Talking Points:

- Euro reclaiming role as funding currency as familiar 'QE' trade resumes.

- EURJPY up over +1% from July low while Nikkei 225 has gained over +7.4%.

- See the DailyFX economic calendar for Tuesday, July 21, 2015.

The Greek crisis isn't over yet. Barely a day after Greece received a €7.16 billion bridge loan from the European Union, it only has around €300 million leftover after repaying the ECB, the IMF, and the Bank of Greece. In a sense, the creditors have extended Greece a bridge loan such that they may see themselves paid back.

While time may have been bought for Greece, it only equates to four weeks of ‘calm,’ as the ECB is owed another €3.2 billion on August 20. The hope is, of course, that Greece is able to finalize its €86 billion EFSF-financed bailout in order to help finance the country for at least the next few years. As history has taught us, however, piling on debt – akin to partial refinancing vis-à-vis maturity extensions and lower interest rates – has only exacerbated the crisis in Greece.

Without debt forgiveness, something both the ECB and the IMF have encouraged, and something that Germany has staunchly stood against, there is very little hope that this bailout will be the last. Political turnover in Greece is all but guaranteed now, and the path forward will be difficult.

The alternative solution – a temporary ‘Grexit’ – is inherently illogical. If Greece leaves the Euro but remains a part of the European Union, and sees its economy recover after a massive internal devaluation (via wages) and dramatically depreciated currency, why would Greece return to the monetary arrangement which perpetuated its economic crisis?

The only version of a Grexit is a permanent one, which is why leaders are fighting to keep Greece integrated: a Grexit and subsequent recovery by Greece outside of the Euro could be the thread that unravels the entire fabric of the Euro, with larger entities such as Italy and Spain seeing that continuing austerity is an economically and a politically unpalatable solution. The only solution that prevents any iteration of a ‘Grexit’, and the Euro-Zone together in the future, is the creation of a European fiscal union – unfortunately a pipedream as long as Germany maintains its current belief system.

For now, as the negotiations draw out and European national parliaments vote on the bailout measures, FX markets are taking a hopeful stance (that the bailout will be approved), and are starting to divert itself from Greece and back to two overarching themes: the ECB's QE through September 2016; and the Fed's desire to raise rates in 2015.

