GROWTHACES.COM Forex Trading Strategies:

Trading Positions:

EUR/USD trading strategy: long at 1.1220, target 1.1550, stop-loss 1.1090

EUR/GBP trading strategy: long at 0.7470, target 0.7650, stop-loss 0.7390

Pending Orders:

USD/JPY trading strategy: sell at 119.20, if filled target 116.60, stop-loss 120.00

EUR/JPY trading strategy: buy at 131.40, if filled target 134.70, stop-loss 130.50

USD/CAD trading strategy: buy at 1.2300, if filled target 1.2720, stop-loss 1.2200

AUD/NZD trading strategy: sell at 1.0680, if filled target 1.0350, stop-loss 1.0770

EUR/USD: Investors Not Scared Of Greek SYRIZA

(long at 1.1220, target 1.1550)

EUR/USD investors were focused on Greek election’s results today. With 99.8% of the vote counted, left-wing Syriza had 149 seats in the 300-member parliament with 36.3% of the vote. The right-wing Independent Greeks party said it would back Syriza leader Alexis Tsipras to be the next prime minister, after he fell just short of the majority needed to govern alone.

Initially the EUR/USD fell as low as 1.1098 after projections showed anti-austerity party Syriza won the election, setting Athens on a collision course with international lenders and potentially threatening its place in the euro. However, the EUR/USD reaction was short-lived and the rate recovered above 1.1200 in the European session, as the election result was largely anticipated. Moreover, it is widely expected that Tsipras, at the end of the day, will work with the European Union and other international lenders.

Another big event today was a release of German Ifo index. Ifo's business climate index increased to 106.7 in January from 105.5 in December. That was the highest reading since July and the consensus forecast for 106.3.

Ifo business conditions index rose in January to 111.7 from 109.8 in December and Ifo business expectations index rose to 102.0 from 101.3. The breakdown by sector revealed a rise in sentiment in the manufacturing sector, perhaps reflecting the fall in the EUR exchange rate.

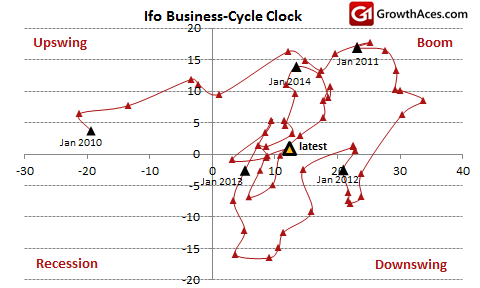

Let’s take a look at Ifo Business-Cycle clock. We see that German economy is getting out of downswing phase of the cycle.

- We saw no panic after Syriza’s win on the EUR/USD market (there was a risk of further falls) and we decided to get long at 1.1220 ahead of Ifo data. Our forecast for Ifo index was even slightly more optimistic (107.0). Good Euro zone macro data may be a good reason to take profits on recent EUR-selling positions. There are no strong resistance levels nearby and the EUR/USD has an open way even to reach even 1.1500 in the coming days. The situation will depend, however, on conclusions from the U.S. FOMC meeting (on Wednesday).

Significant technical analysis' levels:

Resistance: 1.1376 (high Jan 23), 1.1529 (10-dma) 1.1646 (high Jan 22)

Support: 1.1098 (hourly low Jan 26), 1.1047 (low Sep 8, 2003), 1.1000 (psychological level)

USD/JPY: BOJ: Oil Price Falls Will Stimulate The Economy

(sell at 119.20)

The Bank of Japan released minutes from its recent monetary policy meeting. The BOJ kept monetary policy steady at the December meeting. Many Bank of Japan board members said slumping oil prices will weigh on inflation short-term but will accelerate price rises in the long run by stimulating the economy. Some members voiced caution over risks to Japan's economic outlook, pointing to weak consumer and business sentiment surveys.

Foreign trade deficit amounted to JPY 660.7 bn in December. Japanese exports rose 12.9% yoy, up for a fourth straight month, helped by a weak JPY and a pick-up in overseas demand. The data showed exports to the United States rose 23.7% yoy, while those to China rose 4.3% yoy. EU-bound exports rose 6.8% yoy. Imports rose 1.9% yoy in December, as sharp falls in crude oil prices cut into the value of purchases.

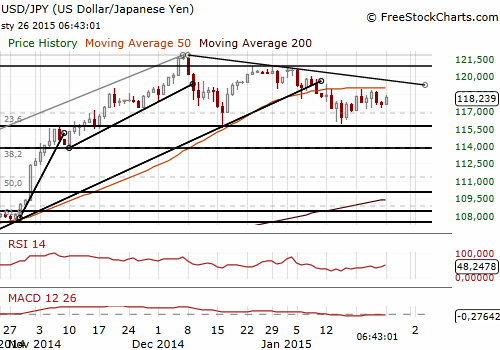

The USD/JPY rose today to 118.39 in the morning of European session from Asian session low of 117.28. We keep our sell order on USD/JPY at 119.20, as we expect some good Japanese macroeconomic figures later this week.

Significant technical analysis' levels:

Resistance: 118.82 (session high, Jan 22), 118.87 (high Jan 20), 119.31 (high Jan 12)

Support: 117.25 (low Jan 22), 117.18 (low Jan 21), 116.93 (low Jan 19)

Our research is based on information obtained from or are based upon public information sources. We consider them to be reliable but we assume no liability of their completeness and accuracy. All analyses and opinions found in our reports are the independent judgment of their authors at the time of writing. The opinions are for information purposes only and are neither an offer nor a recommendation to purchase or sell securities. By reading our research you fully agree we are not liable for any decisions you make regarding any information provided in our reports. Investing, trading and speculation in any financial markets may involve high risk of loss. We strongly advise you to contact a certified investment advisor and we encourage you to do your own research before making any investment decision.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.