Dollar rally in absence of US market shows strong support The dollar started off the new month moving higher against most of the currencies we track, both G10 and EM. The fact that the rally came without any news from the US market, which was closed for a holiday, shows the underlying strength of sentiment for the US currency.

Japanese stocks rose sharply and USD/JPY, as usual, moved higher in tandem after Japan’s main business newspaper said PM Abe will ppoint a pro-reform ally to head the Health Ministry. The Health Ministry oversees the nation’s enormous Government Pension Investment Fund (GPIF), which has assets of around JPY 127.3tn, or about the same as Mexico’s GDP. The person in question has advocated that the GPIF reduce its reliance on domestic government bonds and invest more in stocks and overseas assets. The fund currently has around 55% of its money or JPY 71tn ($675bn) in domestic bonds. Given the size of the GPIF, any change in its asset allocation would have a tremendous effect on Japan’s capital flows. This is yet another reason why I expect USD/JPY to continue to move higher.

In EM currencies, the RUB was the worst-performing EM currency that we follow, owing no doubt to the worsening crisis in Ukraine and the threat of further sanctions later this week. However it was noticeable that in contrast to the weak RUB, HUF and PLN were the best-performing EM currencies we track, even managing to gain a little bit against the dollar. It’s hard to see why they gained, especially after Hungary’s manufacturing PMI for August fell sharply to the lowest level of the year. One of the deputy governors of the Hungarian central bank explained, “Sometimes, we improve even if we don’t deserve it, and other times we deteriorate when we also don’t deserve it.”

Probably, HUF and PLN were helped by Swiss National Bank President Thomas Jordan’s renewed pledge to maintain the EUR/CHF floor. Hungary and Poland have a lot of debt denominated in CHF and any strengthening of the CHF would cause them considerable trouble. With EUR weakening however, as long as the floor is in place then CHF will weaken as well. Jordan said that the floor “is absolutely central to ensure adequate monetary conditions in Switzerland” and he repeated that the SNB stands ready to enforce it by buying unlimited foreign currency. Going further, he said he would “exclude no measure that could be necessary.” In short, there’s no change in the EUR/CHF floor and none seems likely any time soon. Buying EUR/CHF at levels close to 1.2000 could be a low risk long-term trade, although investors would certainly have to be patient.

