You may have an outlook on EUR/USD volatility with no regard for direction. You may expect the pair to move dramatically either UP or DOWN, or on the other-hand, you may expect the pair to trade sideways over a certain period of time. The following article explains how you can trade these scenarios using FX options.

Trading increase in volatility

If you are expecting a large move in EUR/USD but you have no view on direction it is possible to trade this outlook through a Long Straddle strategy. This involves buying a Put and a Call option at the same time. If EUR/USD price falls the Put will profit and if the pair rises the Call will profit. In this position,you loss is limited yet your profit may be unlimited.

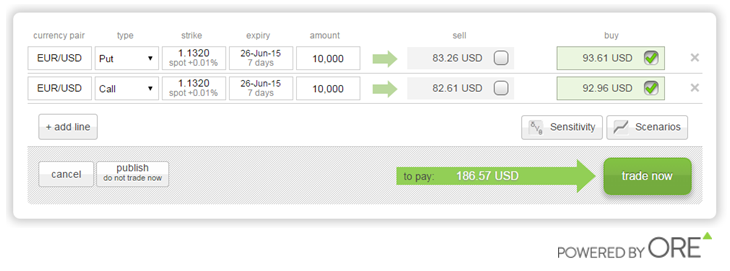

Below is a EUR/USD Long Straddle trade example, built in the optionsReasy platform. The Put and Call have the same strike rate (matching the current market at 1.1320), expiry date at 7 days and amount of 10,000 EUR. This position costs 186.57 USD to buy.

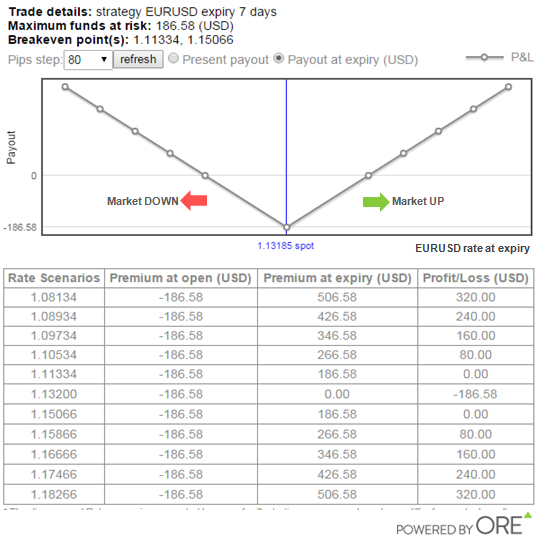

If EUR/USD moves significantly UP or DOWN in the next 7-days, the strategy may profit. If EUR/USD is still and remains trading at, or close-to, 1.1320 the maximum loss will be 186.57 USD.

The scenario chart below shows the profit or loss of the strategy, at its expiry, over a range of EUR/USD rates. If the pair moves DOWN and at expires at 1.0893 the strategy's profit will be 240 USD, if the pair does not move and remains at its current level of 1.1320 the loss is 186 USD, and if the pair moves UP and expires at 1.1746 the profit will be 240 USD.

Trading decrease in volatility

If you expect EUR/USD to become less volatile and it will continue trading around its current level, you may trade this outlook using a Short Straddle strategy. This is the opposite of a Long Straddle and involves selling a Put and a Call option at the same time. Each option should have the same strike rate and expiry date. If over the duration of the strategy, the EUR/USD price does not more (or only moves a little), both the Put and Call option generate a profit for the seller. More attention to risk management may be required when trading this strategy because potential loss is unlimited and profit is limited.

The content provided is made available to you by ORE Tech Ltd for educational purposes only, and does not constitute any recommendation and/or proposal regarding the performance and/or avoidance of any transaction (whether financial or not), and does not provide or intend to provide any basis of assumption and/or reliance to any such transaction.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.