GBP/JPY outlook: GBP/JPY rises to the highest in over five years

GBP/JPY

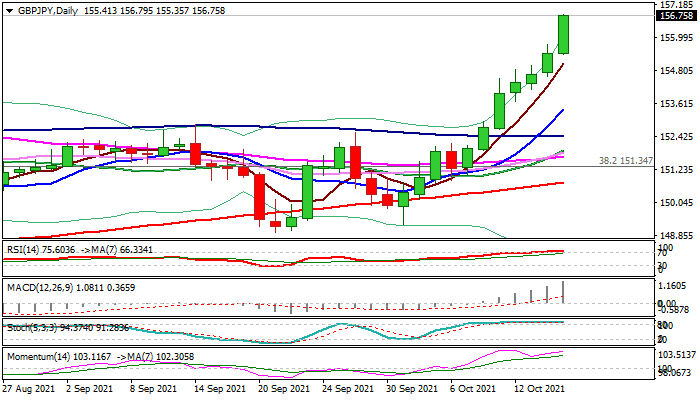

The GBPJPY was among the top performers in early Friday’s trading, as cross accelerated higher and hit the highest level since June 2016.

Fresh risk appetite pushed the dollar further down and lifted sterling against its major counterparts while yen was sold across the board.

The pair was up 0.66% since opening in Asia, extending steep ascend into seventh straight day and also on track for the biggest weekly gain since the last week of May 2020.

Bulls broke above former highs at 156.07/60 (May 2021/February 2018) with weekly close above these levels to generate strong bullish signal and expose next key barriers at 159.84/160.00 (50% retracement of 195.85/123.83/monthly cloud top/psychological) and 162.08 (200MMA).

Steep rally so far does not show signs of fatigue, but overbought daily studies suggest that some corrective action should be anticipated in coming sessions.

Res: 157.86; 158.97; 159.84; 162.08.

Sup: 156.07; 155.35; 154.59; 153.40.

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.