A busy week ahead! We have a really busy week ahead of us. The highlights are.

Tuesday: Reserve Bank of Australia meeting. No likelihood of a change in rates, as the RBA itself has said at every meeting this year that “on present indications, the most prudent course is likely to be a period of stability in interest rates.” Indeed, the market is pricing in no change in rates at least out to March 2015. Rather, the focus will be on the RBA’s view of the economy. At the last meeting (3 June), the RBA was relatively upbeat, saying that “growth looks to have been somewhat firmer” and singling out “moderate growth” in consumer demand and “a strong expansion in housing construction.” It repeated its comment that “the exchange rate remains high by historical standards,” adding, “particularly given the further decline in commodity prices.” AUD/USD is only slightly higher since the last meeting (0.94 vs 0.92) so they probably would not come out with a stronger statement. The last several meetings have not had much impact on AUD/USD and I would not expect this one to be much different.

Japan Tankan The Tankan (Bank of Japan Short-Term Survey of Economic Conditions) is expected to show a decline in current sentiment but optimism about the future. The large manufacturers’ index, for example, is forecast to decline to 15 from 17 but the outlook for Q3 is expected to rebound to 17 again. The pattern reflects the fact that the economy slowed in Q2 because of the hike in the consumption tax, but is expected to return to normal by Q3. Thus the forecasts for Q3 will be more important than the result for Q2, in my view. Looking at the market reaction over the last year, USD/JPY moved only slightly higher the last time there was a negative surprise (in April). All four times USD/JPY was at least somewhat lower than before the announcement within 30 minutes after the release.

PMIs for June The day starts with the official China manufacturing PMI for June alongside the final manufacturing PMI from HSBC/Markit. The preliminary HSBC/Markit PMI for the month unexpectedly rose to 50.8 from 49.4 so we can perhaps expect a rise in the official PMI. Then come the June manufacturing PMI for the UK and many of the other European countries as well as the final PMIs for the Eurozone, Germany and France, as well as the ISM index for the US. That’s expected to show a modest rise and a continued high level on the prices-paid index, which could be USD-positive.

Separately, Fed Chair Janet Yellen delivers the inaugural Michel Camdessus Lecture at the IMF, followed by a 30 minute “Conversation” between Yellen and IMF MD Christine Lagarde. Given the IMF and Ms. Lagarde’s view of US policy, this conversation could take a notably dovish turn.

Thursday: The big day of the week:

ECB Policy Board meeting: Following last month’s unprecedented move to institute a negative deposit rate, the first major central bank ever to do so, I think it’s highly unlikely that the ECB would take any further steps this month. Those easing measures won’t even be fully implemented until September, when they hold the first of their targeted long-term refinancing operations (TLTRO). Until that is done and they start to have some idea how the entire package of measures is performing in terms of stimulating lending, the ECB is likely to be on hold. That means several more months (at least) during which the anticipation ahead of the ECB meetings is much less than it was previously and volatility on the day is likely to be much lower than at the last several meetings.

Riksbank meeting: The Riksbank on the other hand is widely expected to lower its repo rate to 0.5% from 0.75%. At the last Executive Board meeting in April they lowered their forecast for the repo path substantially and two of the six Board members voted for a cut in rates, while others said that “even minor revisions to the inflation forecast could affect their view of monetary policy.” The headline CPI has been in deflation all this year, but high household indebtedness and the possibility of a housing bubble have kept the Riksbank from easing. The key then will be not whether they cut rates, but how they see the rate path progressing afterwards – whether they still think there is a chance of further easing or do they assume they are now at the bottom.

Nonfarm payrolls: As Friday is a national holiday in the US (Independence Day), the nonfarm payrolls for June will be released a day earlier than usual. With inflation in the US creeping up towards the Fed’s target level, the employment data are even more important than usual as the main thing left standing between the FOMC and a rate hike. The market is going for a 215k increase in NFP, about the same as in May (217k), while the unemployment rate is expected to stay at 6.3%. Generally speaking, it’s a 50-50 bet whether the figure beats or misses expectations (20 beats vs 21 misses since 2011) so we can’t recommend taking a position on the figure itself, but it is noticeable that over the last year, on average the dollar has wound up being weaker in the week after the NFP regardless of whether the figure beat or missed expectations (this did not work last month, however).

