GBP/USD analysis: Remains below 1.3830

GBP/USD

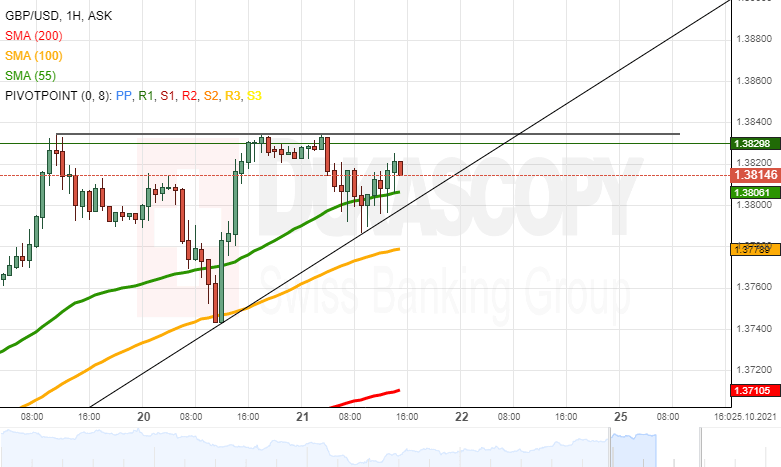

The resistance of the weekly R1 simple pivot point and the 1.3830 mark has continued to keep the rate down. On Thursday, a decline of the rate retreated to 1.3800 and shortly traded below the round exchange rate level before slightly recovering.

In the meantime, by connecting the Wednesday and Thursday low levels and combining it with the resistance of the 1.3830 level, an ascending triangle pattern can be observed. Due to that reason, it is assumed that the pair could get squeezed in between the support line and the 1.3830. A squeeze would most likely result in a break-out, which usually occurs in a sharp move either up or down.

A break out to the upside would most likely reach the 1.3900 mark and the weekly R2 simple pivot point at 1.3904. Above this level, there is no technical resistance as high as the weekly R3 simple pivot point at 1.4034. However, it is highly likely that the pair would encounter resistance in the 1.3850, 1.3950, and 1.4000 round exchange rate levels, despite them not being strengthened by a technical indicator.

Meanwhile, a break-out-down would look for support in the 100-hour simple moving average near 1.3780, before aiming at the 200-hour SMA at 1.3710 and the 1.3700 mark, which is supported by the weekly simple pivot point.

Author

Dukascopy Bank Team

Dukascopy Bank SA

Dukascopy Bank stands as an innovative Swiss online banking institution, with its headquarters situated in Geneva, Switzerland.