Published at 07:16 (GMT) 24 Jul

People Daily: The Chinese renminbi (RMB) will become the world's third largest currency after the U.S. dollar and Euro within five years as the country accelerates the promotion of its currency unit. A report by the International Monetary Institute of Renmin University of China and the Bank of Communications, published on Sunday, said that the RMB internationalization index had risen to 1.69 by the end of 2013 from 0.92 a year before. The main impetus for the internationalization of the RMB comes from cross-border trade settlements and direct investment.

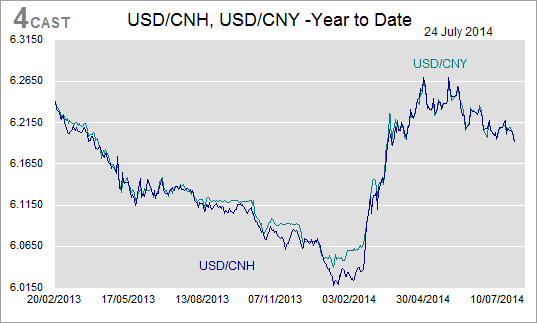

USD/CNH dropped to around 6.1900, mirroring USD/CNY decline, following stronger-than-expected flash PMI data. However further downside is limited as EUR/USD came under pressure ahead of flash Eurozone PMIs. Strong support is seen at 6.1862. BA

Copyright and other intellectual property rights in the material in this report belong to FXMarketAlerts, 4Cast Limited, 4Cast Inc and/or Forecast pte ("4Cast"). The material shall not, under any circumstances, be reproduced or distributed in whole or part without the prior written consent of 4Cast.

The material in this report is based upon information which 4Cast considers to be reliable and the analysis and opinion in the material represents the view of 4Cast at the time of transmission (unless stated otherwise). Such analysis and opinion is subject to change without notice. The material is intended for use by parties knowledgeable and experienced in the financial sector and is only one source amongst others to be considered in carrying on their business or activity.

ACCORDINGLY 4CAST MAKES NO REPRESENTATION OR WARRANTY EXPRESS OR IMPLIED STATUTORY OR OTHERWISE (INCLUDING BUT NOT LIMITED TO) THE ACCURACY OF THE MATERIAL IN THIS EMAIL AND ON THE WEBSITE OR THE FITNESS FOR PURPOSE AND ALL SUCH REPRESENTATIONS AND WARRANTIES ARE HEREBY EXPRESSLY EXCLUDED.

4Cast does not give or purport to give investment advice. Any action taken by users on the basis of material on this website is entirely at their own risk. Independent investment advice should be sought where appropriate.

This email and the website may link to or be linked to other internet sites. 4Cast does not accept responsibility for the content of such other sites.

4Cast’s terms and conditions of business apply to all fee paying subscribers and authorised trial users.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.