Quick Recap

Commodities were the big mover overnight as the reverberations of the break in oil yesterday and concerns over Greece and China hit prices hard.

There a massive fall in Nymex crude after it broke recent support. Prices fell 7.47% in the front month to $52.68 a barrel. Copper also fell heavily hitting a five month low after dropping 9.15 cents a pound to $2.53. Other base metals were also lower, while iron ore was hammered again. Dalian iron ore is at 380 this morning while the September 62% futures contract in the US fell $3.10 to $46.88!

Stocks did relatively well though all things considered and in the end European stock markets were lower but they didn’t crash in the way that futures suggested they might at one stage yesterday morning. The interesting price action in the washup of Europe was the FTSE MIB in Milan which fell 4%. As I highlighted at Business Insider this morning, “That’s the trouble with Greece — if it folds, if it defaults, or if it leaves the Euro, traders, and perhaps populations, will just wonder who is next.”

In the US stocks had a big dip but recovered then fell then recovered again. So, even though the S&P 500 fell down and through the 200-day moving average at one point it rallied and closed above it. That’s a good short term sign but the outlook has shifted.

Forex markets reacted to the Varoufakis resignation news yesterday afternoon but were oitherwise quiet.

We await China today, the EU meeting tonight and Aussie dollar traders will no doubt get a chance at some action around 2.30pm this afternoon.

ON GREECE:

We are still waiting for the meeting tonight of the EU leadership but while the politicians brawl it’s left to the ECB to try to hold Europe together. This morning Reuters reports ECB governing council member Ewald Nowotny said bridge funding to Greece, while a new bailout program is being negotiated, “is something that has to be discussed.” But he did say that more financing can’t be provided if Greece defaults on its debt.

On the day

On the data front today we have the AiGroup performance of construction index, ANZ weekly consumer confidence and then the RBA at 2.30pm AEST. Tonight it’s German industrial production, French trade, UK industrial production and then US trade.

Here’s the overnight scoreboard (8.57am AEST):

- Dow Jones down 0.26% to 17,683

- Nasdaq down down 0.34% to 4,991

- S&P 500 down 0.39% to 2,068

- London (FTSE 100) down 0.76% to 6,535

- Frankfurt (DAX) down 1.52% to 10,890 /li>

- Tokyo (Nikkei) down 2.1% to 20,112

- Shanghai (composite) up 2.42% to 3,776

- Hong Kong (Hang Seng) down 3.18% to 25,236

- ASX Futures overnight (SPI September) +19 points to 5,450

- US 10 Year Bonds -9 points to 2.29%

- German 10 Year Bonds -3 to 0.77%

- Australian 10 Year Bonds flat 2.92%%

- AUDUSD: 0.7490

- EURUSD: 1.1054

- USDJPY: 122.59

- GBPUSD: 1.5600

- USDCAD: 1.2644

- Crude: $52.86

- Gold: $1,169

- Dalian Iron Ore (September): 380.5

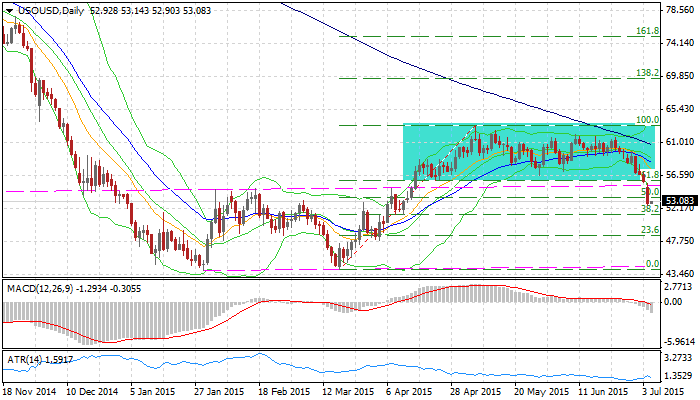

CHART OF THE DAY: US Oil

It’s broken down and through our box and then some with a massive fall overnight. I got stopped out of my short on the open yesterday – for a solid profit but missed out on the next leg lower.

Dang I hate Monday Asia some weeks.

Anyway – not sure when but this looks like it’s heading toward $45 a barrel.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.