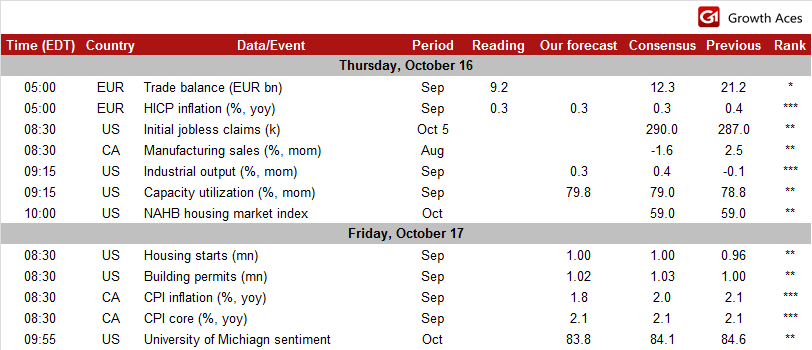

ECONOMIC CALENDAR

EUR/USD: A pitched battle between bulls and bears

(the outlook is mixed, we stay sideways)

The latest Beige Book said the U.S. economy expanded at a "moderate" pace across much of the nation in recent weeks, with the auto industry showing strong growth and banking conditions improving. Labor market conditions, as measured by hiring trends, were reported to be relatively unchanged from generally modest rates in most districts, but in some districts difficulties with finding qualified workers were reported. Wage pressures were generally seen as modest. The Fed said price pressures remained subdued.

U.S. business inventories increased 0.2% mom, the smallest rise since June 2013, below the median forecast of 0.4% mom. August inventory to sales ratio amounted to 1.29 months, unchanged from July.

U.S. seasonally adjusted retail sales dropped 0.3% mom as purchases of autos, gasoline, furniture and clothing slowed. Auto sales fell 0.8% mom, gasoline sales were lower by 0.8% mom. The drop in gasoline sales reflected declining oil prices. Falling gasoline prices free up income for consumers to spend elsewhere. Spending at electronics and appliance stores rose 3.4% mom. Excluding autos, retail sales still dipped 0.2% mom.

U.S. producer prices slipped 0.1% mom and rose 1.6% yoy, the lowest annual reading in six months and down 0.2 pp. from August’s reading. When stripping out volatile food and energy prices, producer prices were unchanged during the month.

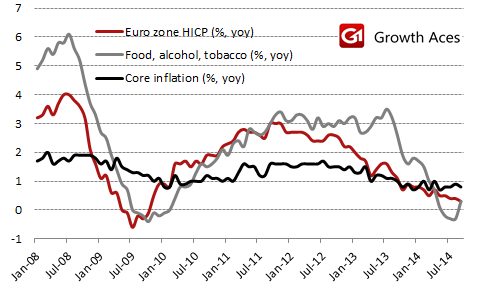

Euro zone inflation fell in September to 0.3% yoy, its lowest level since October 2009, from 0.4% yoy in August. The 0.3% reading was unchanged from Eurostat's earlier flash estimate. Five countries including Italy suffered deflation in September. Inflation has now been in the ECB's "danger zone" of below 1% for 12 consecutive months.

The Euro zone trade balance amounted in August to EUR 9.2 bn vs. EUR 21.6 bn in July. Exports in August fell 3% yoy.

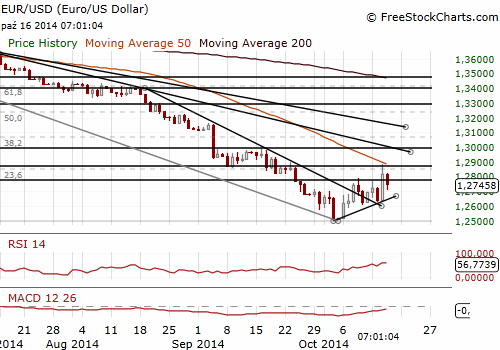

The USD recorded its steepest daily fall against the EUR in well over a year in the previous session. Our short EUR/USD position reached its stop-loss level. The Federal Reserve policymakers have voiced some concern recently that any further dollar rise may prompt the Fed to hold off with raising rates long into next year. Weak U.S. numbers yesterday provided more fuel on that front and now we see a shift in expectations of U.S. interest rate hikes.

The EUR/USD moved higher because of paring of very large EUR/USD shorts built up over the past month. Although fundamentals are still negative for the EUR/USD, there are mixed signals from technical analysis and in the opinion of GrowthAces.com no positions are justified from the risk/reward perspective.

