GROWTHACES.COM Trading Positions

EUR/USD: short at 1.2480, target 1.2330, stop-loss 1.2550

USD/JPY: long at 117.50, target 119.80, stop-loss 116.60

USD/CHF: long at 0.9560, target 0.9760, stop-loss 0.9610

EUR/CHF: long at 1.2025, target 1.2095, stop-loss 1.1995

EUR/GBP: short at 0.7990, target 0.7840, stop-loss 0.7980

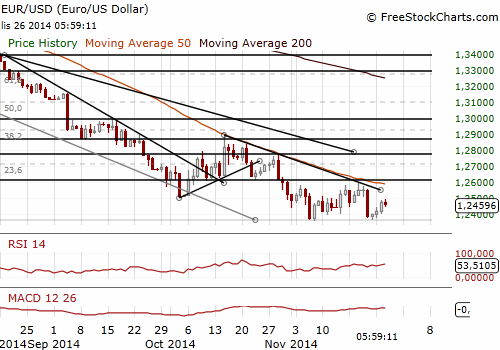

EUR/USD: Short At 1.2480. Target 1.2330

(we got short, medium-term outlook still bearish)

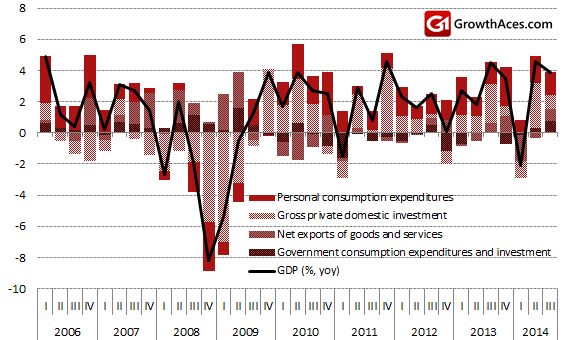

The U.S. GDP grew at a much faster pace than initially estimated in the third quarter. The U.S. economy increased a solid 3.9% in the July-September period vs. an initial estimate of 3.5%.

Consumer spending grew at a 2.2% rate compared to an initial estimate of 1.8% growth. Business investment in equipment increased at a 10.7% rate vs. growth of 7.2% initially estimated.

Separate U.S. data showed consumer confidence sliding to a five-month low. The Conference Board said that U.S. consumer confidence index fell in November 88.7 from a downwardly revised 94.1 the month before. The median forecast amounted to 96.0. The expectations index fell in November to 87.0 from October's revised 93.8, and the present situation index fell to 91.3 from a revised 94.4 in October. A fall in consumer confidence resulted mainly from lower assessment of the labor market.

U.S. single-family home prices showed a stronger-than-expected rise in September. The S&P/Case Shiller composite index of 20 metropolitan areas gained 4.9% yoy in September.

The European Central Bank Vice President Vitor Constancio said the central bank would be able to gauge in the first quarter of next year whether it needs to start buying sovereign bonds to stimulate the Euro zone economy. The ECB has already begun buying covered bonds and asset-backed securities.

A series of U.S. data is scheduled for release today ahead of Thursday's holiday, including the final November consumer sentiment and October new home sales. While Friday is not a holiday, U.S. trading activity is expected to be light.

The EUR/USD opened the Asia session at 1.2474 after rising during the US session yesterday after the release of worse-than-expected U.S. consumer confidence. The EUR is also getting some support from capital flowing into Euro zone stocks and bonds. In our opinion the recovery of the EUR is limited due to expectations on further ECB action. The ECB meeting scheduled for December 4 will be of key importance for the EUR/USD traders.

GrowthAces.com got short on the EUR/USD at 1.2480 and set the target at 1.2330. In our opinion in the medium-term the rate is likely to fall even lower.

Significant technical analysis' levels:

Resistance: 1.2505 (low Nov 2), 1.2560 (30-dma), 1.2569 (high Nov 21)

Support: 1.2402 (low Nov 25), 1.2358 (low Nov 7), 1.2342 (low Aug 21, 2012)

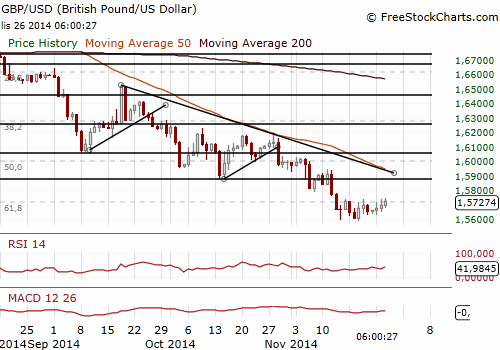

GBP/USD Gains Ground

(sell at 1.5810)

As initially estimated Britain’s GDP between July and September grew by 0.7% qoq and 3.0% yoy slowing from the second quarter's 0.9% qoq.

Consumer spending rose by 0.8% qoq, picking up a bit of speed from the second quarter. Business investment fell by 0.7% qoq in the third quarter, its first fall since the second quarter of last year and a sharp slowdown from the previous quarter's strong rate of 3.3%.

The Confederation of British Industry showed that British retail sales growth slowed slightly in November. The CBI said its monthly retail sales index fell slightly to 27 in November from 31 in October. British retail sales dipped in September, as warmer than usual weather discouraged shoppers from buying new autumn fashions. But retailers' expectations for December picked up to +38, their highest level since September.

The Bank of England's chief economist Andrew Haldane said official interest rates in Britain, after they start to rise, might end up sticking at 3%, below their level before the financial crisis.

The GBP/USD traded near 1.5700 in the Asian session but then rose near 1.5740 in the afternoon. Our outlook for the GBP/USD is still bearish. Our sell order is at 1.5810. However, we expect the GBP to remain relatively strong vs. other major currencies. We keep our short EUR/GBP position with the target at 0.7840.

Significant technical analysis' levels:

Resistance: 1.5780 (high Nov 13), 1.5903 (21-dma), 1.5940 (high Nov 12)

Support: 1.5681 (10-dma), 1.5649 (low Nov 25), 1.5630 (low Nov 24)

Our research is based on information obtained from or are based upon public information sources. We consider them to be reliable but we assume no liability of their completeness and accuracy. All analyses and opinions found in our reports are the independent judgment of their authors at the time of writing. The opinions are for information purposes only and are neither an offer nor a recommendation to purchase or sell securities. By reading our research you fully agree we are not liable for any decisions you make regarding any information provided in our reports. Investing, trading and speculation in any financial markets may involve high risk of loss. We strongly advise you to contact a certified investment advisor and we encourage you to do your own research before making any investment decision.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.