Today’s events: The Eurozone CPI is expected to stay at +0.5% yoy, with the core rate also forecast to remain at 0.7% yoy. Normally no change from such a low rate could be expected to weaken the euro, but with the ECB likely to be on hold, inflation would have to change dramatically in order for it to be market-affecting. Germany’s retail sales for May are expected to have risen 0.8% mom, after declining 0.9% in April. Eurozone’s M3 money supply is forecast to have risen 0.8% yoy in May, the same pace as in April. The 3-month moving average however will decelerate if the forecast is met.

From the UK, BOE mortgage approvals are estimated to have decreased to 61.7k in May from 62.9k in April. The indicator has become even more important after Governor Carney’s latest comments to cap mortgages in order to cool the housing market and the new rules introduced by the Financial Policy Committee on lenders and new borrowers.

Canada’s GDP is expected to have increased by 0.3% mom in April, an acceleration from +0.1% in March, driving the yoy rate up to 2.3% from 2.1%.

In the US, the Dallas Fed manufacturing activity index for June is estimated to have increased, while the Chicago purchasing managers’ index for the same month is forecast to have decreased. Pending home sales for May are expected to have accelerated 1.2% mom, from +0.4% in April, although that would bring down the yoy pace slightly.

THE MARKET

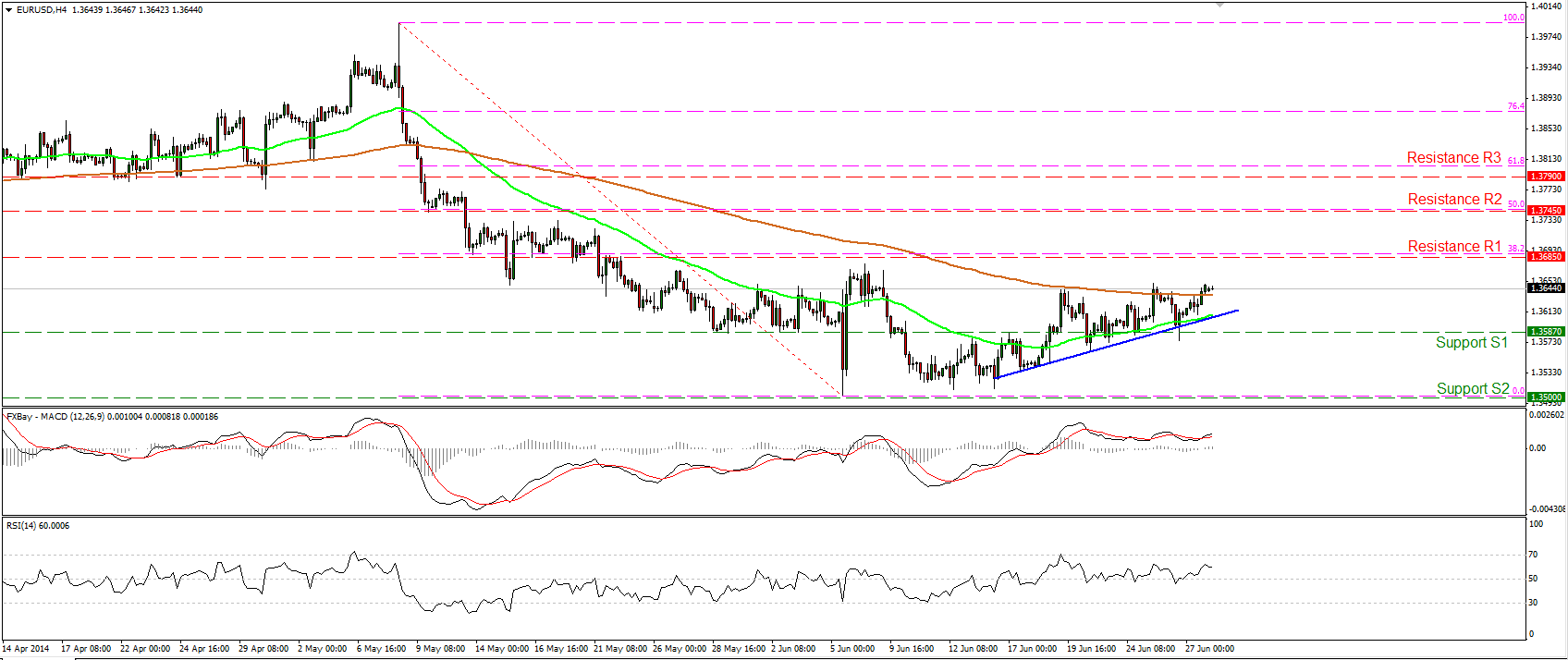

EUR/USD moves above the 200-period moving average

EUR/USD edged higher on Friday, breaking above the 200-period moving average. The RSI continued moving higher after crossing above its 50 level, while the MACD lies above both its zero and trigger lines. Since the pair is still trading above the near-term blue support line and in light of the positive signs provided by our momentum studies, I would expect the bulls to drive the rate towards the resistance bar of 1.3685 (R1), which coincides with the 38.2% retracement level of the 8th May- 5th June decline. However, it’s too early to argue for a trend reversal and as a result I would consider the recent advance as a correcting phase, at least for now.

Support: 1.3587 (S1), 1.3500 (S2), 1.3475 (S3).

Resistance: 1.3685 (R1), 1.3745 (R2), 1.3790 (R3).

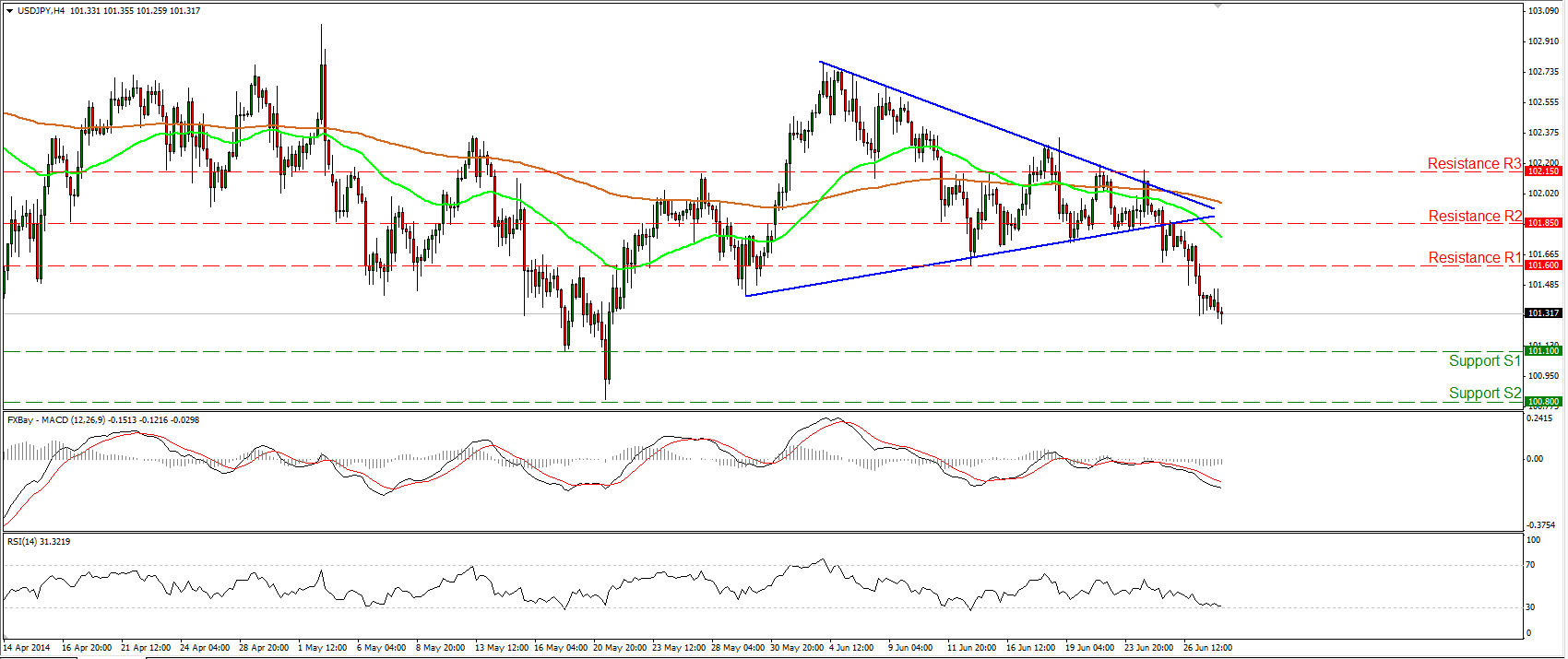

USD/JPY extends declines after exiting the triangle

USD/JPY tumbled after breaking below the 101.60 barrier. If the bears are willing to continue pushing the rate lower, I would expect them to target the support hurdle of 101.10 (S1). A decisive dip below that level could pave the way towards 100.80 (S2). As long as the rate remains below the lower bound of the symmetrical triangle, I see a negative short-term picture. Nonetheless, in the bigger picture, the long-term path of USD/JPY remains to the sideways since we cannot identify a clear trending structure.

