Higher prices are not the same as inflation The Tokyo CPI for April was released overnight, giving us the first glimpse of the impact of the 3 percentage-point hike in the consumption tax in April. The CPI excluding fresh foods, the Bank of Japan’s preferred inflation measure, rose 2.7% yoy, up from 1.0% in March. In other words, retailers passed on about half the hike in the tax. Does this mean that the BoJ has achieved its goal of 2% inflation? Actually, you could look at it the other way: without the tax, prices actually fell 0.3% yoy, which makes it more likely that the BoJ eases further. More to the point, rising prices are not really the same as inflation if they are not accompanied by a rise in the money supply. Wages are actually falling while prices are rising, so all that’s really happening is that consumers’ purchasing power is being eroded. Inflation isn’t just a rise in relative prices (such as the price of goods relative to the price of labor); it’s an erosion in the overall value of money: more money chasing the same amount of goods. Broad money (M3) growth peaked in January at +4.5% yoy and has slowed since then. While it is up from the extremely low levels of recent years (it often shrank on a yoy basis during 2008 to 2012) the money supply is hardly growing any faster than the 2.2% yoy rate of growth in nominal GDP in 2013. Thus I still expect the Bank of Japan will have to take further easing measures in order to boost inflation. Former BoJ Monetary Policy Committee member Miyako Suda said recently that “the BOJ will probably maintain its bullish price forecast for as long as possible and keep policy unchanged until it becomes absolutely impossible to continue arguing that its price target can be met. But once he feels something must be done, I think Governor (Haruhiko) Kuroda will do something quite extraordinary because small steps won't work.” This seems logical to me and is what I would expect to happen. That should give the yen the next leg down. In any event, the CPI figure had little impact on the markets; stocks were barely changed after the figure and so too was USD/JPY.

The situation in Ukraine continues to deteriorate. It was notable yesterday that for once, the markets actually reacted to the Ukrainian news; gold jumped and the dollar declined. I consider this issue well worth watching.

The Danish central bank exited its negative interest rate regime, raising the rate on CDs by 0.15 ppt to 0.05% (lending and other rates remain unchanged). The change comes as pressure on the DKK eases.

During the European day, the main event will be the UK retail sales for March. They’re expected to fall on a mom basis but the yoy rate of change is expected to accelerate.

Belgian business confidence is coming out late in the European day. While the market generally ignores this indicator, economists watch it closely as it has a good correlation with overall European economic activity. The reason is that Belgium is a small open economy that generally gets dragged along however the continent as a whole is going.

In the US, the Markit service-sector PMI for April is expected to rise, while the final U of Michigan consumer confidence index for April is expected to be revised up. These could support the dollar somewhat although they aren’t usually big market movers and they surely will be ignored if conditions in Ukraine worsen.

ECB’s Knot speaks again at the central bank conference in Amsterdam, while Swiss National Bank President Jordan will speak at the SNB’s annual general meeting.

