GROWTHACES.COM Forex Trading Strategies

Taken Positions

EUR/USD: long at 1.1220, target 1.1400, profit locked in at 1.1130, risk factor **

AUD/JPY: long at 83.60, target 87.00, profit locked in at 85.80, risk factor ***

Pending Orders:

GBP/USD: buy at 1.5240, target 1.5400, stop-loss 1.5160, risk factor *

More Forex Strategies Updated Twice A Day - GrowthAces VIP Subscription Only

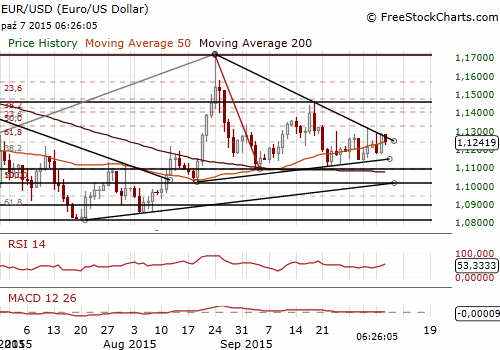

EUR/USD: Fed Hike In December Still Very Likely

(long at 1.1220)

San Francisco Fed President John Williams said that Federal Reserve should be communicating its views of the economy well enough that markets will not be taken by surprise by an eventual interest-rate hike. While it is not a problem if traders are not fully pricing in a rate increase before it happens, “it should not be the case that no one is expecting a rate increase.”

Since the Fed's September meeting, Williams said, there have been no signs of a worsening global outlook, and while recent trade data was worse than expected, data on consumer spending has topped his expectations. In his view the labor market continues to improve.

A government report last Friday showing the US economy added only 142k in September, many fewer than expected, convinced many traders that the central bank is now much less likely to raise rates before the end of this year. Williams sought to counter that view, saying the economy will soon need no more than 100k new jobs a month to feed a healthy labor market.

Fed Williams’ comments suggest that a hike in October is unlikely, but we can expect monetary tightening in December, sooner than the market consensus, which is March now.

European Central Bank Governing Council member Erkki Liikanen said the bank should stay patient and not take hasty action to adjust its asset purchase programme after Eurozone inflation turned negative last month.

We do not change our long EUR/USD position opened at 1.1220 yesterday.

Significant technical analysis' levels:

Resistance: 1.1289 (high Oct 5), 1.1300 (psychological level), 1.1319 (high Oct 2)

Support: 1.1173 (low Oct 6), 1.1159 (200-dma), 1.1154 (61.8% of 1.0808-1.1715)

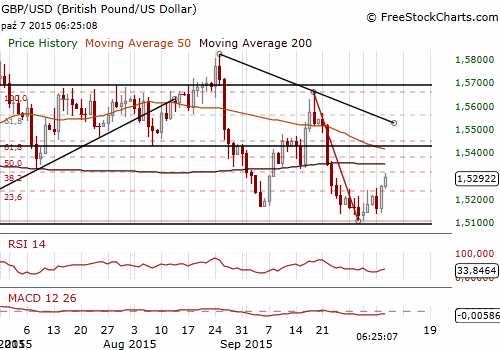

GBP/USD: Profit Taken At 1.5310, Buy Again At 1.5240

(buy at 1.5240)

British industrial production rose 1.0% mom and 1.9% yoy in August vs. growth by 0.7% yoy in July. The reading was above the market consensus of 1.2% yoy. Those figures were boosted by seasonal adjustments in the Office for National Statistics calculations which factor in shutdowns and maintenance work in the North Sea petroleum sector which did not take place on a large scale this year. There was also a small rise in gas production.

British manufacturing output picked up 0.5% mom in August after falling sharply in July as auto plants came back online after summer shutdowns.

Sterling rose to its highest in more than two weeks against the dollar after the data. We have taken profit on our GBP/USD long at 1.5310.

The GBP traders will be now focused on the Bank of England meeting on Thursday, October 8. We expect no change in policy. However, the minutes are likely to be less dovish than the market is expecting.

Since the MPC’s last meeting, financial markets have pushed out their expectation for the timing of the first rate hike, from July 2016 to December 2016. In our opinion this change was unjustified. The most important news during the last month was one of further evidence of a firming of wage growth. Private sector regular pay growth – a measure watched closely by the BoE – rose to its highest level since July 2008, at 3.4%. In September the Committee said that while downside risks from China and other emerging markets have increased, they have not yet crystallized. And we have seen little in the way of news to change this view.

Significant technical analysis' levels:

Resistance: 1.5310 (session high Oct 7), 1.5322 (200-dma), 1.5367 (high Sep 23)

Support: 1.5141 (low Oct 6), 1.5130 (low Oct 5), 1.5107 (low Oct 1)

Our research is based on information obtained from or are based upon public information sources. We consider them to be reliable but we assume no liability of their completeness and accuracy. All analyses and opinions found in our reports are the independent judgment of their authors at the time of writing. The opinions are for information purposes only and are neither an offer nor a recommendation to purchase or sell securities. By reading our research you fully agree we are not liable for any decisions you make regarding any information provided in our reports. Investing, trading and speculation in any financial markets may involve high risk of loss. We strongly advise you to contact a certified investment advisor and we encourage you to do your own research before making any investment decision.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.