Support: 101.10 (S1), 100.80 (S2), 100.00 (S3).

Resistance: 101.60 (R1), 101.85 (R2), 102.15 (R3).

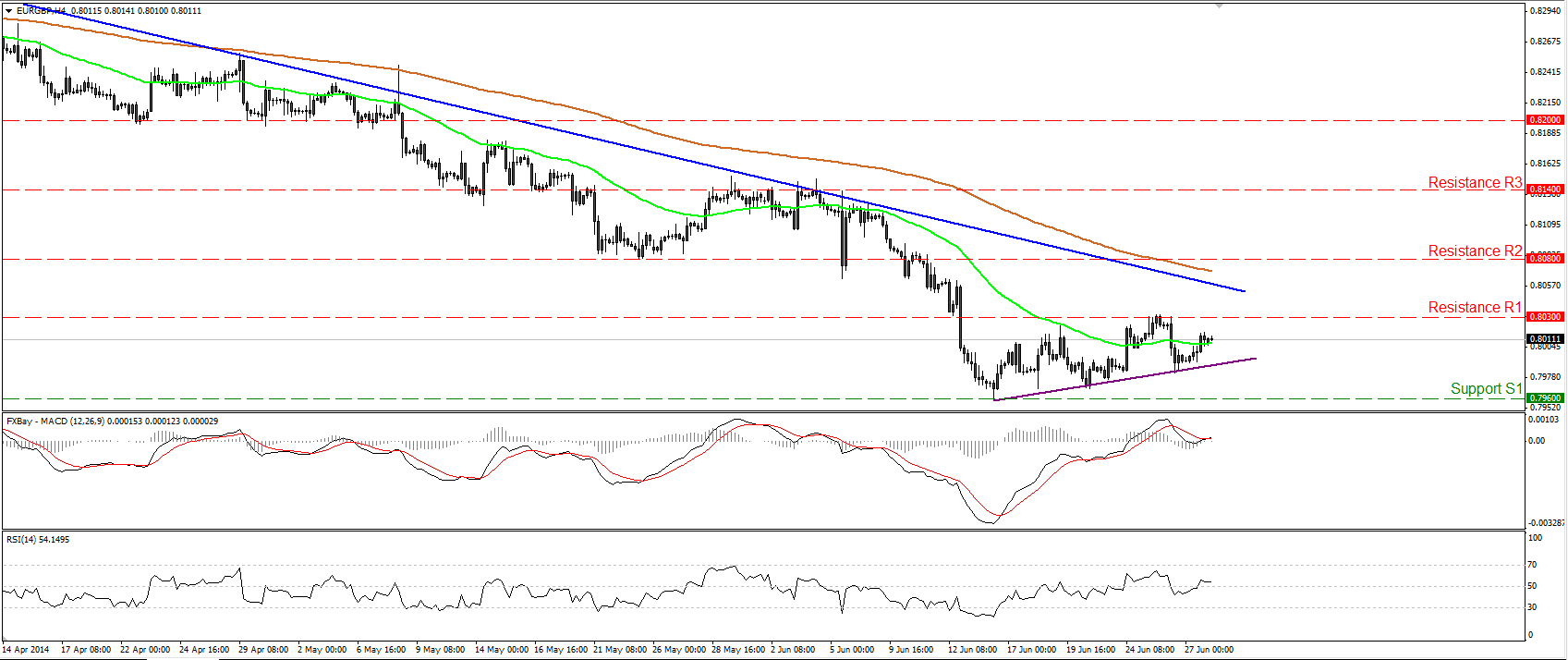

EUR/GBP still in a retracing mode

EUR/GBP rebounded from the purple short-term support line and at the time of writing is heading towards the resistance obstacle of 0.8030 (R1). The MACD, already in its positive territory, poked its nose above its signal line, while the RSI crossed above its 50 level. Given that, I cannot rule out further upside near the blue downtrend line or near the hurdle of 0.8080 (R2). Nonetheless, the pair is trading below the blue downtrend line drawn from back the 11th of April, thus I would consider any further upsides as a retracing wave before the bears prevail again. A dip below the 0.7960 (S1) is needed to confirm a forthcoming lower low and trigger the continuation of the downtrend.