THE MARKET

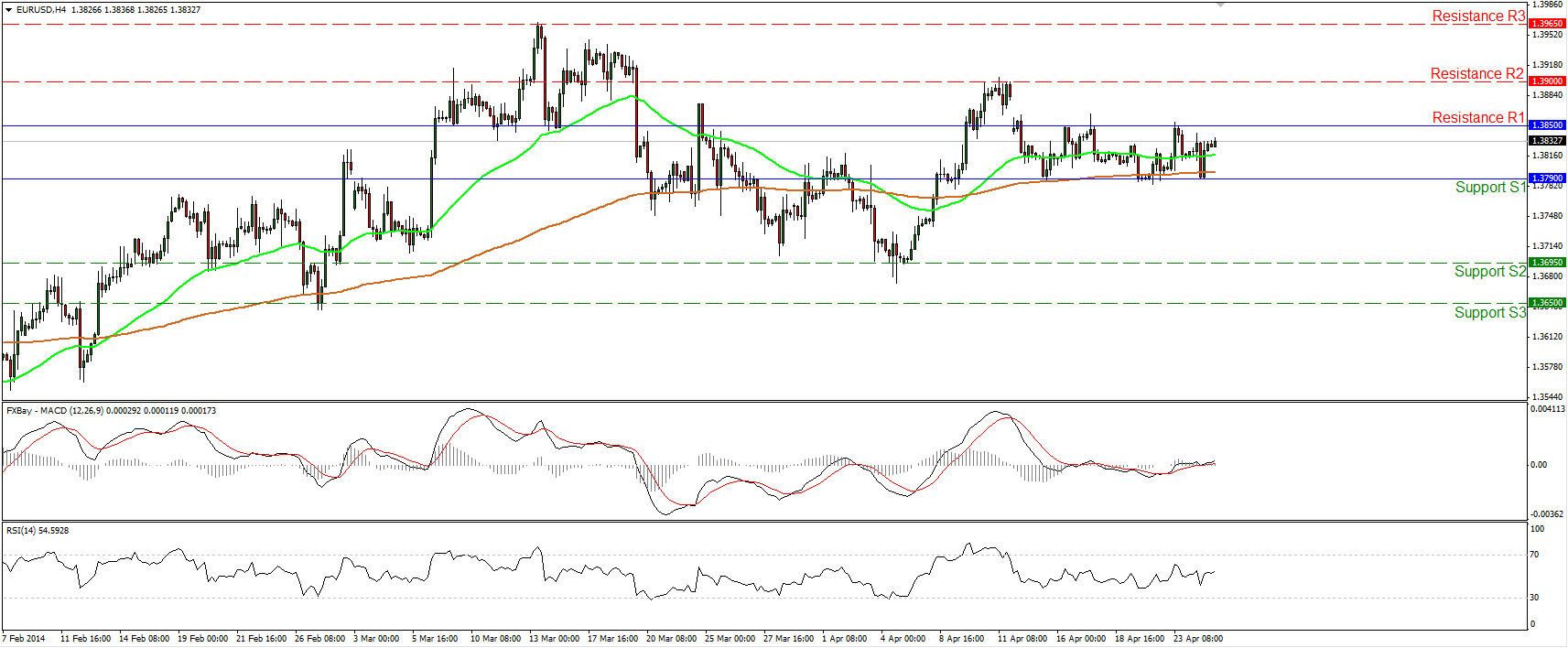

EUR/USD

EUR/USD found once again support at the 1.3790 (S1) bar and moved higher. The pair continues its sideways path between that support level and the resistance of 1.3850 (R1), and as a result I still see a neutral short-term picture. Both the moving averages are pointing sideways, while both the RSI and the MACD lie near their neutral levels, confirming the non-trending phase of the price action.A clear dip below the support of 1.3790 (S1) may have larger bearish implications and target the lows of 1.3695 (S2). On the upside, a clear move above 1.3850 (R1) could probably challenge the resistance bar of 1.3900 (R2).

Support: 1.3790 (S1), 1.3695 (S2), 1.3650 (S3).

Resistance: 1.3850 (R1), 1.3900 (R2), 1.3965 (R3).

