GROWTHACES.COM Trading Positions

USD/JPY: long at 116.50, target 120.90, stop-loss 119.40

USD/CAD: long at 1.1570, target 1.1740, stop-loss 1.1600

EUR/CHF: long at 1.2025, target 1.2090, stop-loss 1.1995

GBP/JPY: long at 186.70, target 189.10, stop-loss 185.80

GROWTHACES.COM Pending Orders

EUR/USD: sell at 1.2360, target 1.2180, stop-loss 1.2410

USD/CHF: buy at 0.9735, target 0.9890, stop-loss 0.9690

EUR/GBP: sell at 0.7880, target 0.7770, stop-loss 0.7910

EUR/JPY: buy at 146.30, target 148.00, stop-loss 145.70

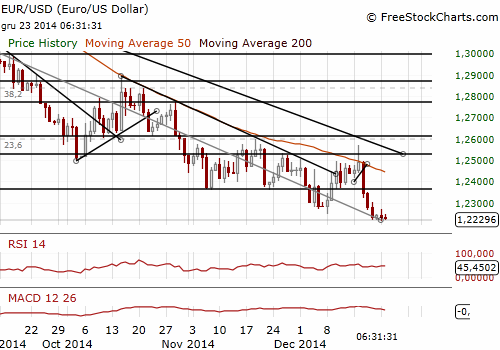

EUR/USD: Markets Are Turning Holiday Mode On

(sell on upticks)

The volatility of the EUR/USD is low and the rate is influenced by holiday mood around the globe. The impact of holidays implies more congestion around current levels, however the medium-term outlook for the rate is bearish.

The most important factor driving a weaker EUR/USD is the divergence between U.S. and Eurozone rates. The spread between U.S. and German 2-year bonds has widened strongly since the middle of December that signals rising expectations for interest rates hikes in the USA and the quantitative easing in the Euro zone.

Is there any chance of real movement of the EUR/USD today despite markets being in holiday mood? The release of U.S. final GDP and durable goods data is scheduled for 13:30 GMT. The market will be focused mainly on GDP figures. The median forecast is at the level of 4.3% qoq annualized.

At GrowthAces.com we are looking to get short again on the EUR/USD. We placed our sell order at 1.2360 as in our opinion corrective moves are likely in the days ahead. We expect new multi-month lows in January.

Significant technical analysis' levels:

Resistance: 1.2302 (high Dec 19), 1.2352 (high Dec 18), 1.2393 (21-dma)

Support: 1.2216 (low Dec 22), 1.2167 (low Aug 3, 2012), 1.2133 (low Aug 2, 2012)

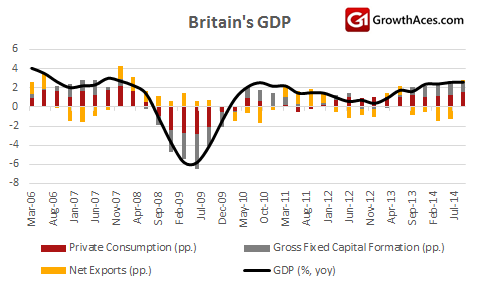

GBP/USD: Large External Deficit And Weaker GDP Reading Hit The GBP

(we stay sideways)

The economy grew by 0.7% qoq in the third quarter, in line with a previous estimate and slowing only a bit from a revised 0.8% qoq in the April-June period. In annual terms, growth was revised down to 2.6% from a previous reading of 3.0%, hurt by lower business and government investment and higher imports than thought in an earlier estimate.

Household spending rose 0.9% from the April-June period, picking up speed from the second quarter, and was the main driver of growth. Bad news are weak growth of household disposable income (the income, after tax and inflation, fell 0.1% qoq and rose only 1.0% yoy) and fall in business investment (by 1.4% qoq). In annual terms business investment was up 5.2%, weaker than the previous estimate for the third quarter.

The Office for National Statistics also released third-quarter current account data, which showed that Britain's deficit with the rest of the world rose to GBP 27.0 bn, equivalent to 6.0% of GDP, matching the biggest deficit on record.

The GBP/USD hit a day’s low of 1.5552 after the release of GDP and current account data. The rate is near December 18 low, before strong Britain’s retail sales data. The next strong support level is 1.5507 (daily low on September 2, 2013).

We stay sideways. We maintain our opinion that the GBP is likely to be relatively strong against non-USD currencies.We are looking to get short on the EUR/GBP and stay long on the GBP/JPY.

Significant technical analysis' levels:

Resistance: 1.5658 (10-dma), 1.5753 (high Dec 17), 1.5785 (high Dec 16)

Support: 1.5539 (low Dec 17), 1.5507 (low Sep 2, 2013), 1.5462 (low Aug 30, 2013)

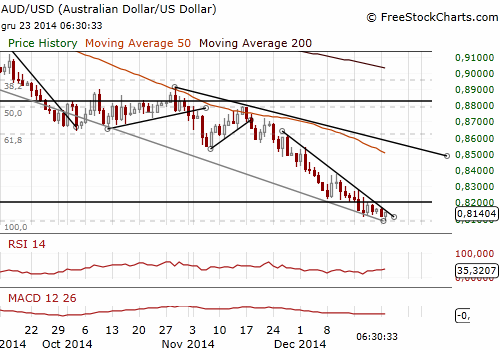

AUD/USD: The Lowest Level Since June 2010

(sideways, medium-term outlook is bearish)

Chinese rebar and iron ore futures both fell more than 2% on Tuesday, dragging rebar prices to a fresh three-week low as some steel mills and other participants liquidate positions ahead of year-end loan repayments. The AUD is very vulnerable to Chinese data, because slowing growth outlook in Chinese economy deteriorates Australia’s terms of trade.

The AUD/USD fell to as low as 0.8087, its weakest since June 2010, on weak data from China and after Australia’s Prime Minister warned of heightened “terrorist chatter”. The next support level is 0.8082 (low Jun 7, 2010) and the next one is at 0.8066 (low May 25, 2010).

A slight recovery of the AUD/USD in the short-term is possible. However, in our opinion the medium- and long-term outlook for the AUD/USD is bearish. Our strategy is to sell the AUD/USD on upticks.

Significant technical analysis' levels:

Resistance: 0.8204 (high, Dec 18), 0.8212 (10-dma), 0.8235 (high, Dec 17)

Support: 0.8082 (low Jun 7, 2010), 0.8066 (low May 25, 2010), 0.8000 (psychological level)

Our research is based on information obtained from or are based upon public information sources. We consider them to be reliable but we assume no liability of their completeness and accuracy. All analyses and opinions found in our reports are the independent judgment of their authors at the time of writing. The opinions are for information purposes only and are neither an offer nor a recommendation to purchase or sell securities. By reading our research you fully agree we are not liable for any decisions you make regarding any information provided in our reports. Investing, trading and speculation in any financial markets may involve high risk of loss. We strongly advise you to contact a certified investment advisor and we encourage you to do your own research before making any investment decision.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.