Support: 0.7960 (S1), 0.7900 (S2), 0.7830 (S3).

Resistance: 0.8030(R1), 0.8080 (R2), 0.8140 (R3).

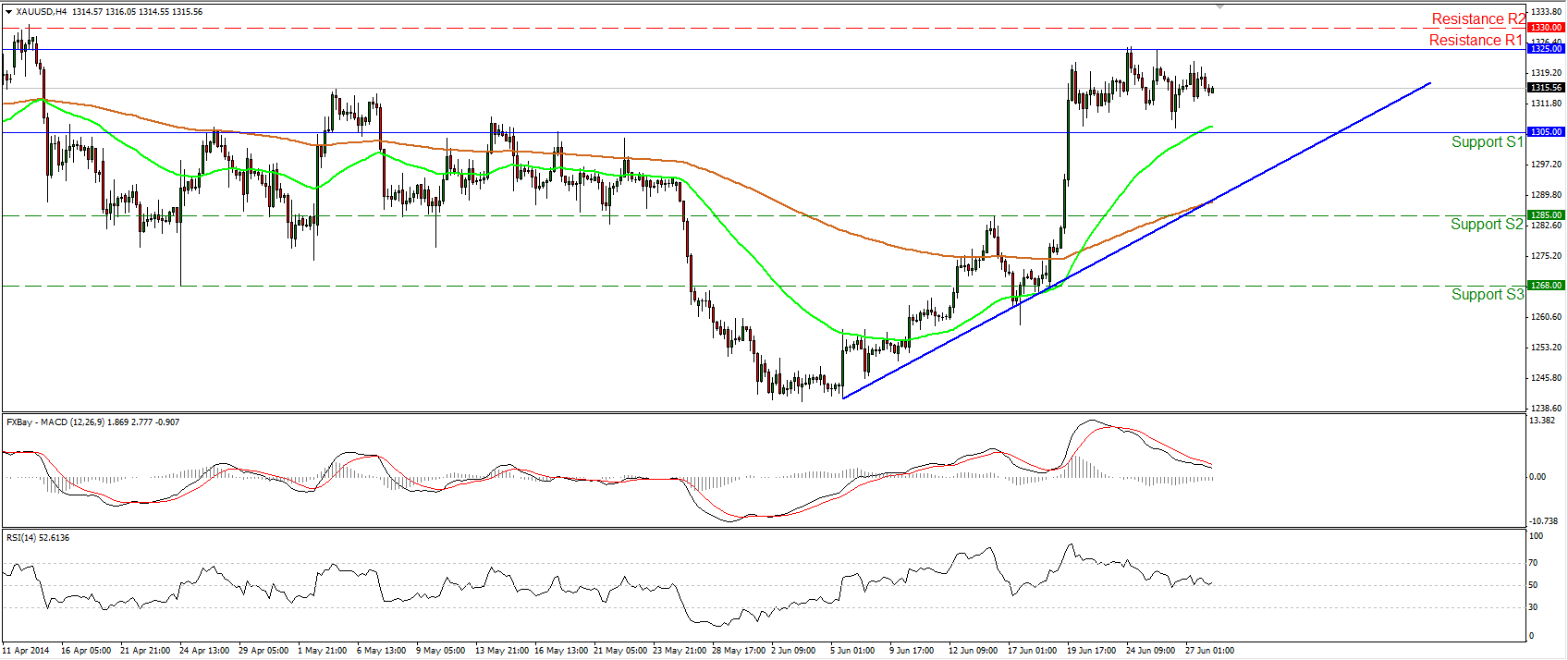

Gold still within a short-term range

Gold moved slightly lower, remaining within the short-term trading range between the support barrier of 1305 (S1) and the resistance of 1325 (R1). Given that, I would maintain my neutral stance as far as the near-term picture is concerned. However, as long as the precious metal is trading above both the moving averages and above the blue uptrend line, the overall technical picture remains positive. A clear move above the highs of 1330 (R2) could reinforce the upside path.

