GROWTHACES.COM Trading Positions

USD/CAD: long at 1.1280, target 1.1480, stop-loss 1.1200

EUR/CHF: long at 1.2085, target 1.2160, stop-loss 1.2045

GBP/JPY: long at 172.00, target 175.00, stop-loss 171.00

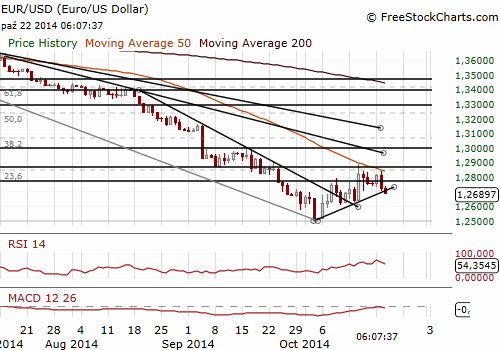

EUR/USD: Get short at 1.2800

(bear signs are growing, looking to use upticks as opportunities to get short)

The EUR/USD fell below 1.2700 following a Reuters report that the European Central Bank is considering buying corporate bonds. On the other hand, the USD recovered. While some Fed officials earlier this month flagged a possible global slowdown as a risk to that scenario, solid earnings from U.S. tech firms, upbeat U.S. housing data, and less worrisome economic figures from China on Tuesday all helped to ease that concern.

U.S. CPI data due at 1230 GMT will be the major focus later in the day. Softer reading could undermine the USD.

We are now flat on the EUR/USD. We see bear signs are growing again. GrowthAces.com is looking to use upticks as opportunities to get short. We have placed our sell offer at 1.2800.

Significant technical analysis' levels:

Resistance: 1.2738 (10-dma), 1.2784 (hourly high Oct 21), 1.2838 (session high Oct 21)

Support: 1.2624 (low Oct 15), 1.2605 (low Oct 10), 1.2583 (low Oct 7)

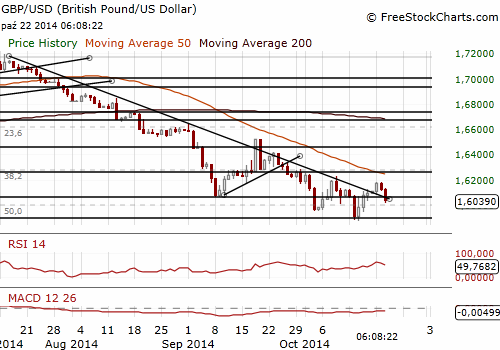

GBP/USD dropped after BoE minutes

(we stay sideways)

The minutes of the October MPC meeting delivered an unchanged vote of 7-2, as was widely expected. Most Bank of England policymakers were firmly against raising interest rates. Most of the MPC's nine members saw few signs of inflation pressures building. They said pay growth was lower than needed for the Bank to meet its 2% inflation target. In their opinion further downside news in the Ruro area had increased the risks to Britain's economy. Members were concerned that Britain's output gap would be slightly larger than previously estimated and there were downside risks to a durable recovery from the Ruro zone.

Despite some weaker data of late the dissenters, Weale and McCafferty maintained their calls for a hike. They said keeping rates low could unbalance Britain's economic recovery and long delays in the effectiveness of interest rate rises meant an increase now was needed.

The BoE's staff stuck to forecast for third-quarter economic growth in Britain of 0.9%. A preliminary reading of British GDP in the third quarter is due to be released on Friday.

The GBP/USD fell after the Bank of England minutes showed policymakers were against raising interest rates in October. The GBP/USD declined to 1.6012 after the release from around 1.6080 beforehand.

We keep our long position on the GBP/JPY at 172.00 with the target of 175.00. We stay sideways on the GBP/USD.

Significant technical analysis' levels:

Resistance: 1.6184 (30-dma), 1.6186 (high Oct 21), 1.6200 (50% of 1.6525-1.5875)

Support: 1.6012 (session low Oct 22), 1.5940 (low Oct 16), 1.5875 (low Oct 15)

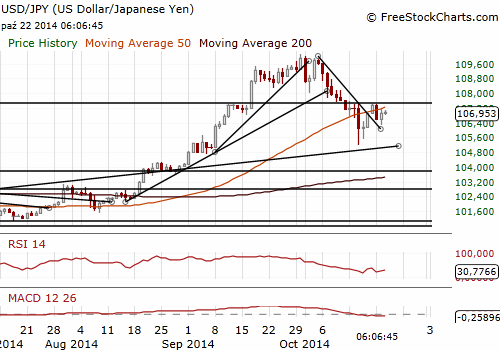

USD/JPY: Japan's trade deficit widens on higher imports

(looking to get long again at lower levels)

Japan's trade deficit edged higher in September to JPY 958 bn from JPY 950 bn in August and the seasonally adjusted deficit rose to JPY 1070 bn from JPY 912 bn.

Japan's exports rose at the fastest pace in seven months in September as sales to Asia picked up. Exports rose an annual 6.9% vs. the median forecast of 6.8%. Exports to Asia, which accounts for more than half of Japanese shipments, rose 8.1% in September from a year ago due to growing demand for electronic parts and metals from China and Vietnam, the data showed.

However, the main surprise last month was the strength of imports. It rose an annual 6.2% in September, significantly above the median forecast for a 3.0% increase. In our opinion the strong growth in imports is unlikely to be sustained due to falling commodity prices, depreciating JPY and weakening domestic demand. That is why the trade deficit is likely to narrow over the months ahead.

An economic adviser to Japanese Prime Minister Shinzo Abe, Etsuro Honda, said that the next sales tax hike should be delayed until April 2017, given the big risk that a tax increase would pose to the fragile economy. A sales tax increase in April to 8% from 5% pushed Japan's economy into the deepest quarterly slump. Prime Minister Abe will have to decide by the end of the year whether to proceed with the hike to 10% in October 2015.

The USD/JPY is near 107.00 now and the market is calm. In our opinion the USD/JPY bias remains on the upside. We are looking to get long at lower levels (below 106.50).

Significant technical analysis' levels:

Resistance: 107.12 (session high Oct 22), 107.39 (daily high Oct 20), 107.49 (high Oct 15)

Support: 106.25 (low Oct 21), 106.14 (low Oct 17), 105.51 (low Oct 16)

Our research is based on information obtained from or are based upon public information sources. We consider them to be reliable but we assume no liability of their completeness and accuracy. All analyses and opinions found in our reports are the independent judgment of their authors at the time of writing. The opinions are for information purposes only and are neither an offer nor a recommendation to purchase or sell securities. By reading our research you fully agree we are not liable for any decisions you make regarding any information provided in our reports. Investing, trading and speculation in any financial markets may involve high risk of loss. We strongly advise you to contact a certified investment advisor and we encourage you to do your own research before making any investment decision.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.