Risk on sentiment continues The market has quickly gotten over whatever shocks it felt due to the recent increase in geopolitical tensions and a “risk on” mode pervades, although the correlation among assets seems to be less than it was several months ago. Most European stock markets were up over 1% yesterday despite conflicting headlines on Ukraine that, overall, make it look like things are going from bad to worse there. NATO chief Anders Fogh Rasmussen said he saw a "high probability" that Russia could intervene militarily in eastern Ukraine and that NATO detected no sign that Moscow was pulling back thousands of troops from close to the Ukrainian border. Nonetheless USD/RUB trended lower for most of the day, which demonstrates how the market is ignoring Ukrainian developments.

While the “risk on” mood weakened the dollar on Friday as the need for safe-haven assets diminished, that wasn’t the case on Monday. The US currency was generally higher against its G10 counterparts. It was mixed vs the EM currencies as some of the more beat-up currencies that we identified yesterday (BRL and MXN in particular) rebounded. NZD was the worst-performing G10 currency overnight as the REINZ house price index and house sales fell by more than expected, and as European trading starts it’s showing no signs of recovering. I may yet have to abandon my bullish NZD view as more and more negative news comes out about the country. Meanwhile NOK and CAD, the two best-performing currencies over the last 24 hours, have been losing some of their gains in Asian trading this morning. They may be ripe for profit-taking.

EUR/USD trended lower yesterday despite higher European stocks. ECB President Draghi said at his press conference last week was that “the fundamentals for a weaker exchange rate are today much better than they were two or three months ago.” He pointed to “a decline in short-term capital inflows” as one of those fundamentals. It may be that less money is flowing into European stock markets from abroad nowadays in light of the Ukraine crisis, not to mention the concerns about lower European growth, and this is slowly eroding support for the euro. I remain bearish on EUR/USD.

While the Ukrainian crisis may not have that big an effect on most Eurozone economies, it could impact the FX market through its effect on inflation. The EU exports 4.5% of its total agricultural production to Russia. Assuming a lot of these exports will now be diverted to the home market, they could cause food prices to drop (or at least hold down increases), which would add to the downward pressure on inflation. Thus the Ukraine crisis could be one additional factor that keeps the ECB in an easing mode.

Today’s calendar: The main point of interest in Europe today will be the German ZEW survey for August. The current situation index and the expectations index are both anticipated to have fallen, as one might expect as Germany will bear the largest impact of the Russian sanctions. The forecast of the weakening indices adds to the recent signs of a slowdown in the Eurozone’s recovery and more specifically to the bloc’s strongest economy. The report may well add to the downward pressure on EUR/USD.

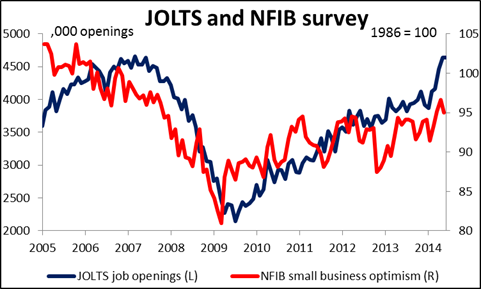

In the US, the NFIB small business optimism for July is forecast to reach its highest level since October 2007. This indicator is important because most of US employment is in small businesses. The Job Opening and Labor Survey (JOLTS) report for June is also due out and the forecast is for the number of job openings to fall slightly from May, which would be normal after two months of strong gains. While this indicator is not particularly market-affecting, it is gaining more attention nowadays because of the Fed’s emphasis on the overall job situation.

We have no speakers scheduled on Tuesday.

The Market

EUR/USD back below 1.3400 ahead of the ZEW survey

EUR/USD slid lower on Monday, moving back below 1.3400. The RSI fell below its 50 line, while the MACD turned negative and seems willing to fall below its trigger line. Bearing that in mind and that both the August German ZEW indices (coming out today), are expected to have declined, I would expect the pair to continue lower and challenge last week’s lows of 1.3330 (S1). In my view, the overall picture remains negative, since the rate is trading within the long-term blue downside channel, connecting the highs and the lows on the daily chart, but only a dip below 1.3300 (S2) would confirm a future lower low and is likely to reinforce the trend.

Support: 1.3330 (S1), 1.3300 (S2), 1.3200 (S3).

Resistance: 1.3445 (R1), 1.3500 (R2), 1.3540 (R3).

EUR/JPY rebounds from 135.70

EUR/JPY rebounded from the support barrier of 135.70 (S2) and the lower boundary of the purple downside channel. The rate moved above 136.40 (S1) and is now trading below the resistance of 137.10 (R1). A decisive violation of that level could trigger extensions towards the upper boundary of the channel, or near the next resistance at 137.85 (R2). Nonetheless, as long as the rate remains within the channel, I still see a negative overall picture and I would consider the recent advance as a corrective move. On the daily chart, the 50-day moving average is getting closer to the 200-one and a bearish cross in the near future would add to the negative picture of EUR/JPY.

Support: 136.40 (S1), 135.70 (S2), 135.50 (S3).

Resistance: 137.10 (R1), 137.85 (R2), 138.45 (R3).

Are GBP/USD bears going for 1.6700?

GBP/USD dipped below the 1.6800 (support into resistance barrier), signaling a lower low and keeping the trend to the downside. As mentioned in previous comments I expect the dip below 1.6800 to set the stage for further bearish extensions and target the key support line of 1.6700 (S1). As long as Cable is printing lower lows and lower highs below the blue downtrend line and below both the moving averages, I would still see a negative short-term picture. On the daily chart, the pair remains below the 80-day exponential moving average, supporting my view that we are likely to see the rate lower in the near future.

Support: 1.6700 (S1), 1.6655 (S2), 1.6600 (S3).

Resistance: 1.6800 (R1), 1.6880 (R2), 1.6950 (R3).

Gold stays near 1305

Gold moved quietly on Monday and remained near the 1305 (S1) line. A dip below that support is likely to target the next one at 1295 (S2). Zooming on the 1-hour chart, I see negative divergence between the yellow metal and both the hourly momentum studies, while on the daily chart, the price has formed a shooting star candle, enhancing my view that the forthcoming wave could be negative. Nevertheless, both the 50- and 200-day moving averages are still pointing sideways, while the daily oscillators are sitting near their neutral lines, keeping the overall path sideways as well.

Support: 1305 (S1), 1295 (S2), 1280 (S3).

Resistance: 1325 (R1), 1345 (R2), 1355 (R3) .

WTI continues trendless

WTI continued its consolidative mode, remaining within the range between the support of 96.50 (S2) and the resistance of 98.65 (R1). As a result, I would still see a sideways path and I would prefer to stay flat until we have a clear trending condition. A decisive move above 98.65 (R1) would signal a future higher high and could bring a near-term trend reversal, while only a dip below 96.50 (S2) could signal the continuation of the prevailing downtrend. Looking on our momentum technical indicators, the RSI lies on its 50 line, while the MACD is touching its zero lines, both pointing sideways. This corroborates my neutral view for now.

Support: 97.00 (S1), 96.50 (S2), 95.85 (S3).

Resistance: 98.65 (R1), 99.45 (R2), 100.45 (R3).

BENCHMARK CURRENCY RATES - DAILY GAINERS AND LOSERS

MARKETS SUMMARY

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.