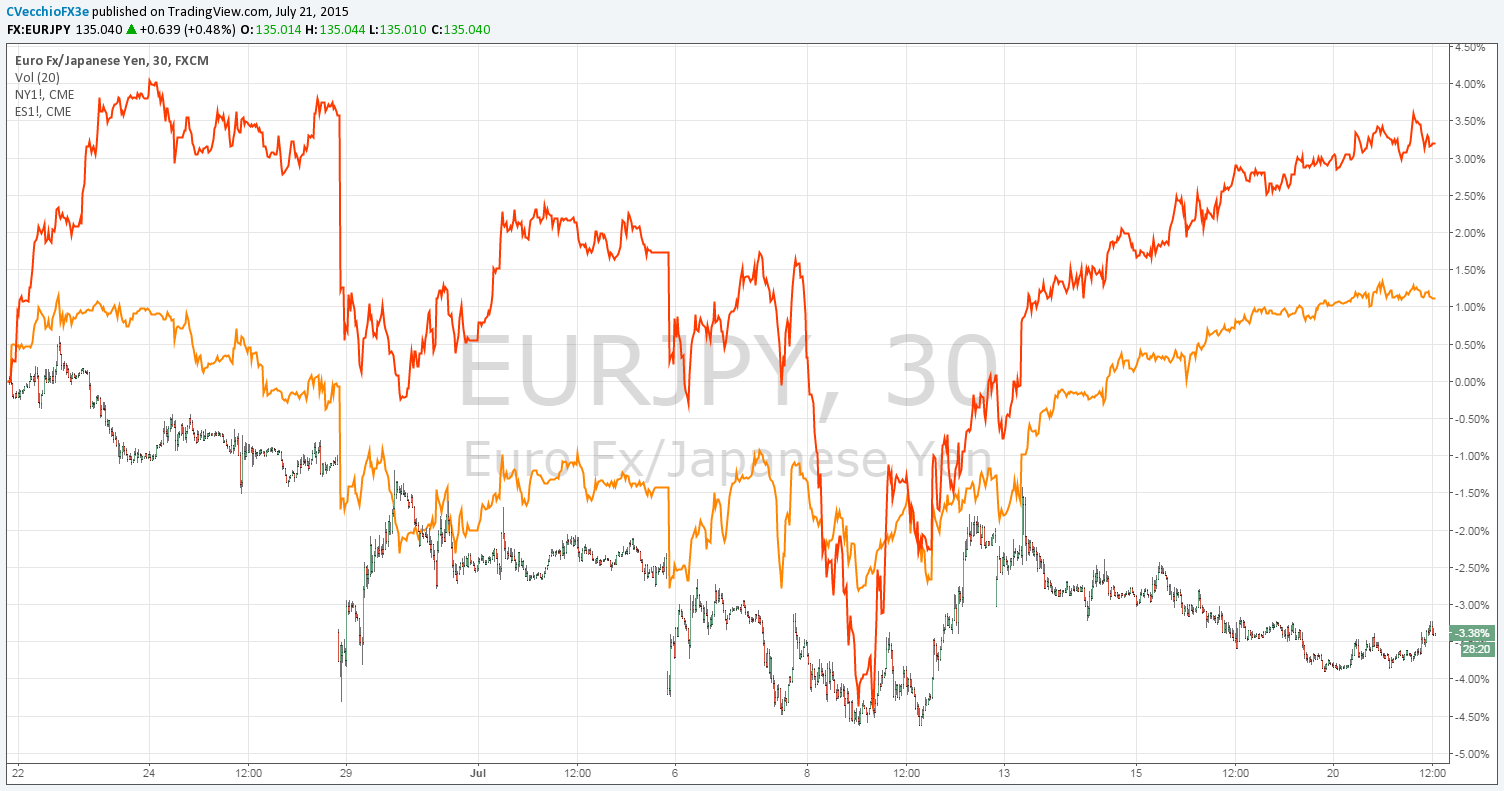

EURJPY Diverges from Global Equities Past Month (30-minute Chart)

The familiar situation of falling European sovereign yields, rising European (and global) equity markets, and a depreciating Euro are all back in play (this is the QE-driven trade: as yields fall, investors are forced to seek yield elsewhere, either by increasing exposure to riskier EUR-denominated debt (from core to periphery); by increasing exposure to EUR-denominated equity markets; or by exchanging euros for foreign currency to invest in foreign assets). But for brief event-driven short covering rallies, the Euro may be in the early stages of reclaiming its role as a funding currency – look no further than the divergence in performance between EURJPY and global equity markets (DAX, Nikkei, S&P 500) in recent days: the Euro is following sovereign yields; and yields are moving inversely with equity markets.

Recommended Content

Editors’ Picks

AUD/USD drops toward 0.6500 after dismal Aussie Retail Sales, mixed China's PMIs

AUD/USD is extending losses toward 0.6500, hit by an unexpected drop in the Australian Retail Sales for March while China's NBS April PMI data came in mixed. Upbeat China's Caixin Manufacturing PMI data failed to lift the Aussie Dollar amid a softer risk tone and the US Dollar rebound.

USD/JPY holds rebound to 157.00 after Monday's suspected intervention-led crash

USD/JPY is trading close to 157.00, staging a solid rebound in the Asian session on Tuesday. The pair reverses a part of heavy losses incurred on Monday after the Japanese Yen rallied hard on probable FX market intervention by Japan's authorities. Poor Japan's jobs and Retail Sales data weigh on the Yen.

Gold price traders remain on the sidelines ahead of FOMC decision on Wednesday

Gold price remains confined in a narrow range as traders prefer to wait on the sidelines. Reduced Fed rate cut bets revive the USD demand and act as a headwind for the metal. Investors now await the FOMC decision and US macro data before placing directional bets.

BNB price risks a 10% drop as Binance founder and ex-CEO Changpeng Zhao eyes Tuesday sentencing

Binance Coin price is dumping, with the one-day chart showing a defined downtrend. While the broader market continues to bleed, things could get worse for BNB price ahead of Binance executive Changpeng Zhao sentencing on Tuesday, April 30.

FX market still on intervention watch

Asian foreign exchange traders will be particularly attentive to any signs of Japanese intervention on Tuesday, following reports of Tokyo's involvement in the market on Monday. This intervention action propelled the yen upward from its 34-year low of 160 per dollar, setting off shockwaves of volatility.