Significant technical analysis' levels:

Resistance: 1.2887 (high Oct 15), 1.2901 (high Sep 23), 1.2929 (high Sep 19)

Support: 1.2770 (high Oct 14), 1.2724 (21-dma), 1.2693 (10-dma)

USD/JPY bears have taken control

(we went long at 105.60, but set the stop-loss tight)

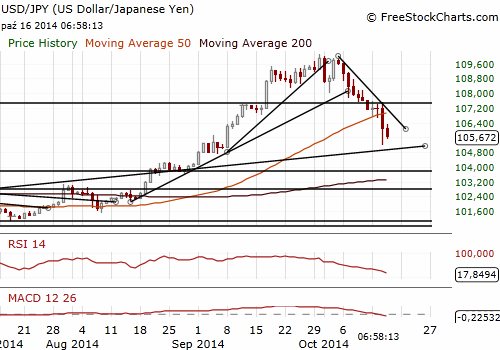

Bank of Japan Governor Haruhiko Kuroda said the central bank has no pre-set deadline for ending its quantitative easing programme, stressing that the stimulus will remain in place until its price target is achieved in a stable manner. He added: “We won't allow inflation to accelerate well past 2%” and said it was too early to debate an exit strategy for quantitative and qualitative easing.

He also reiterated that a weak yen is positive for the economy as long as it reflects fundamentals. Kuroda repeated his view that while a weak yen benefits exporters and Japanese firms with operations overseas, it hurts households and service-sector firms through rising import costs. Japanese Finance Minister Taro Aso said that regardless of whether the yen rises or falls, it is better for currency moves to be gradual.

The USD/JPY plunged to 105.19 after the release of US numbers yesterday. The demand for the safe-haven JPY was also a consequence of a slide in Tokyo stocks. We had moved our bid offer to 105.60 and now are long at this level with the target of 107.50. We set the stop-loss tight, at 104.90. GrowthAces.com is looking to get long also on the EUR/JPY. Our bid offer is at 134.80.

Significant technical analysis' levels:

Resistance: 107.02 (hourly high Oct 15), 107.49 (session high Oct 15), 107.57 (hourly high Oct 13)

Support: 105.20 (low Oct 15), 105.00 (psychological level), 104.87 (low Sep 8)

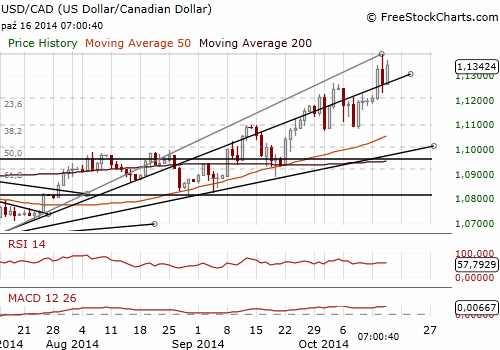

USD/CAD: Long for 1.1580

(we have raised the target in anticipation of tomorrow’s lower CPI data)

The Canadian Real Estate Association said home resales were down 1.4% mom, the first monthly decline since January. Sales were up 10.6% yoy. The continuation of extraordinarily low mortgage rates has been, and will continue to be, the key support for home sales activity. The Association said prices rose 5.3% mom, as the number of houses listed declined 1.6%, keeping supply tight.

It was a wild session for the USD/CAD yesterday. The USD/CAD reached the high at 1.1385 but then plunged after weak U.S. data to 1.1226. We went long again at 1.1280, as we assumed in our trading strategy. The USD/CAD is again above the 1.1300 level today. The bias is firmly on the upside, despite the retreat from the new multi-year high yesterday. The nearest resistance is the psychological barrier of 1.1400.

Investors will be focused on tomorrow’s CPI reading. We expect a reading of 1.8% yoy vs. the median forecast of 2.0% yoy. We have initially set the target of our long position at 1.1480, but the USD/CAD is rising and lower CPI reading tomorrow is likely to give the USD/CAD bulls a strong boost. That is why GrowthAces.com has raised the target to 1.1580.

Significant technical analysis' levels:

Resistance: 1.1385 (high Oct 15), 1.1400(psychological level), 1.1500 (psychological level)

Support: 1.1226 (low Oct 15), 1.1205 (23.6% 1.0620-1.1385), 1.1190 (low Oct 14)

Our research is based on information obtained from or are based upon public information sources. We consider them to be reliable but we assume no liability of their completeness and accuracy. All analyses and opinions found in our reports are the independent judgment of their authors at the time of writing. The opinions are for information purposes only and are neither an offer nor a recommendation to purchase or sell securities. By reading our research you fully agree we are not liable for any decisions you make regarding any information provided in our reports. Investing, trading and speculation in any financial markets may involve high risk of loss. We strongly advise you to contact a certified investment advisor and we encourage you to do your own research before making any investment decision.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.