the currency exchange rate starts a surge, it would have to pass the 1.3750 mark, before aiming at the 1.3800 mark. Above the 1.3800 level, the weekly R3 simple pivot point could act as resistance at 1.3820.

However, a potential decline of the Pound against the US Dollar would have to pass below the 50-hour simple moving average, the weekly R2 simple pivot point and the 1.3700 mark. A move below 1.3700 would leave the pair with no support as low as the 100-hour simple moving average near 1.3650 and the weekly R1 simple moving average at 1.3652.

Author

Dukascopy Bank Team

Dukascopy Bank SA

Dukascopy Bank stands as an innovative Swiss online banking institution, with its headquarters situated in Geneva, Switzerland.