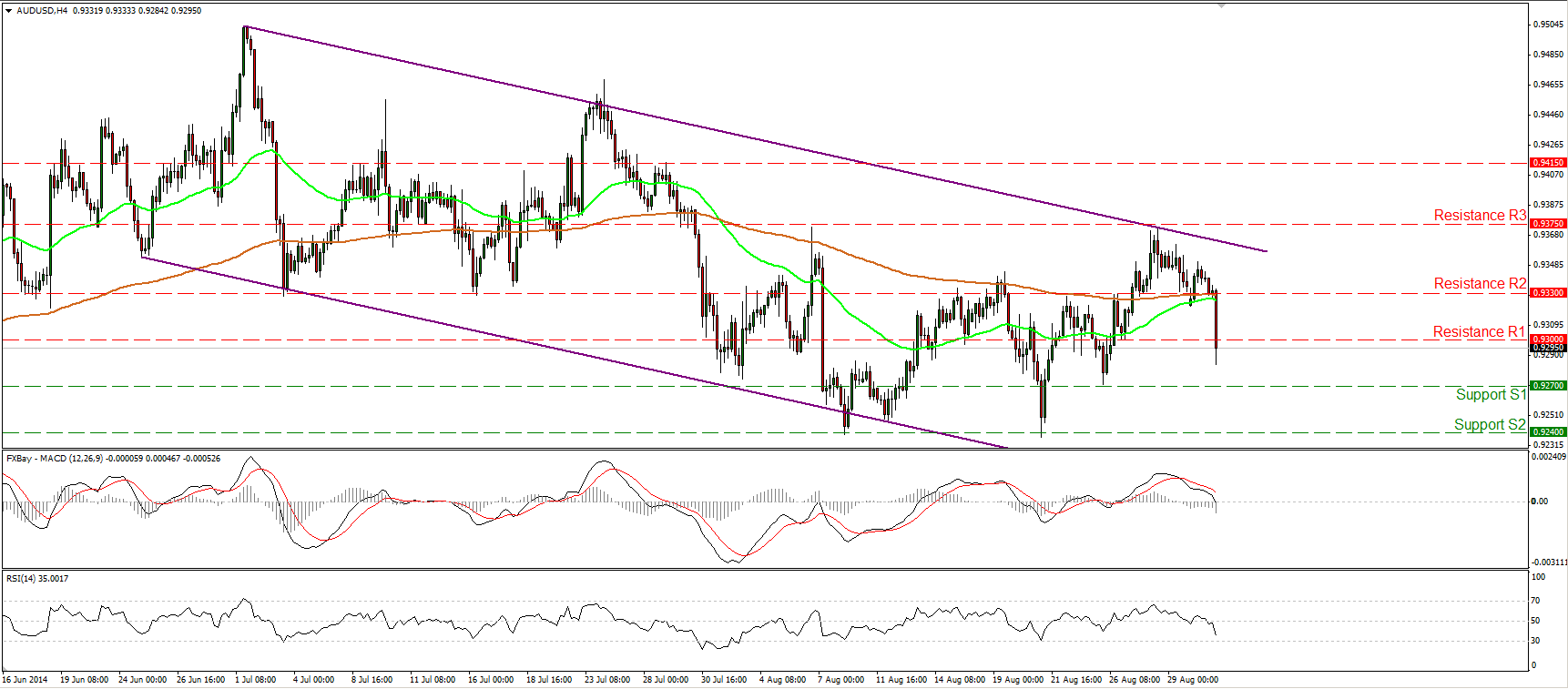

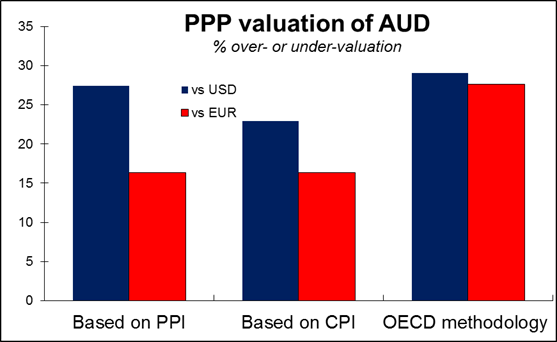

RBA protests strong currency: The Reserve Bank of Australia (RBA) kept its cash rate target unchanged, as was unanimously expected. The monthly statement was marginally more optimistic. It mentioned “gradually improving business conditions and some recovery in household sentiment,” which it said suggests “moderate growth in the economy.” Also, it noted that “investment intentions in some (non-mining) sectors continue to improve.” But for the FX market, the significant point was that the RBA ratcheted up its protest against the high level of the currency by pointing out that the currency “remains above most estimates of its fundamental value.” That’s indeed true; the OECD estimates it to be 29% overvalued vs USD, while based on producer prices, it’s about 23% overvalued. (However, the Economists’ Big Mac index rates it at 10% undervalued.)

I was surprised to see AUD fall sharply 10 minutes before today’s building approvals figure came out and then fail to rebound when the indicator came in higher than expected. That suggests negative sentiment towards the currency. Adding on the RBA’s protest against the strong AUD, I expect the decline to continue. See technical comment for more details.

Today’s indicators: During the European day the only noteworthy economic indicator we get is the Eurozone’s PPI for July. The forecast is for the PPI to decline -1.1% yoy, a faster drop in prices from -0.8% yoy in June, adding to worries about low inflationary pressures in the bloc two days ahead of the ECB meeting.

From the UK, construction PMI for August is coming out and the forecast is for the figure to decrease slightly.

In the US, the ISM manufacturing PMI and the final Markit manufacturing PMI for August are coming out. The former is forecast to decline a bit but to remain near its highest level for the year, while the latter is expected to stay at its highest level. Both indicators could prove USD-supportive.

From Canada, the RBC Manufacturing PMI for August is expected with no forecast available.

Only one speaker, ECB Governing council member Klaas Knot, is on Tuesday’s agenda.

