The move happened during the planned meeting, but immediately followed the surprising downgrade of its sovereign rating from the S&P.

The market reacted to the S&P action completely ignoring the CBR decision. USD/RUB came back to weekly low at 36.00. It means the market reacts to risk factor forgetting about yield for now, and there is plenty of capital outflow from Russia ahead.

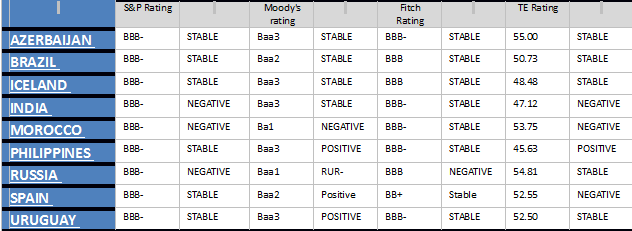

Nevertheless, we need to find out if the move from the S&P of completely economic nature, or it has the political flavor as well? Below is the table of countries having the same level of rating as Russia now.

It’s a strange neighborhood, isn’t it?

Pay attention to the fact that it is just a notch above the junk status. Moreover, the S&P kept the outlook on Russia on negative, hinting on a higher risk that the sovereign ratings will be further revised to the downside soon. That’s the main reason the investors again ran away.

And it’s not because they believed in weakness of Russia and total collapse of the economy, it’s not because they believed that Europe will stop buying oil and gas from Russia, and hope not because they believed there will be World War III. It’s just a rational approach of the investors who don’t want to take risks and wait until something irreparable happens.

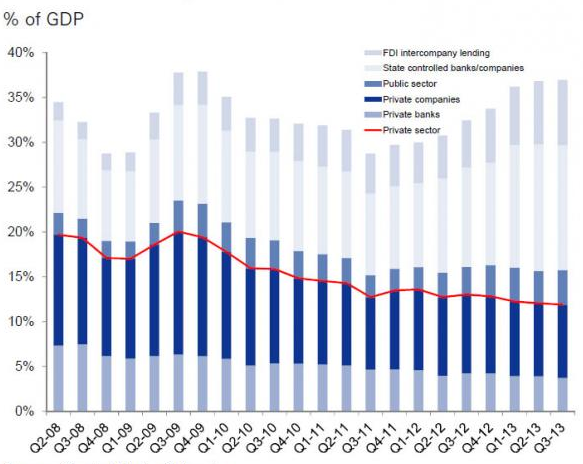

Nevertheless, we need to understand that although S&P grounded its move by “the large capital outflows from Russia in the first quarter of 2014” which “heighten the risk of a marked deterioration in external financing, either through a significant shift in foreign direct investments or portfolio equity investments”, it is hardly something that will kill the economy.

According to Moody’s Investors Service and Fitch Ratings, the Russian companies, facing $115 billion of debt due over the next 12 months, will have the funds even as bond markets shut because of the Ukraine crisis.

Firms will have about $100 billion in cash and earnings at their disposal during the next 18 months, Moody’s said in an analysis of 47 businesses April 11. Almost all 55 companies examined by Fitch are “well placed” to survive in a closed refinancing market environment for the rest of 2014, it said in a note on April 16.

And one more point to consider. Russia's total external debt is not that big in relation to technically insolvent G-7 countries who were forced to borrow heavily from the future, for very modest growth today.

To summarize, we live in those times when political decisions have very big impact on all kinds of economic processes, sometimes distorting the financial reality.

The MICEX has already lost about 10% from the start of the year, and about 2.8%, after falling briefly to -3.8% during the recent days. The index has not probably found the bottom yet, but most probably all who wanted to run away already did it, and soon the market will see attractively low level. The choice between risk and profit is a hard one.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.