Quick Recap

A really interesting night last night.

Of course there was a sea of red on global stock markets, again, and Wal-mart got hammered but in many ways it’s the Chinese CPI and PPI along with the US PPI which are the big stories. yesterday Chineses inflation data undershot expectations with PPI falling further into deflation and CPI slipping anchor further below 2% with a 1.6% print. Last night in the US retail sales were weak and producer prices fell 0.5% to take the YoY rate to -1.1%.

I’m a guy who things that economy wide measures of price movements like the CPI and PPI reflect underlying aggregate demand in an economy. When there is price power companies can charge more or hold prices steady at the very least. When demand is weaker, or supply higher than demand, things slip. So lower producer prices speak of a weaker Chinese and US economy.

So even though the Fed released its Beige Book last night and said the US economy is humming along the fact that it highlighted that manufacturing was “generally weaker” knocked the US dollar for another six when it was released. Likewise the other data was indicative of the economy slowing.

Indeed, I add that even with the relative weak price of oil my sense is that in the US, and China, the a low PPI means aggregate demand in hte economy is not overly strong and pricing power is absent. That said, its no surprise that our friends at Forexlive report that “The hatchets are being taken to US growth after soft data.” Ryan Littlestone says:

- •BAML cuts its Q3 GDP tracker to 1.3% from 1.7%

- •BNP cut theirs to 2.3% from 2.5%

- •Goldman Sachs cut theirs to 1.2% vs 1.5% prior

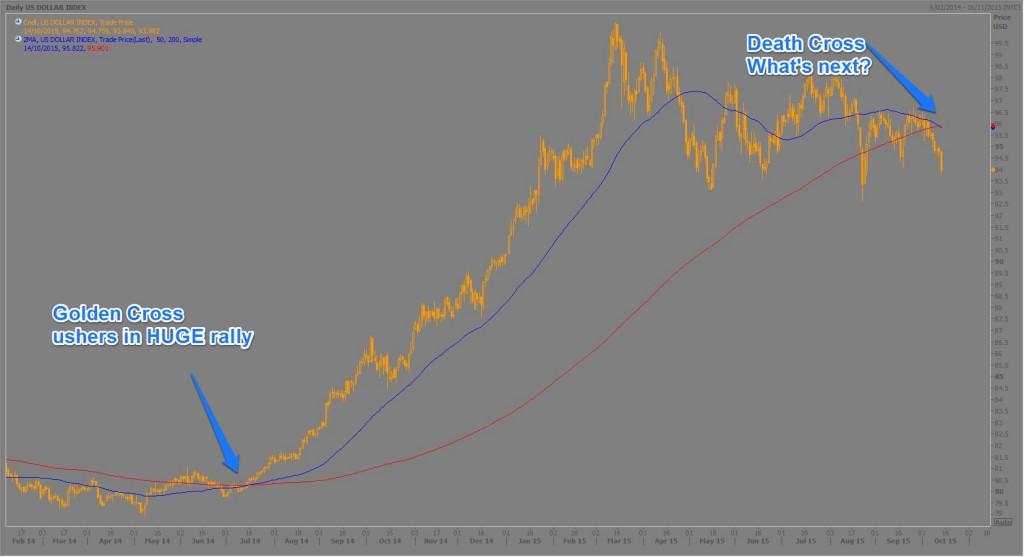

Lower growth rates, lower expectations of Fed hikes and the legs on the chair that have supported the US dollar for many months have been kicked out. As a result the US dollar index is breaking lower and has formed a death cross.

Here’s the chart:

US Dollar Index (Reuters Eikon)

If the US dollar turns. Everything changes. Look at gold, the Aussie back above 73 cents, Euro near 1.15, teh reversal in Sterling, copper at $2.42 and US 10 year bonds back below 2%.

Watch this space.

The overnight scoreboard (8.57am ADST):

- Dow Jones Industrials -0.92% to 16,924

- Nasdaq Composite -0.29% to 4,782

- S&P 500 -0.47% to 1,994

- London (FTSE 100) -1.15% to 6,269

- Frankfurt (DAX) -1.17% to 9,915

- Tokyo (Nikkei) 17,891

- Shanghai (composite)-0.95% to 3,262

- Hong Kong (Hang Seng) -1.13% to 3,406

- ASX Futures overnight (SPI December) -1 to 5,174

- AUDUSD: 0.7301

- EURUSD: 1.1478

- USDJPY: 118.75

- GBPUSD: 1.5480

- USDCAD: 1.2927

- Nymex Crude (front contract): $46.64

- Copper (US front contract): $2.42

- Gold: $1,184

- Dalian Iron Ore (January): 373 (denominated in CNY)

- US 10 year bond rate: 2.97%

- Australian 10 year bond rate: 2.60%

On the day

Today is a huge day for Australian data with the release of the September labour force data. depending on who you ask the market is forecasting somewhere between 5 and 10 thousand new jobs with an unemployment rate either unchanged at 6.2% or a little higher at 6.3%. David Scutt has an excellent preview of everything you need to know about the jobs data you can read here.

Offshore we are still waiting on China’s new loans and money supply data and after yesterday’s PPI and CPI more easing as well. Today in Japan it’s industrial production and then tonight its jobless claims in the US, Empire State Manufacturing Index, the Philly Fed index and speech’s by the Fed’s Bullard, Dudley and Mester. Oil traders will be watching the EIA stocks numbers as well.

CHART OF THE DAY: Gold

This is a big move in gold and an important one.

On a fundamental level it is no surprise gold is rallying if the price of out of the money options on the CBOE for stocks and stock indexes is rising. It speaks of uncertainty and that’s gold’s home ground (or it should be). Likewise the death cross on the US dollar and the weakness that is occurring as a result of the push back of expectations about the Fed raising rates in 2015 into 2016 also helps gold.

Technically you can see the trendline which was support and then became resistance has now broken. On the dailies we could be set for a pullback but as I’ve been saying over the past couple of days on the weeklies are building momentum.

We’ll likely see a move above $1200 and potentially a retest of down trend in the high $1,230’s.

Risk Warning: Trading Forex and Derivatives carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Derivatives may not be suitable for all investors, so please ensure that you fully understand the risks involved, and seek independent advice if necessary. The FSG and PDS for these products is available from GO Markets Pty Ltd and should be considered before deciding to enter into any Derivative transactions. AFSL 254963. ABN 85 081 864 039.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.