Introduction

Only equities in Hong Kong traded overnight in Asia as the Japanese took a bank holiday. The Hang Seng index moved lower by close to 4% and USD/JPY moved to a low of 112.28. The move has been extravagant in this currency pair and shows the extent of the flight to JPY that has taken place amidst intense risk-off sentiment. The Fed. chair did not rule out a base interest rate rise in the US this year, which comes as no surprise of course, but ultimately after some initial positivity, the market sold USD and oil, moving WTI crude futures to a low of US$26.72.

Asian Session

It is important to remember that USD/JPY traded at the high so far this year of 121.69 less than two weeks ago. Talk of the BoJ checking prices and placing bids at around the 115.0 mark may or may not have been true, but this support has now been taken out as a Fibonnacci level at 111.75 is eyed.

The Asian Dollar index trades at the 105.85 right now with Yellen set to speak for the second day in a row today. Emerging Asian currencies have all made limited gains, but those gains are essentially across the board.

The NEISR released its GDP estimate for the UK overnight. Considered an important number, the figure came in at 0.4% compared to 0.6% previously and GBP/USD trades currently at 1.4511.

The day ahead in Europe and NY

The idea that the central bank in Japan may step in to the interbank market in order to stabilise the USD/JPY pair is not out of the question after such a large move recently. In the JPY crosses, EUR/JPY and GBP/JPY trade lower at 127.22 and 163.56 respectively.

The Eurogroup meets today whilst Swiss inflation data prints at 08:15 GMT. The figures are anticipated to prove in line with expectations of a YoY print at -1.3% and a MoM number at -0.4%.

USD/RUB trades at 79.09 ahead of the release of central bank reserve figures today at 13:00 GMT. Later in the states, initial jobless claims figures will be released as well as natural gas storage data. The active natural gas future contract trades currently at US$2.055.

Spot

| Last | % since US Close | High | Low | |

| EURUSD | 1.1289 | -0.03% | 1.1320 | 1.1274 |

| USDJPY | 112.44 | -0.80% | 113.60 | 112.28 |

| GBPUSD | 1.4511 | -0.22% | 1.4564 | 1.4485 |

| AUDUSD | 0.7097 | 0.02% | 0.7153 | 0.7083 |

| NZDUSD | 0.6663 | -0.33% | 0.6735 | 0.6656 |

| EURCHF | 1.0974 | 0.17% | 1.0995 | 1.0969 |

| USDCAD | 1.3961 | 0.16% | 1.3966 | 1.3883 |

| USDCNH | 6.5359 | 0.16% | 6.5504 | 6.5275 |

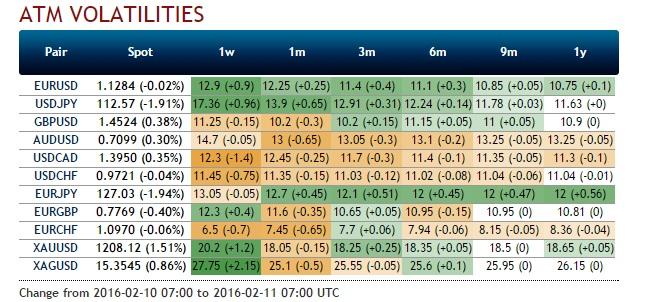

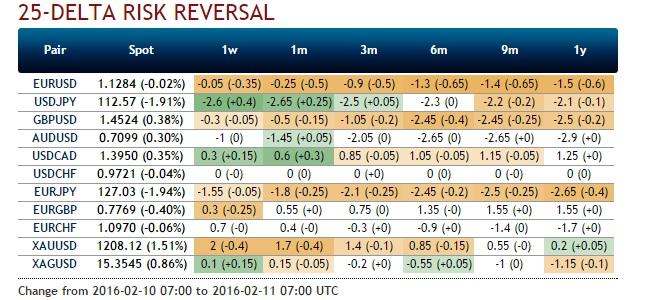

FXO

The one month 25-delta risk reversal trades at an approx. volatility differential of 2.6% in favour of the downside this morning. This is a jump of over half a vol. The one week straddle opens this morning very high, at a mid. volatility of approx. 17.5%.

Sentiment within the currency options space at Saxo Bank A/S has moved significantly regarding USD/CHF and EUR/GBP options. 57% and 84% of traders favour the downside in these currency pairs, with the long call and/or short put positioning moving over the last day or so by -18% and 8% respectively.

The products offered by Saxo Markets UK Limited ("SCML") include but are not limited to Foreign Exchange, Stock, Index and Commodity CFDs, Options and other derivative products. These products may not be suitable for all investors, as trading derivative products carries a high level of risk to your capital. It is possible to lose more than your initial investment so before deciding to trade you should ensure you understand the risks involved and seek independent advice if necessary.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.