Support: 1305 (S1), 1285 (S2), 1268 (S3).

Resistance: 1325 (R1), 1330 (R2), 1342 (R3).

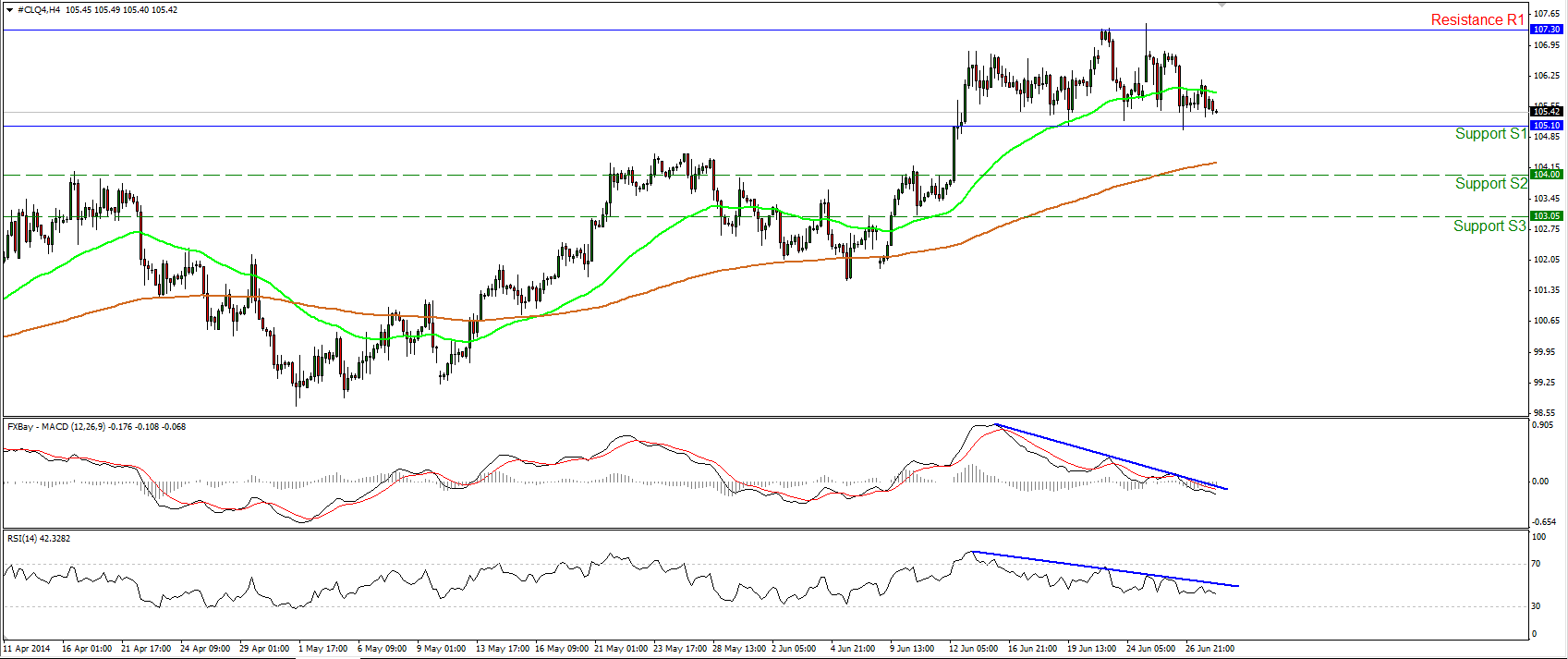

WTI remains neutral

WTI moved in a consolidative mode, remaining near the levels we left it on Friday. Considering that WTI continues trading between the support of 105.10 (S1) and the resistance of 107.35 (R1), I still see a sideways path. Both our momentum studies continue moving below their downside resistance lines, while the MACD fell below both its trigger and zero lines. Although our momentum studies favor further declines, only a decisive break out of the sideways range could provide more clues about the forthcoming directional movement of WTI.

Support: 105.10 (S1), 104.00 (S2), 103.05 (S3).

Resistance: 107.35 (R1), 108.00 (R2), 110.00 (R3).

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.