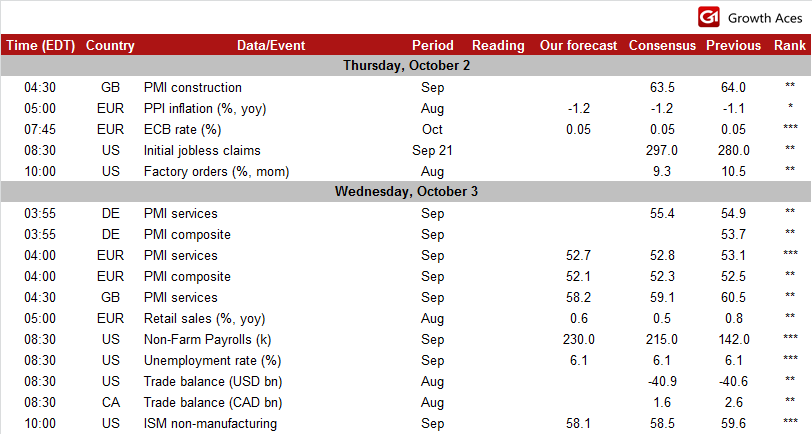

ECONOMIC CALENDAR

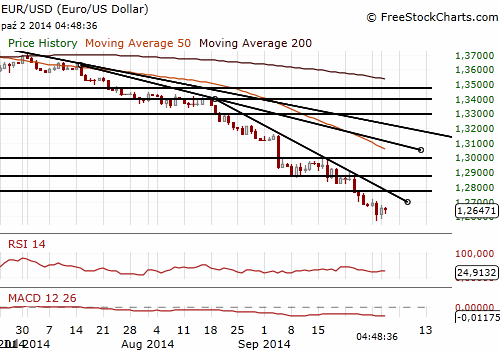

EUR/USD: Short at 1.2665, waiting for Draghi

(the target is 1.2510)

Euro zone factory prices fell slightly less than expected in August. PPI inflation amounted to -0.1% mom and -1.4% yoy vs. the median forecast of -0.2% mom.

The US ISM manufacturing index fell to 56.6 from 59.0 in August and was worse than the consensus forecast of a drop to 58.5. The drop in the employment index, to 54.6 from 58.1, could suggest weaker payroll employment in the manufacturing sector in September. In line with our estimates the ISM reading is still consistent with GDP growth at an annualised rate of more than 3%.

The ADP Employment Report for September showed a private sector payrolls gain of 213k, close to expectations. The August increase was revised down to 202k. The median of market expectations for Friday’s Non-Farm Payrolls reading is now at 215k.

GrowthAces.com forecasts the level of 230k that should be supportive for the USD.EUR/USD climbed to 1.2676 today in Asia and we used higher level to get short. Our target is 1.2510.

We encourage you to visit our website and subscribe to our newsletter to receive trading positions summary for major pairs and crosses.

Significant technical analysis' levels:

Resistance: 1.2715 (high Sep 29), 1.2732 (10-dma), 1.2761 (high Sep 26)

Support: 1.2571 (low Sep 30), 1.2561 (low Sep 6, 2012), 1.2502 (76.4% of 1.2042-1.3995)

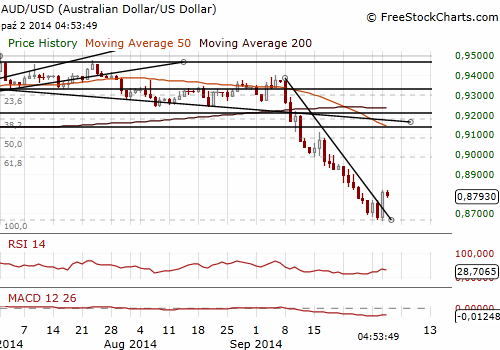

AUD/USD firmer after macroeconomic data

(we went short at 0.8800, the target is 0.8650)

AUD/USD opened on Thursday at 0.8736 and traded 0.8726-0.8816 range in Asia. AUD/USD broke above 0.8760 before the trade and building approvals data were released.

Australian approvals to build new homes in August rose 3.0% mom (more than the median forecast of 1.0% mom) and faster than a month earlier (2.1% mom).

Australia’s balance of goods and services amounted to AUD -0.787 bn. Exports totaled AUD 26.372 bn and imports AUD 27.159 bn. The median forecast assumed a deficit of AUD 0.700 bn.

Better than expected building approvals data gave AUD/USD another boost and the rate went over 0.8800. The AUD/USD reached the session high of 0.8816. In line with GrowthAces.com trading idea, we used the recovery to get short. Our target is 0.8650.

Significant technical analysis' levels:

Resistance: 0.8770 (high Sep 29), 0.8813 (high Sep 26), 0.8885 (high Sep 25)

Support: 0.8663 (low Oct 1), 0.8660 (low Jan 24), 0.8500 (psychological level)

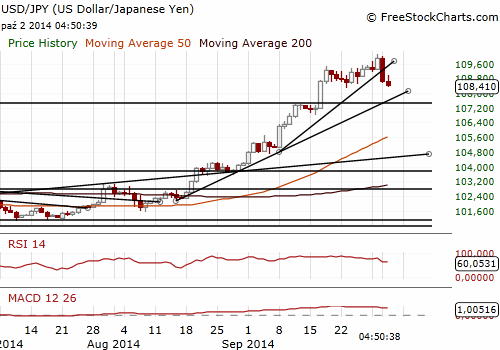

USD/JPY failed to break above 110.00.

(we are flat now and see now major support levels nearby)

A central bank survey showed on Thursday Japanese companies expect consumer prices to rise an average 1.5% a year from now, unchanged from their projection three months ago. The release added more doubts over the Bank of Japan's pledge to achieve its 2% inflation target next year.

USD/JPY failed to break above 110.00 after Wednesday’s Tankan release and the rate fell significantly below 109.00. Given the speed of the recent USD/JPY push up there is no major technical support and big figures till 106.82. That is why further downside move cannot be excluded.

We are flat now after taking small profit on our long position yesterday. On the other hand, our long EUR/JPY position has reached stop-loss level.

Significant technical analysis' levels:

Resistance: 109.97 (hourly high Oct 1), 110.09 (high Oct 1), 110.33 (high Aug 19)

Support: 109.56 (session low Oct 1), 109.19 (low Sep 30), 109.15 (10-dma)

Our research is based on information obtained from or are based upon public information sources. We consider them to be reliable but we assume no liability of their completeness and accuracy. All analyses and opinions found in our reports are the independent judgment of their authors at the time of writing. The opinions are for information purposes only and are neither an offer nor a recommendation to purchase or sell securities. By reading our research you fully agree we are not liable for any decisions you make regarding any information provided in our reports. Investing, trading and speculation in any financial markets may involve high risk of loss. We strongly advise you to contact a certified investment advisor and we encourage you to do your own research before making any investment decision.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.