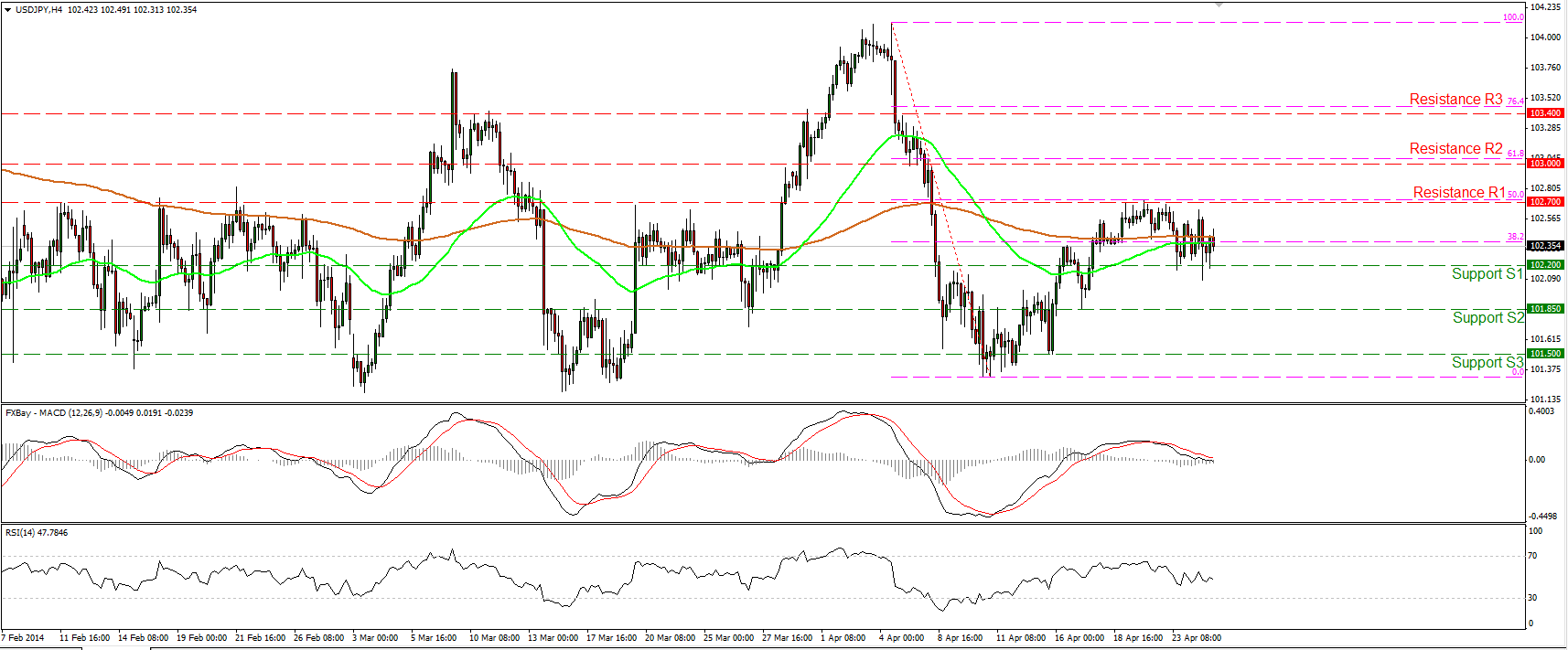

USD/JPY

USD/JPY moved in a consolidative mode after finding support at 102.20 (S1). A decisive break below that barrier may indicate that the 11 - 22 Apr. advance was just a 50% retracement of the 4 - 11 Apr. decline. The MACD lies below its signal line and seems ready to fall below its zero line and turn the momentum to the downside. On the daily chart, we can identify a doji followed by a hanging man, increasing the possibilities for further declines.

Support: 102.20 (S1), 101.85 (S2), 101.50 (S3).

Resistance: 102.70 (R1), 103.00 (R2), 103.40 (R3).