THE MARKET

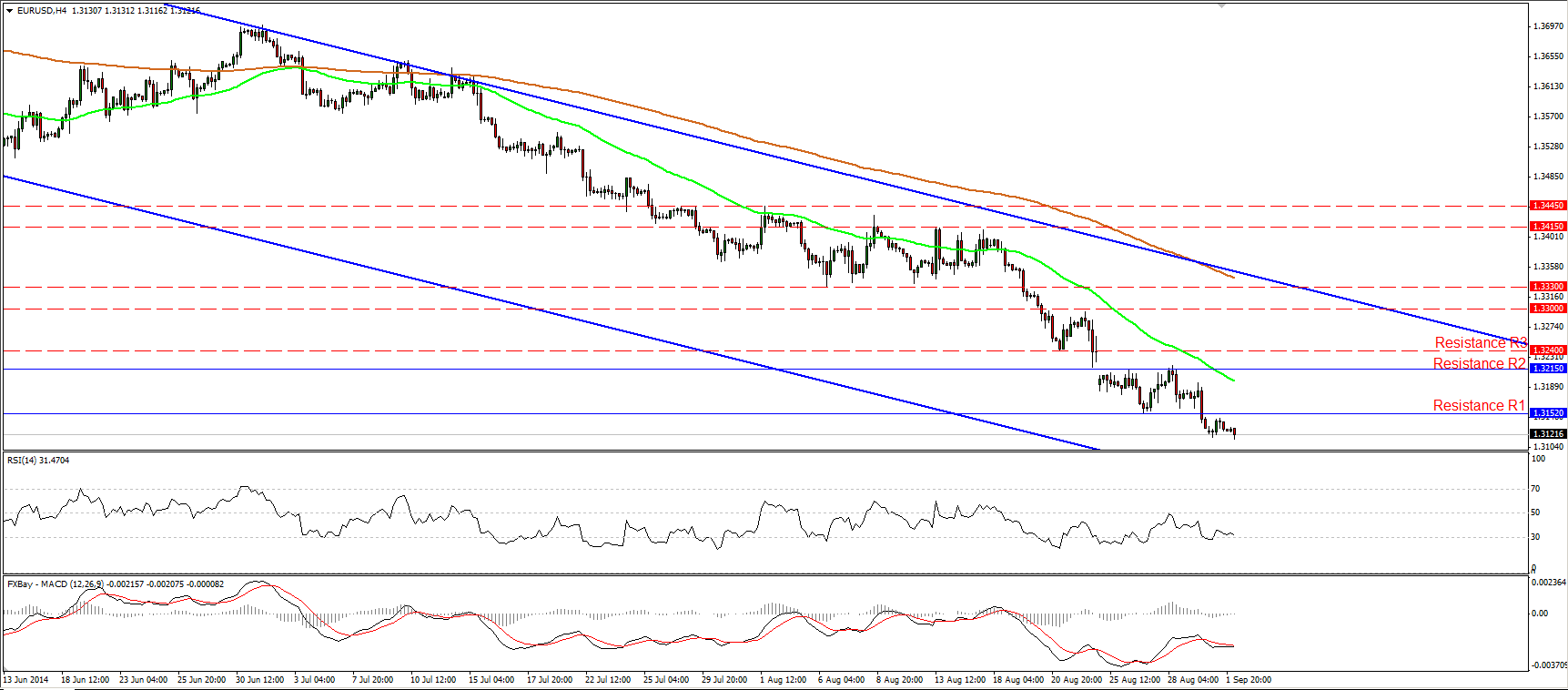

EUR/USD remains unchanged

EUR/USD moved in a consolidative mode, remaining below 1.3152 (R1), the lower boundary of the range it’s been trading in from the 25th of August until last Friday. I still expect the rate to find support at 1.3100 (S1), the lows of the 6th of September 2013, or near the lower boundary of the blue downside channel, connecting the lows and the highs on the daily chart. Although the overall picture remains to the downside, I will take to the sidelines as soon as the rate reaches the aforementioned support area. The possibility of a rebound near the lower line of the channel remains high, so I will wait for the market reaction once the price is near that zone. If the bears ignore these support lines and continue pushing the rate lower, we are likely to see extensions towards the psychological zone of 1.3000 (S2).

Support: 1.3100 (S1), 1.3000 (S2), 1.2900 (S3).

Resistance: 1.3152 (R1), 1.3215 (R2), 1.3240 (R3).

