GROWTHACES.COM Trading Positions

USD/JPY: long at 117.50, target 119.80, stop-loss 116.60

USD/CHF: long at 0.9560, target 0.9760, stop-loss 0.9630

EUR/CHF: long at 1.2025, target 1.2095, stop-loss 1.1995

EUR/GBP: short at 0.7990, target 0.7840, stop-loss 0.7980

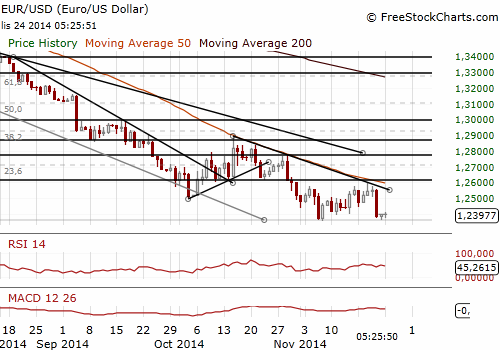

EUR/USD: The Medium-Term Target Is 1.2050

(sell at 1.2480)

German business sentiment rebounded in November, breaking a streak of six straight declines. The Ifo's business climate index rose to 104.7 from 103.2 in the previous month. The median forecast amounted to 103.0.

The index of current business conditions rose to 110 from 108.4 in the previous month. Ifo expectations index rose to 99.7 from 98.3 in October. The rise in Ifo index, especially its current component, is a big surprise after the sharp fall in the German composite PMI in the same month.

The rise in the Ifo together with the strong improvement in ZEW investor sentiment in November, suggests that the German economic activity is rising in the fourth quarter after the stagnation around the middle of the year. However, the recovery is moderate.

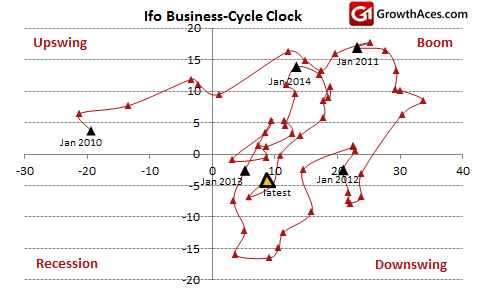

Let’s take a look at Ifo Business-Cycle Clock. It shows that the economy is in the downswing phase, but the November reading suggests improving activity.

The EUR/USD fell strongly after Draghi’s speech on Friday. The market priced in full blown quantitative easing in the first half of 2015. Our short position on the EUR/USD (entered at 1.2550) reached its target at 1.2400.

The EUR/USD opened the Asian session at 1.2380 and recovered slightly after better-than-expected German Ifo reading. In our opinion downside risks remain evident. We lowered our sell order from 1.2520 to 1.2480. In the opinion of GrowthAces.com the medium-term target for the EUR/USD is 1.2050.

Significant technical analysis' levels:

Resistance: 1.2477 (10-dma), 1.2511 (21-dma), 1.2569 (high Nov 21)

Support: 1.2358 (low Nov 7), 1.2342 (low Aug 21, 2012), 1.2296 (low Aug 20, 2012)

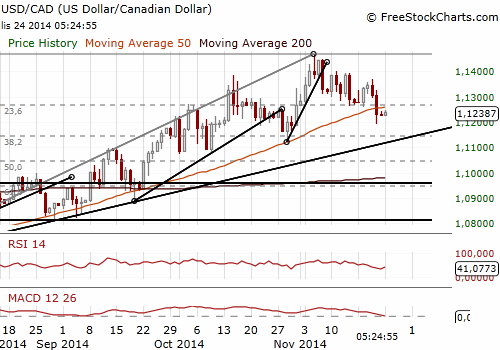

USD/CAD: The Loonie Rallied On CPI Data

(bid order at 1.1160)

Canada's inflation rate rose in October to an unexpectedly high 2.4% yoy from 2.0% yoy in September, with higher shelter and food prices accounting for most of the change. The reading was higher than the median forecast of 2.1% yoy. Core inflation rate was 2.3% yoy, up from 2.1% yoy in the previous month. The median forecast amounted to 2.1% yoy. Cost of shelter went up 2.8% yoy, pushed higher by a 20.1% yoy jump in natural gas prices. Food prices rose 2.8% yoy.

In the opinion of the Bank of Canada higher inflation is likely temporary. The central bank is expected to keep rates on hold for an extended period of time.

The USD/CAD fell below the support at 1.1253 (the 61.8% of 1.1122-1.1466) after the inflation data. The CAD rallied to a three-week high against the USD and the USD/CAD hit a day’s low at 1.1191. The currency was also buoyed by a rise in crude prices. Our long position at 1.1260 reached the stop-loss level at 1.1220. The daily momentum indicators are neutral now. We are looking to get long again. We placed the bid order at 1.1160.

Investors are focused now on Canadian retail sales data for September on Tuesday. It will be the final key piece of economic data before GDP figures for the third quarter on Friday.

Significant technical analysis' levels:

Resistance: 1.1253 (61.8% 1.1122-1.1466), 1.1326 (high Nov 21), 1.1369 (high Nov 20)

Support: 1.1191 (low Nov 21), 1.1181 (low Oct 31), 1.1122 (low Oct 29)

Our research is based on information obtained from or are based upon public information sources. We consider them to be reliable but we assume no liability of their completeness and accuracy. All analyses and opinions found in our reports are the independent judgment of their authors at the time of writing. The opinions are for information purposes only and are neither an offer nor a recommendation to purchase or sell securities. By reading our research you fully agree we are not liable for any decisions you make regarding any information provided in our reports. Investing, trading and speculation in any financial markets may involve high risk of loss. We strongly advise you to contact a certified investment advisor and we encourage you to do your own research before making any investment decision.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.