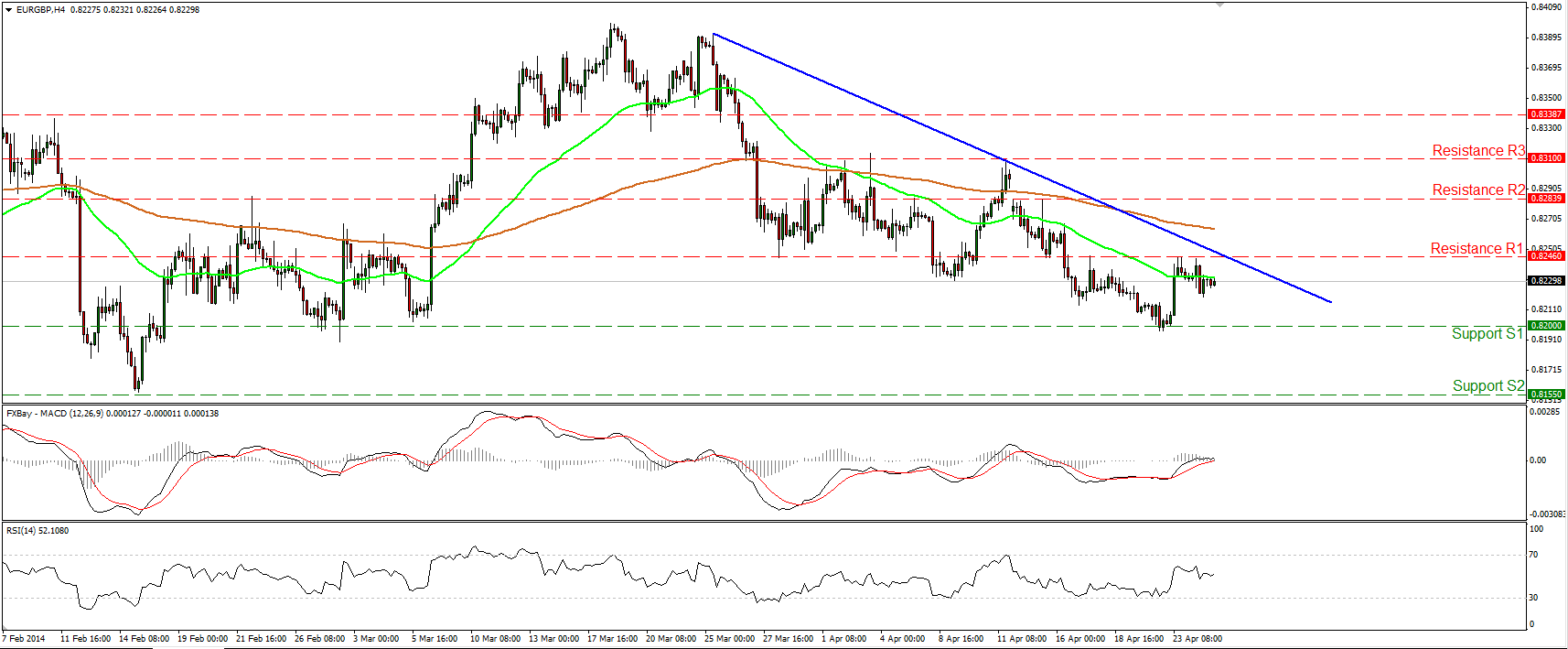

EUR/GBP

EUR/GBP retreated after finding resistance at 0.8246 (R1). If the bears are strong enough to push the rate lower, I would expect them to challenge once again the support of 0.8200 (S1). A decisive dip below that hurdle would confirm a forthcoming lower low and may pave the way towards 0.8155 (S2). The MACD seems ready to cross below both its zero and signal lines, turning the momentum back negative.

Support: 0.8200 (S1), 0.8155 (S2), 0.8085 (S3).

Resistance: 0.8246 (R1), 0.8285 (R2), 0.8310 (R3).

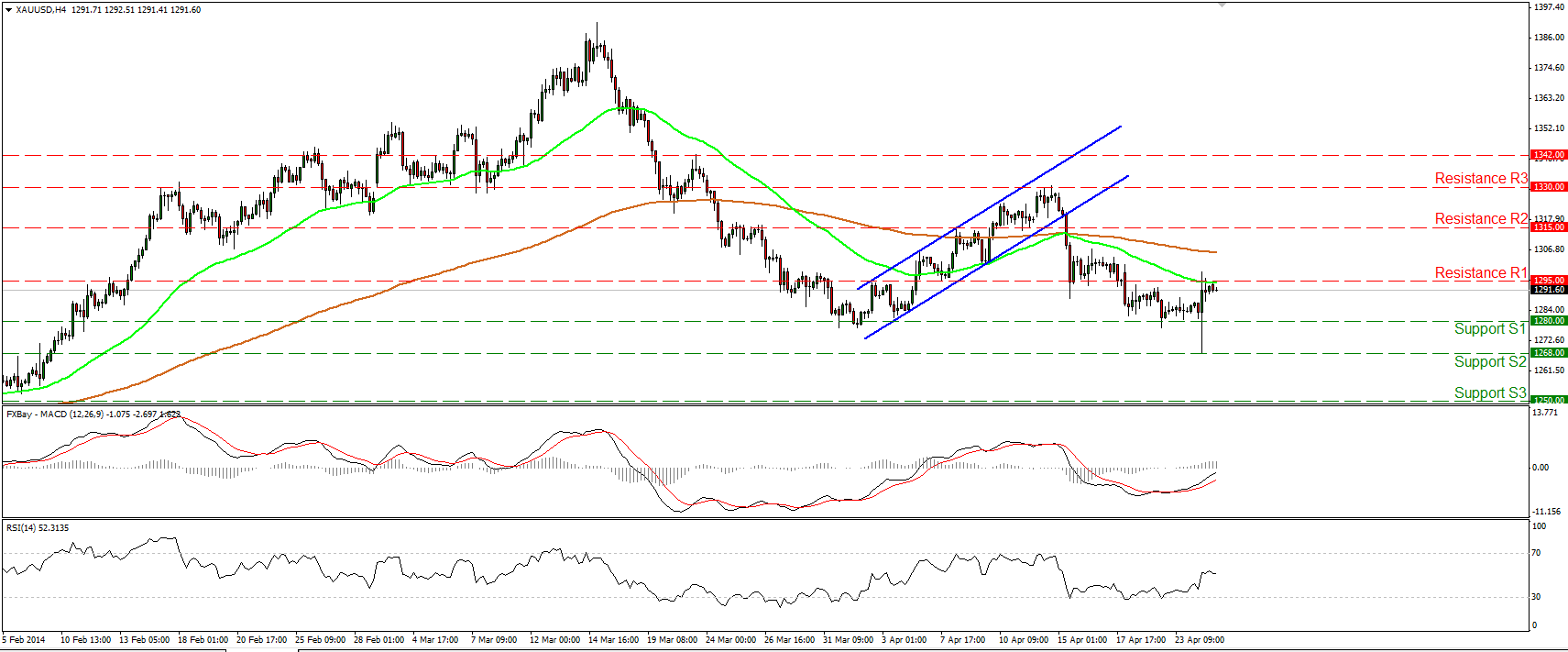

GOLD

Gold fell to find support at 1268 (S2) and then moved higher to challenge the resistance of 1295 (R1), which coincides with the 50-period moving average. An upside break of that barrier may pave the way towards the next resistance at 1315 (R2). The MACD, although in its bearish territory, remains above its trigger line, favoring further advance. On the downside, a dip below 1280 (S1) is needed to see once again the 1268 (S2) level.

