GROWTHACES.COM Forex Trading Strategies

Trading Positions

EUR/USD trading strategy: long at 1.1325, target 1.1550, stop-loss 1.1325

GBP/USD trading strategy: long at 1.5400, target 1.5580, stop-loss 1.5460

USD/CAD trading strategy: short at 1.2620, target 1.2370, stop-loss 1.2560

EUR/JPY trading strategy: long at 134.60, target 137.50, stop-loss 134.60

AUD/JPY trading strategy: long at 92.60, target 94.30, stop-loss 92.80

Pending Orders

AUD/USD trading strategy: buy at 0.7780, if filled – target 0.7980, stop-loss 0.7680, risk factor **

NZD/USD trading strategy: buy at 0.7470, if filled - target 0.7660 stop-loss 0.7370, risk factor **

EUR/CHF trading strategy: buy at 1.0675, if filled - target 1.0990, stop-loss 1.0570, risk factor *

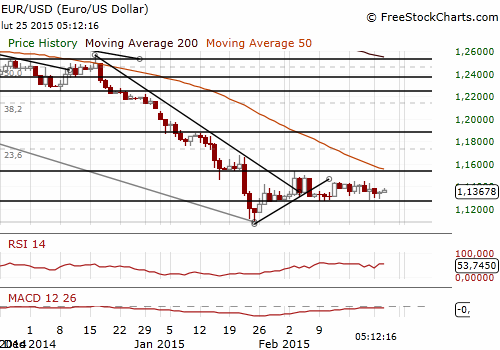

EUR/USD: No Rush To Raise Fed Rates

(long for 1.1550)

Fed Chair Janet Yellen said the Federal Reserve remains patient in deciding when to start raising interest rates because wage growth remains sluggish and inflation is running below the Fed's target.

Janet Yellen said the Federal Reserve is preparing to consider interest rate hikes on a meeting-by-meeting basis. Yellen described how the Fed's rate-setting policy committee will likely proceed in coming months - first by removing the word "patient" in describing its approach to rate hikes, then entering a phase in which rate hikes are possible at any meeting. She said, when the word "patient" disappears it means the Fed will have full flexibility to act if its judges the economic data warrant it. She added: “It is important to emphasize that a modification of the forward guidance should not be read as indicating that the committee will necessarily increase the target range in a couple of meetings.”

The USD fell against a basket of currencies after Janet Yellen indicated no rush to raise interest rates. The EUR/USD recovered from 1.1288 and is rising towards the psychological level of 1.1400. Yellen’s comments were in line with our expectations and supportive to our EUR/USD long position. On the other hand, Yellen’s testimony increased the likelihood of removal of the word “patient” at the March meeting.

Greek list of reforms won conditional approval in Brussels for an extension of a rescue package, as widely expected. The impact of the EU/Greece deal has faded very quickly and markets are focused again on central banks expectations.

U.S. macroeconomic figures are still disappointing. The Conference Board said its index of consumer attitudes fell to 96.4 from an upwardly revised 103.8 in January. The February reading was the lowest for the index since September, and was below market expectations for a reading of 99.6.

Significant technical analysis' levels:

Resistance: 1.1400 (psychological level), 1.1430 (high Feb 20), 1.1450 (high Feb 19)

Support: 1.1288 (low Feb 24), 1.1278 (low Feb 20), 1.1270 (low Feb 9)

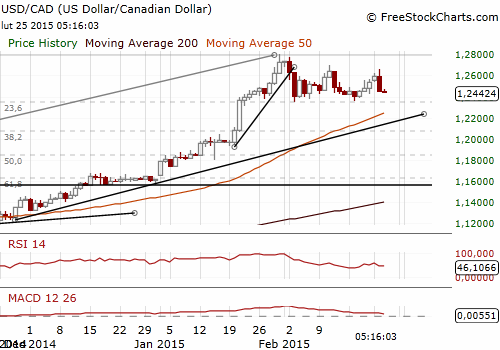

USD/CAD: BoC Signals No Rate Cut In March, In Line With Our Expectations

(stay short, stop-loss lowered to save profits)

Bank of Canada Governor Stephen Poloz said that the central bank remains comfortable that its 25 bps cut in January was a fitting manoeuvre to buy time for the bank to assess the effects on the country's economy of a dramatic plunge in the price of oil.

Poloz offered a more fulsome explanation for why the bank cut its main lending rate to 0.75% in January. He said: “It gives us greater confidence that we can get back to full capacity and stable inflation by the end of 2016, instead of sometime in 2017, and it will cushion the decline in income and employment, as well as the rise in the debt-to-income ratio, that lower oil prices will bring.” He added: “The negative effects of lower oil prices hit the economy right away, and the various positives, more exports because of a stronger U.S. economy and a lower dollar, and more consumption spending as households spend less on fuel, will arrive only gradually, and are of uncertain size.” In his opinion a rate cut in January was “the appropriate amount of insurance”.

His comments were interpreted as dovish, but were pretty in line with our expectations that the central bank will not cut interest rates at its March meeting. Poloz’s speech indicated the bank may be taking a wait-and-see approach. However, the market is still pricing in about a 70% chance of another cut next week, which in our opinion is still much too high and generates potential for further fall in the USD/CAD.

The USD/CAD fell below 1.2500 after Poloz’s comments and the loonie continued to depreciate during Asian session. The nearest support level is at 1.2422 (low on February 20). Breaking below this level will open the way to the target of our short USD/CAD position of 1.2370. We have lowered the stop-loss on our short position to save profits.

Dovish Poloz’s comments may have also influence on other commodity currencies – AUD and NZD and may lower expectations for a rate cut in Australia. After taking profits on our recent AUD/USD and NZD/USD longs, we are looking to get long again on dips.

Significant technical analysis' levels:

Resistance: 1.2516 (21-dma), 1.2662 (high Feb 24), 1.2697 (high Feb 11)

Support: 1.2422 (low Feb 20), 1.2360 (low Feb 17), 1.2354 (low Feb 3)

Our research is based on information obtained from or are based upon public information sources. We consider them to be reliable but we assume no liability of their completeness and accuracy. All analyses and opinions found in our reports are the independent judgment of their authors at the time of writing. The opinions are for information purposes only and are neither an offer nor a recommendation to purchase or sell securities. By reading our research you fully agree we are not liable for any decisions you make regarding any information provided in our reports. Investing, trading and speculation in any financial markets may involve high risk of loss. We strongly advise you to contact a certified investment advisor and we encourage you to do your own research before making any investment decision.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.