Introduction

Although the NY session yesterday saw some waning of risk-off sentiment, turnover is high across asset classes and the Nikkei 225 index has lost close to 2.5% overnight. EUR/USD broke the 1.1300 barrier during both NY and APAC trading and trades just below there now. Ahead, Yellen takes centre stage in front of the Fed. committee, not before data releases in both Denmark and the UK.

Asian Session

AUD underwent some strength overnight with Westpac bank releasing good consumer confidence data and also positive new home sales info. released. The currency trades close to the .7100 figure versus the greenback and has found resistance there.

Across the Tasman sea, Kiwi trades at .6635 and 1.0678 against USD and AUD respectively. Electronic card retail sales data proved relatively positive overnight, particularly MoM.

Amongst the emerging Asian currencies, IDR was the largest gainer versus US dollar. Largely this came as a result of USD weakness, seen evident in the fact that the ADXY index has traded close to the 106.0 level.

The day ahead in Europe and NY

Holidays continue in Asia and lead the market to lack definition somewhat as Europe opens. USD/JPY trades below 115.0 at the moment and has meandered just above this level and within the 114.0 figure over the last thirsty six hours.

Danish inflation data prints at 08:00 GMT today with USD/DKK trading at 6.6154 right now. The pair has moved down from a high this week on Monday at 6.7316.

At 09:30 GMT the UK will witness manufacturing and industrial production data releases. Although the YoY manufacturing production info. is set to come in at -1.4% compared to -1.2% previously, the industrial manufacturing print is set to rise up to 1.0%.

Spot

| Last | % since US Close | High | Low | |

| EURUSD | 1.128 | -0.11% | 1.1311 | 1.1276 |

| USDJPY | 114.6 | -0.22% | 115.26 | 114.26 |

| GBPUSD | 1.4453 | -0.13% | 1.4486 | 1.4451 |

| AUDUSD | 0.7081 | 0.14% | 0.7093 | 0.7038 |

| NZDUSD | 0.6636 | 0.00% | 0.6646 | 0.6605 |

| EURCHF | 1.0979 | 0.05% | 1.1001 | 1.0973 |

| USDCAD | 1.3889 | -0.15% | 1.3921 | 1.3867 |

| USDCNH | 6.5534 | 0.19% | 6.5678 | 6.5501 |

FXO

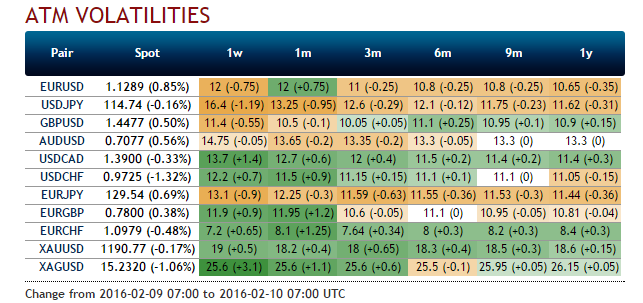

Volatility has come a little softer in general, although Friday options are notably bid after Yellen testifies today and tomorrow. The one month straddles are also notably bid in the EUR space, covering the March ECB meeting.

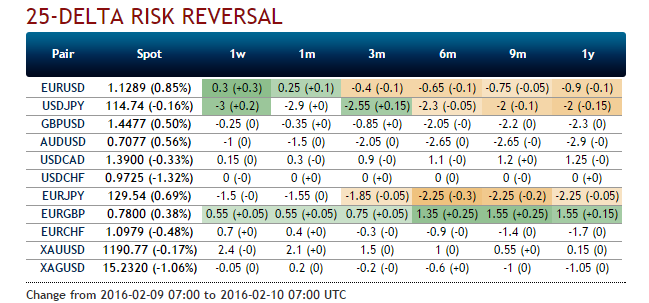

Within the retail currency options space at Saxo Bank A/S, a continued move towards the downside I is evident in the USD/JPY space. 72% of traders now favour long put and/or short call positions regarding options in this currency pair. In another safe-haven currency pair, USD/CHF sees a similar bias.

The products offered by Saxo Markets UK Limited ("SCML") include but are not limited to Foreign Exchange, Stock, Index and Commodity CFDs, Options and other derivative products. These products may not be suitable for all investors, as trading derivative products carries a high level of risk to your capital. It is possible to lose more than your initial investment so before deciding to trade you should ensure you understand the risks involved and seek independent advice if necessary.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.