Support: 1280 (S1), 1268 (S2), 1250 (S3).

Resistance: 1295 (R1), 1315 (R2), 1330 (R3).

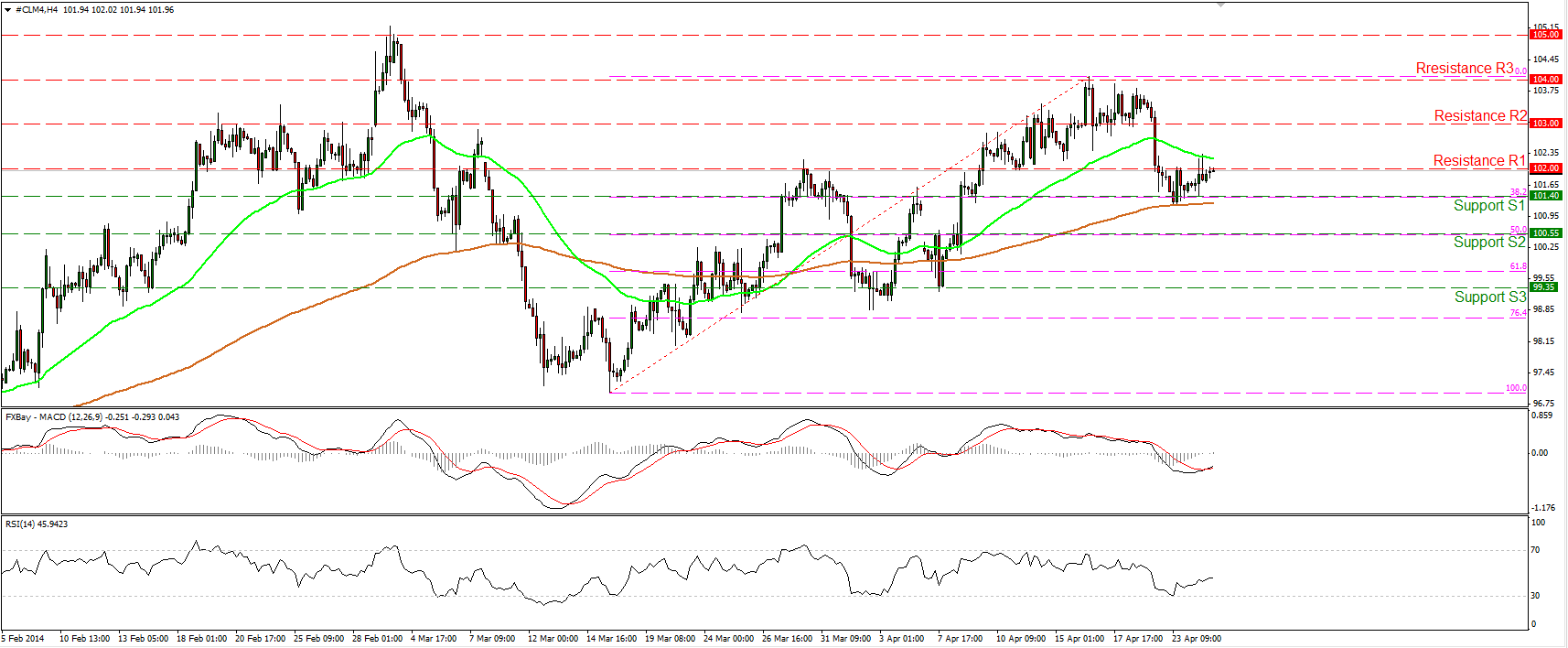

OIL

- WTI moved slightly higher to challenge the resistance of 102.00 (R1). An upside break of that hurdle may indicate that the recent decline was just a 38.2% retracement of the 17 Mar-16 Apr. uptrend and may pave the way towards the next resistance at 103.00 (R2). The MACD, although in its negative area, crossed above its trigger line, while the RSI is moved higher, confirming the inability of the bears to overcome the 101.40 (S1) support, which lies near the 200-period moving average. A clear dip below that support zone is needed to turn the outlook negative again and target the 50% retracement level of the 17 Mar-16 Apr. uptrend at 100.55 (S2).

Support: 101.40 (S1), 100.55 (S2), 99.35 (S3).

Resistance: 102.00 (R1), 103.00 (R2), 104.00 (R3).

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.