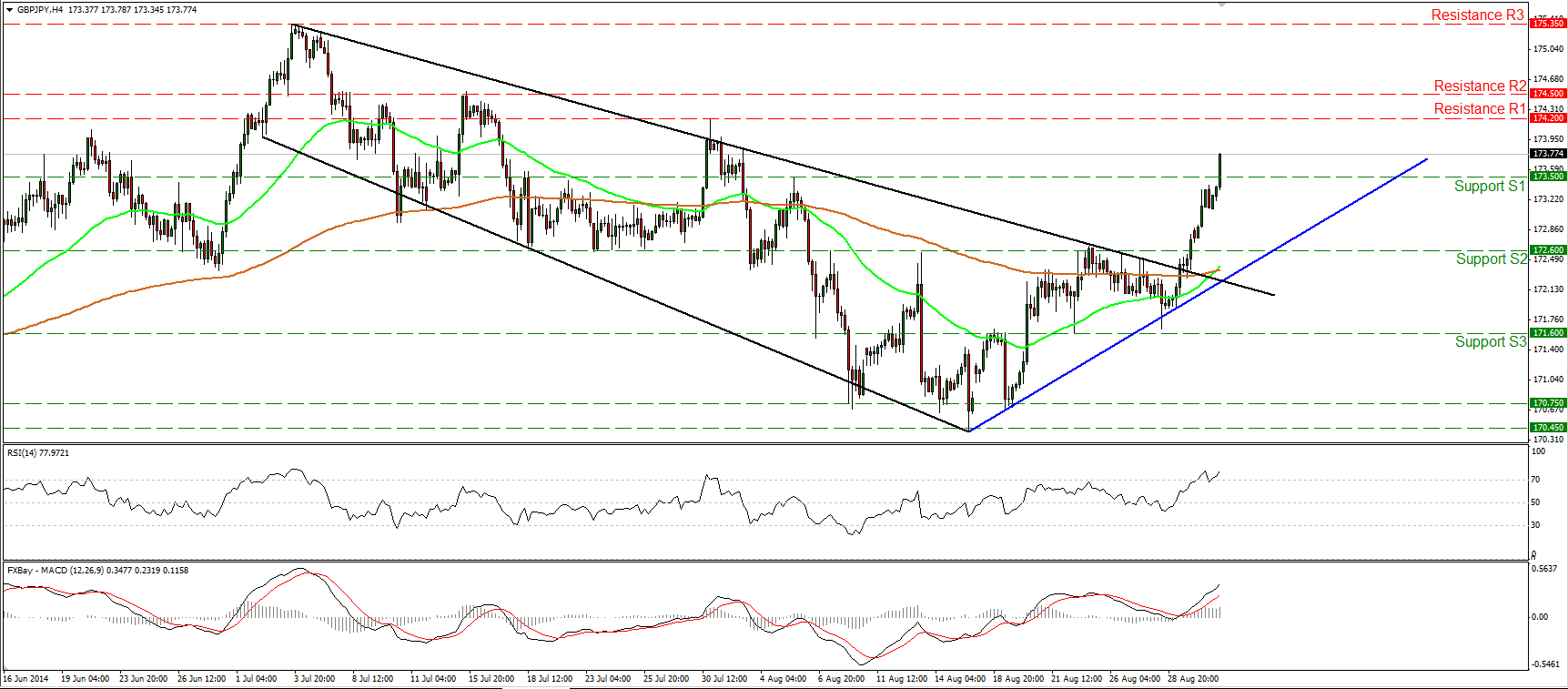

GBP/JPY surges above 173.50

GBP/JPY rallied on Monday, breaking above the obstacle of 173.50 (resistance turned into support). I expect this break to drive the battle towards the 174.20/50 area. The MACD lies above both its zero and signal lines, while the RSI is within its overbought territory but is pointing up. This confirms yesterday’s accelerating bullish momentum. As long as the rate is printing higher highs and higher lows above the blue uptrend line and above the prior black downtrend line, I consider the near-term path to be to the upside.

Support: 173.50 (S1), 172.60 (S2), 171.60 (S3).

Resistance: 174.20 (R1), 174.50 (R2), 175.35 (R3).

AUD/USD breaks below 0.9300 ahead of the RBA meeting

AUD/USD collapsed during the Asian morning ahead of the RBA policy meeting (with no reasonable explanation), falling below the barrier of 0.9300 (support turned into resistance). After the decision, the picture was little changed. The Bank left its benchmark rate unchanged and reiterated its concerns regarding the Aussie’s strength. Combining that with the technical picture, I would expect today’s decline to continue and to challenge our support barrier of 0.9270 (S1). A decisive break here could extend the bearish wave and is likely to find support near the recently double-tested 0.9240 (S2) zone. The MACD looks ready to turn negative, while the RSI has room to go before signaling oversold conditions. This magnifies the case for further declines in the near-term. In the bigger picture, the overall trend is cautiously to the downside, since the pair is trading within the downside channel connecting the highs and the lows on the daily chart.

Support: 0.9270 (S1), 0.9240 (S2), 0.9200 (S3).

