Near term crude oil outlook:

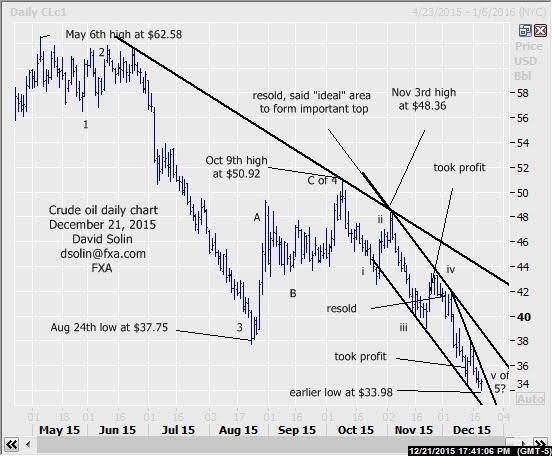

The market remains heavy recent lows as the view over the last few months of a downside "washout", ideally into the longer term $34.00 area (year long falling support line) and ideally into the mid/late Dec timeframe, has indeed played. Additionally seen as an "ideal" area to form a potentially more major bottom (see longer term below). Nearer term lots of positives also raise the potential of an important bottom nearing and include an oversold market after the last few months of sharp declines and seen within the final downleg in the decline from the Oct 9th high (wave v) as well as the larger decline from the May high at $62.58 (wave 5). At this point, there is still no confirmation of even a shorter term bottom "pattern-wise" (5 waves up for example) and with thinning markets on the approach of the end of the year, there is scope for a period of chopping and even further, but likely limited downside. Support is seen at the earlier $33.75/00 low and the base of the bearish channel since Nov (currently at $32.75/00). Resistance is seen at the bearish trendline from Dec 4th (currently at $35.75/00), with a break above likely to trigger at least some stops. Bottom line: within an "ideal" area to form a bottom (and potentially more major bottom), but no confirmation of even a shorter term low so far.

Strategy/position:

Flat after taking profit on that Dec 2nd resell at $40.97 on Dec 14th at $36.22 ($4.75 profit). For now, would buy on a break $0.25 above that bearish trendline from Dec 4th. Would also buy on an intraday break as there is potential for an acceleration higher on such a move (stops), and don't want to have to buy at substantially higher prices by waiting for the close (if that does indeed occur). Would also initially stop on a close $0.25 back below.

Long term outlook:

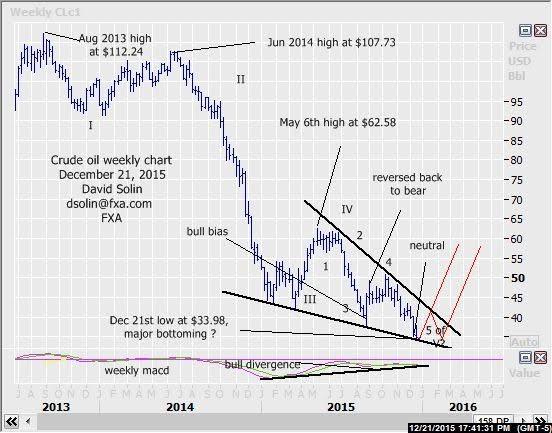

As discussed above, the market is heavy within that long discussed "ideal" area to form a more major low (9-12 months or more) near $34.00. Longer term positives support this potential and include the market within the final downleg in the decline from the whole decline from the Aug 2013 high at $112.24 (wave V) and technicals that have not confirmed either the Aug or more recent lows (see bullish divergence on the weekly macd for example). Additionally, the market may be forming a falling wedge/reversal pattern for nearly the last year, currently near the base and suggesting an eventual (and potentially sharp) upside resolution of the ceiling (currently at $45.00/50). However, though the market may near an important low, this bottoming make take a more extended period (months) of broad chopping/base building with good sized swings in both directions ($5-6/bbl), and versus a straight, major surge higher (no "V" bottom, but sharp moves from a shorter term standpoint). New (and potentially limited) new highs are favored in the US$ (inverse relationship), it will no doubt take some time to work through the excess supply, and interestingly, many are still trying to call the bottom (contrary indicator and not common before sharp, sustained reversals), with all supporting the view of a more extended period of bottoming. One final comment, a little concerned about the time of year and thinning markets. So would be wary of a last gasp lower, false break of this key, longer term support area (clearing out the last of the bulls), spiking below only to reverse and close back above, and would argue that a more major bottom is in place. Bottom line: within the "ideal" $34.00 area to form a more major bottom, but likely to see an extended period (months) of a wide chopping/basing ahead.

Strategy/position:

Reversed the longer term bullish bias that was put in place on Aug 27th at $40.00 to bearish on Sept 3rd at $48.00 and then to neutral on Dec 14th $36.22 ($11.78 profit). For now, would use the same entry as the shorter term above to also switch the longer term bias to the bullish side.

Recommended Content

Editors’ Picks

AUD/USD loses ground due to the absence of a hawkish RBA

The Australian Dollar has plunged following the Reserve Bank of Australia's decision to maintain its interest rate at 4.35% on Tuesday. Investors sentiment leaned toward a potentially more hawkish stance from the RBA, particularly after last week's inflation data surpassed expectations.

EUR/USD edges lower to near 1.0750 after hawkish remarks from a Fed official

EUR/USD extends its losses for the second successive session, trading around 1.0750 during the Asian session on Wednesday. The US Dollar gains ground due to the expectations of the Federal Reserve’s prolonging higher interest rates.

Gold price remains on the defensive on a firmer US Dollar

Gold price attracts some sellers on the firmer US Dollar during the Asian trading hours on Wednesday. The hawkish remarks from Federal Reserve officials dampen hopes for potential interest rate cuts in 2024 despite weaker-than-expected US employment reports in April.

FTX files consensus-based plan of reorganization, awaits bankruptcy court approval

FTX has filed a consensus-based plan for its reorganization, coming almost two years after the now defunct FTX filed for Chapter 11 Bankruptcy Protection in the District of Delaware.

Living vicariously through rate cut expectations

U.S. stock indexes made gains on Tuesday as concerns about an overheating U.S. economy ease, particularly with incoming economic reports showing data surprises at their most negative levels since February of last year.