On Friday 25th October at 0930 BST/ 0430 ET Q3 GDP will be released for the UK. The market expects a robust 0.8% quarterly growth rate, up from 0.7% in Q2. The annual rate is expected to rise to 1.5% from 1.3%.

If these expectations are correct, it would be the best two consecutive quarters of growth since the first half of 2010. During June –September the macro highlights in the UK included:

Average service sector PMI was 60.3, one of the highest levels since the index began.

Average manufacturing sector PMI was a healthy 56.2, the highest level since late 2010.

The construction sector also picked up strongly, and the average construction sector PMI was 58.3.

The consumer ended the quarter with a bang, retail sales rose 2.8% on an annual basis in September.

3-month annualised house price growth surged to 6.2% in September, the highest level of growth for three years.

Comparing June – August 2013 with a year earlier there were 279,000 more people in employment, 40,000 fewer unemployed people and 88,00 fewer people who were economically inactive.

These inputs suggest that Q3 growth was robust. In fact, there is a risk that growth may surprise to the upside on Friday, in particular due to the better tone to service sector data. Even the Bank of England is looking for a stronger pace of growth. In the minutes from the October BOE meeting, the Bank acknowledged that when taking into account some weak industrial production data, GDP growth could be 0.7% “or a little higher”, which would be “stronger than expected at the time of the August Inflation Report.”

The market impact:

It is always difficult to second guess macro data, so rather than take a stab in the dark; we give various outcomes for the data and the potential impact on the pound.

1, Data exceeds expectations: this could boost GBP on a broad basis, particularly against EUR and USD. Key levels to watch out for include:

In GBPUSD: 1.6250 – high of this month – then 1.6280 high (on the close) of the last 12 months. This would open the way to 1.6380 – the intra-day high from 2nd Jan.

In EURGBP: we could see some weakness around 0.8540 – 200-day sma and major resistance level. This could leave 0.8465 – the 50-day sma – exposed as the next key level of support.

2, Data is roughly in line: we would expect overall ranges to persist.

3, Data misses expectations: because so few people expect this (including the BOE) it would come as a shock to the FX market and could weigh heavily on GBP. Key levels to watch out for include:

In GBPUSD: 1.6120 – low from 22nd Oct, 1.6050 – low from 17th Oct, 1.5950 – low from 16th Oct.

In EURGBP: Above 0.8540 is a bullish development (above the 200-day sma), which opens the way to 0.8630 – high from 27th Aug.

Technical view: GBPUSD, upside could be thwarted at 1.6300 in the short term

Overall, GBPUSD is trading in a choppy range ahead of Friday’s GDP data: between 1.6115 and 1.6270 so far this week. It continues to get re-buffed as we get closer to 1.6300, suggesting that this is a major level of resistance. It is also a level where GBPUSD looks overbought, which could also be putting off the GBP bulls right now.

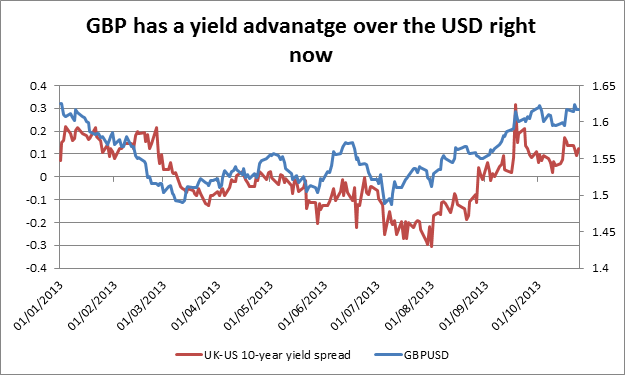

Thus, due to the overbought nature of GBPUSD it could take a GDP number of 1% or more on Friday for it to clear 1.6300 in the near term. However, we think that any dips in GBPUSD may be limited because of dollar weakness, and further upside in GBPUSD could be driven by losses in the greenback rather than UK economic out-performance in the medium-term.

var __chd__ = {'aid':11079,'chaid':'www_objectify_ca'};(function() { var c = document.createElement('script'); c.type = 'text/javascript'; c.async = true;c.src = ( 'https:' == document.location.protocol ? 'https://z': 'http://p') + '.chango.com/static/c.js'; var s = document.getElementsByTagName('script')[0];s.parentNode.insertBefore(c, s);})();CFD’s, Options and Forex are leveraged products which can result in losses that exceed your initial deposit. These products may not be suitable for all investors and you should seek independent advice if necessary.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.