Resistance: 0.9300 (R1), 0.9330 (R2), 0.9375 (R3).

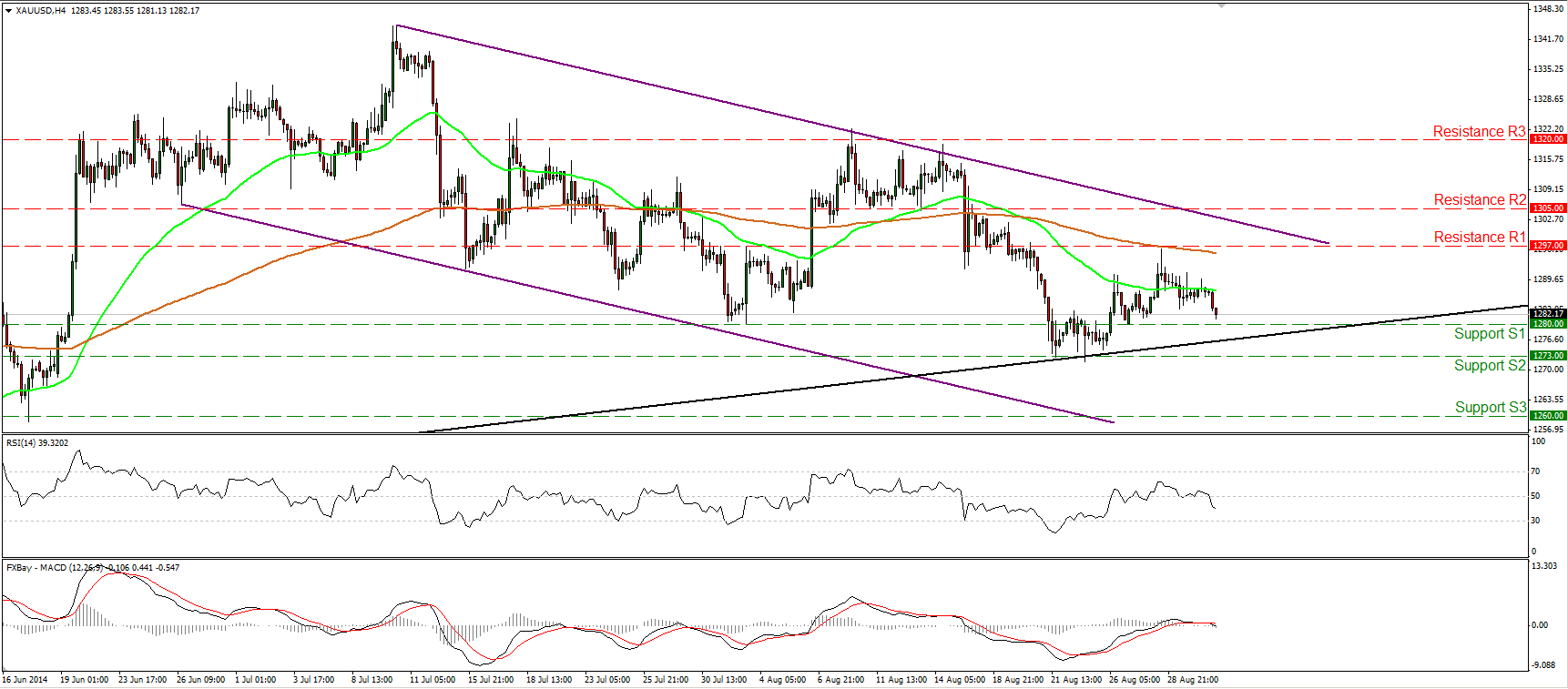

Gold ready to test the 1280 barrier

Gold declined yesterday, and today during the European morning it seems ready to challenge the support level of 1280 (S1), which lies slightly above the long-term upside support line (black line) drawn from back at the low of the 30th of December. The metal is also trading within the purple downside channel connecting the highs and the lows on the daily chart. However, given our proximity to a strong support area, I would remain neutral for now. Only a clear and decisive dip below 1273 (S2) could turn my attention to the downside. Such a move could pave the way for the 1260 (S3) zone. On the upside, a rebound near the aforementioned black line is likely to aim for another test near the 1297 (R1) hurdle.

Support: 1280 (S1), 1273 (S2), 1260 (S3).

Resistance: 1297 (R1), 1305 (R2), 1320 (R3).

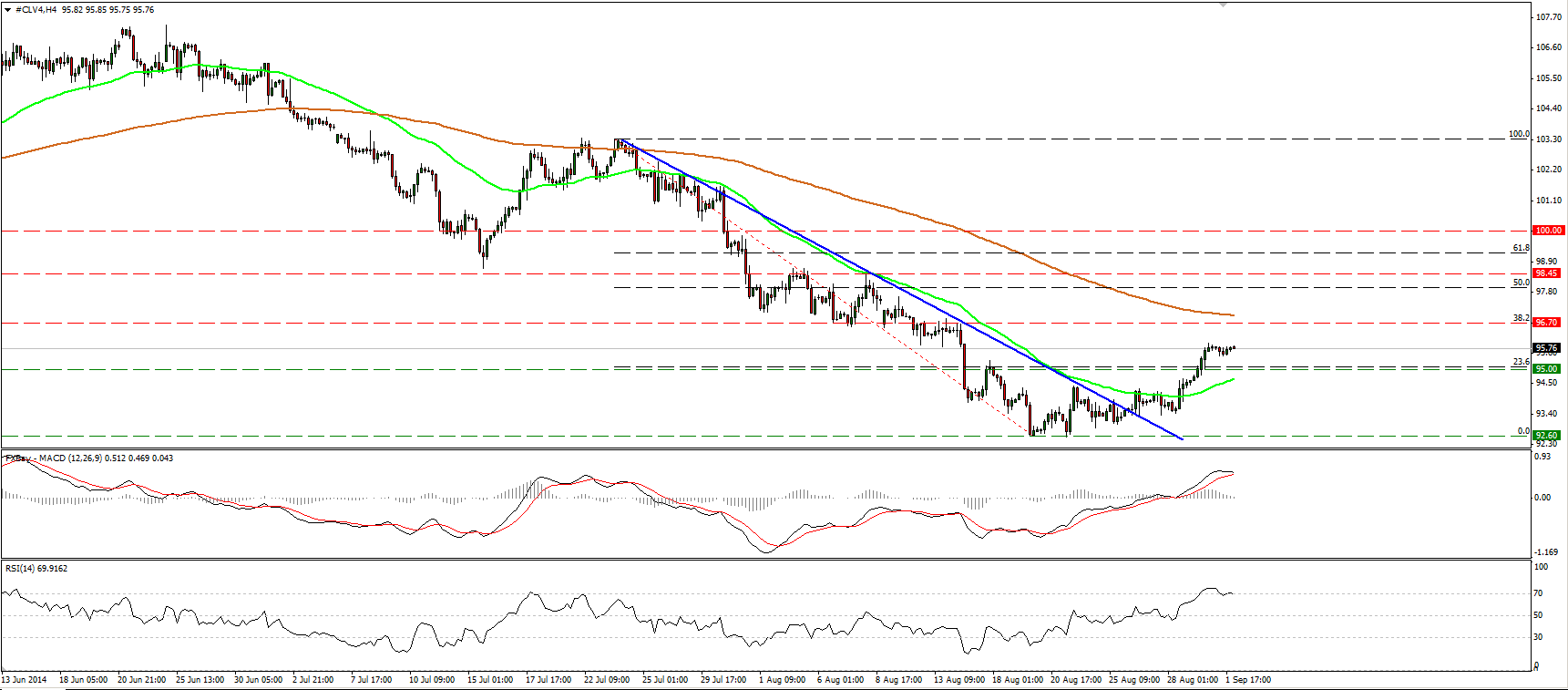

WTI in a quiet mode

WTI moved in a quiet mode, remaining where we left it yesterday, above the psychological barrier of 95.00 (S1). I will maintain my view that we are likely to see the price targeting our next resistance, at 96.70 (R1), which coincides with the 38.2% retracement level of the23rd July – 19th August downtrend. Nevertheless, the MACD shows signs of topping and could move below its signal line in the near future, while the RSI appears willing to exit its overbought field. Given our momentum signs, I would be cautious of a pullback before the longs take control again, perhaps to challenge the 95.00 (S1) zone as a support this time. On the daily chart, the 14-day RSI moved higher and is now slightly below its 50 line, while the daily MACD, although negative, lies above its trigger. This corroborates my view that we are likely to see further bullish moves, at least towards our first resistance, at 96.70 (R1).

Support: 95.00 (S1), 92.60 (S2), 91.60 (S3).

Resistance: 96.70 (R1), 98.45 (R2), 100.00 (R3).

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.